![]()

Extreme Market Volatility: Managing Fear and Greed

Authored by: Scott Masters

The Russian invasion of Ukraine set the market on a wild ride that many participants haven’t experienced since 2008. Wheat rallied $4.825 and locked limit up for multiple days in a row in a massive, short squeeze, as those who had been short wheat panicked and exited their positions at a premium. In the meantime, corn’s implied option volatility, a primary mechanism used to determine option value, spiked to about 50% (at the time of this writing), when somewhere around 20% might be considered “normal.”

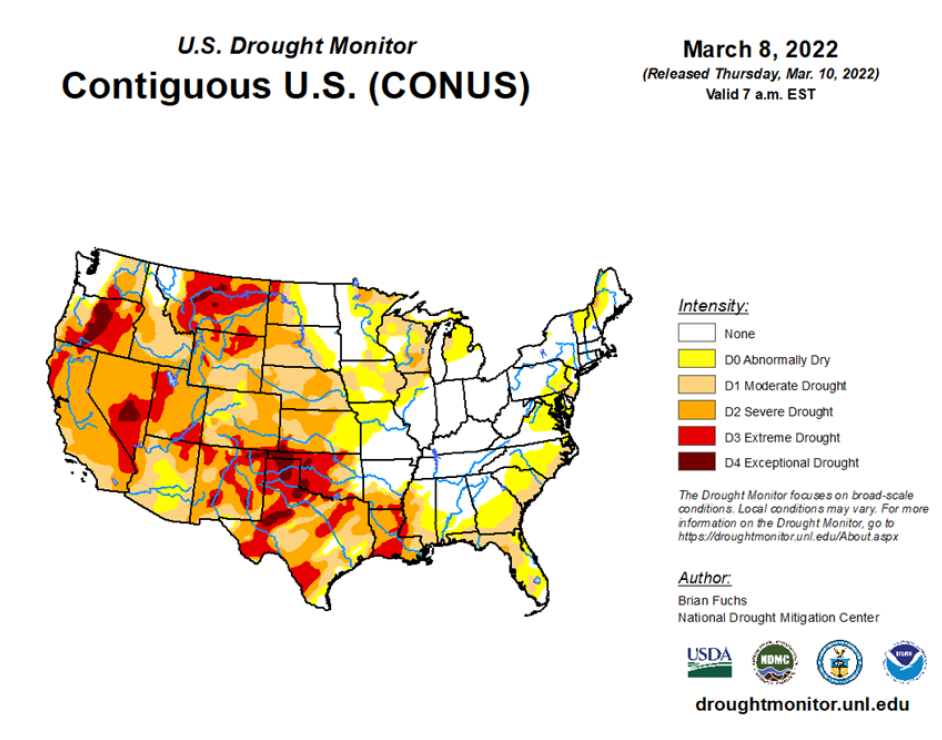

Uncertainty isn’t limited to Ukraine alone. Growing crop losses in South America and continued dry weather in the U.S. Plains and western Corn Belt continue to add considerable volatility to the grain markets. So, dare we say, there may still be some “exciting” times ahead.

For many farmers, market volatility can often lead to two conflicting emotions commonplace for all market participants: the greedy desire to ride out the market to get the highest possible price and the fear of holding out too long and losing your advantage in the market. A key to successfully managing these emotions and the market’s potential is having a strategic plan in place to give you the discipline to act with your head and not your heart. The best place to start is by understanding the factors that may drive prices ultimately higher or lower across the markets.

Potential Ramifications of the Russia-Ukraine War on Grain Production

Whether the Russia-Ukraine war ends quickly or is drawn out, we may be just beginning to understand the impact to the global grain trade. According to the USDA’s February WASDE report, Ukraine was expected to export 33.5 million metric tonnes (mmt) of corn to the world market for the 21/22 season. In March, the USDA adjusted that number down 6 mmt to 27.5 mmt in consideration of the conflict. There are some in the industry that are more pessimistic and estimate upwards of 15 mmt (550 million bushels) of the original 33.5 mmt may not get shipped out of Ukraine.

Whether the Russia-Ukraine war ends quickly or is drawn out, we may be just beginning to understand the impact to the global grain trade. According to the USDA’s February WASDE report, Ukraine was expected to export 33.5 million metric tonnes (mmt) of corn to the world market for the 21/22 season. In March, the USDA adjusted that number down 6 mmt to 27.5 mmt in consideration of the conflict. There are some in the industry that are more pessimistic and estimate upwards of 15 mmt (550 million bushels) of the original 33.5 mmt may not get shipped out of Ukraine.

As of this writing, Ukraine’s exports have since ceased because their ports are closed, and little is known as to when they may fully reopen. If Ukraine is unable to ship out corn, wheat, or sunflower oil for a significant amount of time, where will the world get those supplies? Will it be the U.S.? Brazil? Argentina? There is also the question of whether Ukraine will get their corn planted this spring. What will happen if they only get 40% planted, as some think? How will that change the global corn market for the 22/23 season? On the flip side, what if the full crop does get planted and there’s a bumper crop with 15 mmt carried over from 21/22? How will that affect prices and trade flows? Only time will tell. In the meantime, volatility remains on the horizon in the face of uncertainty.

Like what you’re reading?

Sign up for our free daily TFM Market Updates and stay in the know!

Questionable that South American Production Can Cover Potential Ukrainian Shortfalls

There have already been questions regarding South America’s production. Northern Argentina and southern Brazil experienced extreme heat and dry conditions, which affected the size and quality of their crops. In its March WASDE report, the USDA cut its December combined Argentina and Brazil corn estimate by 5.5 mmt (or 201.67 million bushels) from 172.5 mmt to 167 mmt.

Given the impact of weather on South American production, how much of Ukraine’s corn export business will South America be able to absorb? Note that Brazil had already been experiencing fertilizer shortages prior to the Russia-Ukraine war, and they import about 22% of their fertilizer needs from Russia. If their supplies from Russia are reduced, how much might that affect the yields of Brazil’s second corn crop, the Safrina crop? And if Brazil is able to find fertilizer sources for the Safrina crop, will they be sufficient to help Brazil meet even potential gaps from their current crop? Again, uncertainty abounds. Between Ukraine’s potential 15 mmt export shortfall and South America’s potential 5.5 mmt production shortfall, upwards of 20.5 mmt in export business may open up.

Can U.S. Absorb Potential Corn Shortfall of 751.67 Million Bushels?

If the U.S. were to assume the potential 20.5 mmt export shortfall, that’s potentially 751.67 million bushels of added U.S. export business. In an effort to adjust for potential trade disruptions, the USDA added 75 million bushels to its March WASDE export outlook—only a tenth of the export shortfall just discussed—and subsequently lowered 2021 ending stocks 100 million bushels. How would the assumed export increase affect U.S. ending stocks?

Let’s use the USDA’s unadjusted ending stocks estimate of 1,540 million bushels from February and subtract the 751.67 million bushels of potential U.S. export business. We could have U.S. ending stocks of just 788.33 million bushels, and a stocks-to-use ratio of 5.3% instead of the tight (yet adequate) estimated 1,440 million bushels ending stocks and 9.6% stocks-to-use ratio as reported in the March WASDE report.

Unfortunately, the U.S. is not inoculated from its own uncertainty. Currently, the southern Plains and parts of the western Corn Belt are experiencing serious dryness. The Hard Red Winter wheat crop, for example, is in far from ideal condition as it comes out of dormancy. In the coming weeks, the market will begin to focus on U.S. planting and growing conditions. There is currently little (if any) risk premium in the corn market for any possible U.S. shortfalls. As we move into the growing season, the market may be quick to add risk premium to compensate for any potential losses in less-than-ideal growing conditions. Usually, once the threat has passed in weather markets, the market will quickly sell off to remove any risk premium that has been added.

The Bottom Line

There is no way of knowing which, if any, of the outlined scenarios may come to fruition. However, we do know that if the worst-case scenarios come true, then prices will probably trade much higher. If the best-case scenarios come true, then prices will probably trade lower. Most likely, as time goes by, fear and greed will take hold, and we will find that reality lies somewhere in the middle of the possibilities. Until then, the markets will be taken on a wild ride that many of us haven’t seen in quite some time.

At Total Farm Marketing, we believe the best way to approach these unsettled times is to make sure you have a plan in place to capitalize on market volatility. You do that by building a plan based on strategy that helps you to take bites out of a rising market while building in triggers and tactical steps to minimize the pain of a falling market. While a strategic plan takes time and focus, it has the potential to help you avoid the emotional sting of the market. Customers of TFM360 benefit from that discipline and consistency day after day.

If you have questions about how TFM360 is approaching the market, talk with one of our TFM representatives or your TFM consultant at 800.334.9779. You can feel confident that we are continually monitoring the fundamentals and charts and are fully prepared to incorporate them into our recommendations. We will keep you informed as events unfold, and look forward to helping you make decisions that best fit your operation.

Learn More

Go to www.totalfarmmarketing.com or call us at 800.334.9779

to make a difference in your farm marketing.

©March 2022. Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. Total Farm Marketing and TFM refer to Stewart-Peterson Group Inc., Stewart-Peterson Inc., and SP Risk Services LLC. Stewart-Peterson Group Inc. is registered with the Commodity Futures Trading Commission (CFTC) as an introducing broker and is a member of National Futures Association. Stewart-Peterson Inc. is a publishing company. SP Risk Services LLC is an insurance agency and an equal opportunity provider. SP Risk Services LLC and Stewart-Peterson Inc. are wholly owned by Stewart-Peterson Group Inc. A customer may have relationships with all three companies. TFM360 is a service of Stewart-Peterson Group Inc., Stewart-Peterson Inc., and SP Risk Services LLC.