MARKET SUMMARY 10-19-2022

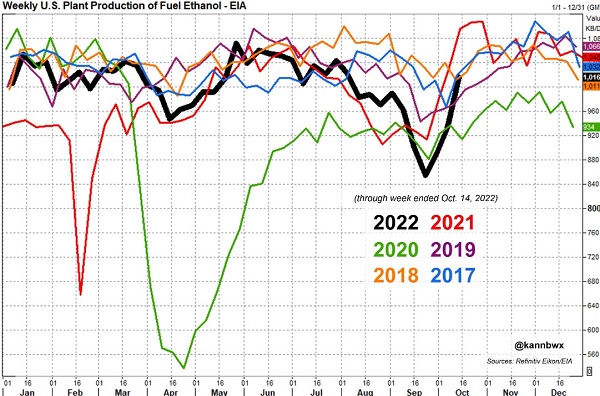

U.S. ethanol production jumped to a 10-week high last week as production ramped up seasonally. Production last week reached 1.061 million barrels/day, up 19% from three weeks ago. The biggest impact is the ongoing harvest bringing fresh supplies into ethanol plants. Production dropped aggressively through August and September as corn supplies were tight, and prices were high, and ethanol producers limited usage. The USDA has made downward adjustments to the corn totals used for ethanol for the new marketing year, adding to a demand concern in the corn market. Now, as fresh supplies are available, ethanol producers are ramping up production. The biggest concern for ethanol is the large ethanol stockpiles, and the limit demand for gasoline that may limit the ethanol usage.

Like what you’re reading?

Sign up for our free daily TFM Market Updates and stay in the know!

CORN HIGHLIGHTS: Corn futures edged lower, finishing lower for the fourth session in a row. December lost 2-3/4 to close at 6.78 and December 2023 gave up 1-1/4 to close at 6.20-1/2. After starting the over-night with small gains, prices traded close to double digit losses by mid-morning, but did manage to claw back after energy prices turned higher. The stock market also made a reversal downward, which may have had some traders buying value in corn and selling equities. A firmer dollar and harvest pressure is keeping pressure on prices, as is growing concerns exports will ream weak due to lack of available supplies due to low water on the Mississippi.

If behind on sales, give thought to what it might look like if the trend were to move sharply lower. Back in June, this was the case as the price of corn, as well as many other commodities and equities, was the recipient of big money flow out of ownership. We are not arguing that will occur again, yet with a strong dollar, slow exports, and a lot of time between now and when South American weather matters, if large traders become impatient, they may choose to put their money elsewhere. Support is the low of 6.61 December, the low from 9/28, which is also where the Bollinger band rests. The 50-day moving average is at 6.68. Bullish traders will argue that a high dollar, harvest pressure and slow exports have not been able to pressure prices, despite at high levels historically. The do have a point. Our point to consider the financial consequences to your operation. If wanting a more quantified risk, consider selling cash and retain ownership with a call option.

SOYBEAN HIGHLIGHTS: Soybean futures climbed back from lower prices throughout the day and managed to close green as rising soybean oil prices raise crush margins and keep soybeans relatively supportive. Bearish influences still come from the barge backup on the Mississippi River. Nov soybeans gained 1/2 cent to end the session at 13.72-1/2, and Jan gained 3/4 at 13.82-3/4.

While the logistics issue with low water levels on the Mississippi have been pulling prices lower, soybean oil is now trading at its highest prices in over three months which is increasing the demand for cash beans to crush and keeping prices more afloat. Domestic demand is strong with the value of a crushed bushel of soybeans now 3.47 above the cost of beans based on January futures, but the gains in and demand for bean oil have been bearish for bean meal as the more crushing occurring the bigger the supply of meal on the market. Globally, the US saw plenty of interest for bean sales last week, but the logistical issues here may end up directing China to make purchases from South America rather than deal with the delays possible from buying from the US. According to the USDA, China will have a production deficit of 3.61 billion bushels for 22/23, and even if Brazil does produce a record 5.58 bb crop, China will still need to come to the US for supplies. Brazil has had favorable planting conditions so far, but forecasts are set to turn drier next week, and conditions in Argentina are still extremely dry but they have better chances for rain over the next week. Weather scares out of South America are possible and would send prices higher. The trend for Jan beans is still sideways and stuck between both bullish and bearish arguments. Resistance is at 14 dollars and a strong close above it would be friendly.

WHEAT HIGHLIGHTS: Wheat futures sank again today – without any positive headlines to keep them afloat, and a chance for the Ukraine export deal to be renewed, traders were more willing to sell today than buy. Dec Chi lost 8-1/4 cents, closing at 8.41-1/4 and Mar down 8-1/4 at 8.59-1/2. Dec KC lost 2-3/4 cents, closing at 9.41-3/4 and Mar down 2-3/4 at 9.39-3/4.

It turned out to be another sour day for wheat, with all three US futures classes closing in the red. Without news to propel the market higher it sank off of earlier strength. Additionally, the trend of a lower stock market and higher US dollar again contributed to weakness. This was in contrast to Paris milling futures which eked out a positive close, rebuffing yesterday’s trend of sharp losses. Part of the weakness in the US markets may also stem from confusion and uncertainty surrounding Ukraine’s export corridor deal with Russia. There has been conflicting talk, with some thinking the deal will be ended in November, while there are also rumors that Russia may actually agree to extend the deal. The Ukraine Grain Association reported that 6.8 mmt of grain and oilseeds have been exported since the agreement took effect. Also in Ukraine, their ag ministry estimated 6.2 million acres of winter wheat have been planted – less than half of least year’s 14.8 million. What also may have offered some weakness to the US market today is in the forecast for parts of the southern plains. Southeast areas of that region are expected to get some rains but will likely return to dryness after that. From a global point of view, Australia is getting too much rain, causing quality concerns. Some of their crop may be downgraded to feed wheat.

CATTLE HIGHLIGHTS: The cattle market stayed supported with buying strength for the fourth consecutive day on December futures based on cash optimism and a firmer retail carcass tone. Oct live cattle gained 0.875 to 149.350, closing with a new contract high for the third straight day, and Dec added 1.575 to 151.350. Feeders saw more strength as well, as Nov feeders traded .250 higher to 178.075.

December live cattle prices are looking to challenge the contract high as the market has rallied over $4.00 in the past four days. Cash trade optimism and short covering fueled the move, and cash trade started to develop on Wednesday with some Texas trade at $147, up $1-2 from last week. Northern bids are still pushing the $150 handle with no finalized trade on the day. Trade will continue to develop going into the end of the week. Beef cutouts were higher on Monday, showing a strengthening trend. Choice carcasses traded 2.46 higher to 253.24 and select added 2.00 to 223.28 on light demand of 87 loads. Today’s estimated slaughter totaled 127,000 head, 1,000 less than last week, but 4,000 above a year ago. Feeders saw another good day of buying support, fueled again by the weak price action in the corn and wheat markets and optimistic the strength in the live cattle. The Feeder Cattle Cash Index was 0.24 lower to 172.03, which was a limiting factor on the front-end contracts, especially October, as expiration nears on 10/27. Feeder prices rallied through chart resistance, and additional buying strength could trigger a stronger short-covering rally in feeders. Friday is bringing the next round of Cattle on Feed numbers, and expectations are for the total cattle on Feed and placements last month to be reduced from last year. The cattle market has rallied aggressively, and is looking to challenge contact high, technical and fundamental picture look supportive in the short-term.

LEAN HOG HIGHLIGHTS: Lean hog futures traded higher for the fourth consecutive day, as the hog charts are placing a v-bottom recovery on the charts as short covering and technical buying keeping pushing prices higher. Dec hogs gained .900 to 87.375 and Feb added 1.200 to 89.000.

Dec hogs have now gained nearly $7.00 over the past three sessions, establishing a V-bottom pattern on the charts. but now may be running into some resistance over the top of the market, established by previous price highs. In the past couple sessions, hog futures are trading above the key 100 and 200-day moving averages for the first time since September, reflecting a improved technical picture in the hog market. These moving average levels can act as a swing point, and trigger buying into the market. The fundamentals overall will still be a key focus to maintain the rally. The Lean Hog Cash Index traded 0.16 lower on Wednesday to 93.19 and is still at a $5.815 premium to the futures. The cash hog market was supportive on Wednesday as morning direct trade was a strong 7.49 higher to 94.56 and a 5-day average of 89.47. Pork retail values were softer at midday after a firm close on Tuesday, slipping .27 to 102.40 on demand of 171 loads. A stronger demand tone will give the market some price optimism. The USDA will release the next weekly export sales report on Thursday morning, the hog market will be watching the pork demand and who the buyers are. The estimated slaughter for Tuesday was 491,000, steady with last week, and 12,000 over last year, as hog supplies are still available. Prices have had a strong recovery and the chart looks supported on the prospects of demand and an improved technical picture, but the hog market will still need to have the cash market to complete the rally, which provided good strength on Wednesday.

DAIRY HIGHLIGHTS: Second month Class II futures had a strong day of trade, up 60 cents, to settle at $21.30. This strong move, along with Monday and Tuesday’s gains, has elevated the November contracts from a low of 20.28 on Monday. December Class III futures also had a sizable move higher with 30 cent gains to bring December futures back above $20 since the market opened on the 14th. Class IV futures saw very little change on the day and maintains a strong premium to its Class III counterpart with second month November closing at $23.62 and December futures settling at $21.41. The spot markets remained relatively quiet besides strong activity in the powder market with 7 loads traded. Spot cheese gained less than a penny to settle at $2.1275/lb, butter was unchanged at $3.20/lb on no loads traded, whey down slightly to $0.435/lb, and although powder spot market was active the price was under pressure again and settled down over 2 cents to $1.44/lb.

Total Farm Marketing and TFM refer to Stewart-Peterson Group Inc., Stewart-Peterson Inc., and SP Risk Services LLC. Stewart-Peterson Group Inc. is registered with the Commodity Futures Trading Commission (CFTC) as an introducing broker and is a member of the National Futures Association. Stewart-Peterson Inc. is a publishing company. SP Risk Services LLC is an insurance agency. A customer may have relationships with all three companies. TFM Market Updates is a service of Stewart-Peterson Inc. Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition.