MARKET SUMMARY 01-04-2023

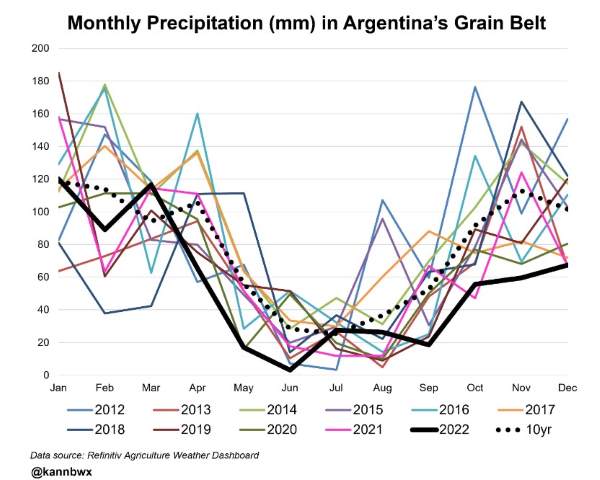

Much of the premium in the grain markets going into the end of the year has been focused on the weather conditions in Argentina. Analyzing monthly rainfall totals for the South American country has seen rainfall 295% of normal, and the second driest year in the last 35 years, and since 2008. This has brought premium into the soybean market, pushed soybean meal prices to new contract highs, and spilled over some of that strength into the corn market. For the start of 2023, weekend rainfall in some regions has brought profit taking as some of the weather premium has quickly moved to the sidelines, pressuring grain prices. Longer-range forecasts still have a drier tendency, so the story may still have some time. The grain market will continue to monitor rainfall forecasts and rain totals to gauge the possible recovery or lack of relief for this region.

Like what you’re reading?

Sign up for our free daily TFM Market Updates and stay in the know!

CORN HIGHLIGHTS: Corn futures plunged today finishing lower for the second day in a row giving up 12 to 16-3/4 cents. Mar led the way lower closing at 6.53-3/4, while new crop Dec gave up 12 ending the session at 5.94-3/4. Sharp losses in wheat (down near 30 cents) and crude oil (down near 3.00) as well as weaker soybeans (down near 9 cents) all weighed on corn futures. Additionally, prices slid through major moving averages likely uncovering and triggering a significant number of sell stop orders adding to selling pressure.

It is not a great start to the new year. While today may have been a heavy load of technical and “risk off” selling, the bottom line is that prices went lower and with what appeared ease. Last week’s Commitment of Traders report indicated that through Tuesday funds had added a net of 45,000 long futures contracts. The report is through the prior Tuesday. With prices climbing on Wednesday, Thursday, and Friday during the day, it is likely a large number of additional contracts were added. Ultimately, the bet was for perhaps more strength this week on weather in Argentina. Heavier-than-expected rainfall amounts had futures retreating yesterday and likely encouraged traders to keep stops tight for today. The question is now where from here? Have prices moved low enough to suggest buying resurfaces or are they now positioned to continue to erode and retesting the recent low in Mar futures at 6.35-3/4? It may be too early to tell, however, the market may be signaling that if you are waiting to make cash sales, you should go ahead and move forward with at least some sales. One scenario is that a growing concern of a world recession and weaker energy prices leave prices vulnerable to erosion, especially if South American weather is not a factor over the next 90 days.

SOYBEAN HIGHLIGHTS: Soybean futures closed lower today, along with meal and bean oil, as the grain complex took another big hit following yesterday’s selloff. Prices were a few cents higher at the beginning of the day before falling to more fund liquidation. Jan soybeans lost 9 cents to end the session at 14.78-1/4, and Mar lost 8-3/4 cents at 14.83-1/2.

The bulk of today’s sell-off is just follow-through selling from yesterday’s news which is that funds and producers are selling, rain has fallen in Argentina, and concerns over Chinese demand are rising. It will take a few more days to have a better idea but the trend seems to have reversed for soybeans and lower prices could be ahead. The La Nina pattern is breaking up over Argentina and though they still aren’t getting as much rain as they need, the chances are better than they were. Argentinian bean planting is now 72% complete and some analysts are estimating a drop in production to 43 mmt which is down from the USDA estimates of 49.5 mmt. The bright spot in the day was a soybean sale of 4.6 mb to unknown destinations, but January is really the last month that the U.S. has for solid exports before Brazil becomes the key player in sales to China. Domestic demand remains strong and could be the main factor that supports prices as crush values are historically high. November census crush was pegged at 189.3 mb, which was down from the 196.6 mb in October but still large. Worries about a recession this year and raw material demand from China have put pressure on the soy complex as well, and although China has lifted many of their Covid restrictions, cases are now rising quickly. Mar beans closed just below their 21-day moving average, and only time will tell if the downward momentum continues.

WHEAT HIGHLIGHTS: Wheat futures gave up significant ground today as the markets faced another risk off session. Mar Chi lost 30 cents, closing at 7.45-1/2 and Jul down 28-1/2 at 7.58. Mar KC lost 28-1/2 cents, closing at 8.40-3/4 and Jul down 27 at 8.32-1/2.

All three U.S. wheat futures classes, along with Paris milling futures, closed sharply lower today. In fact, all three U.S. classes closed below their respective 21-day moving averages. In another risk-off session, lower corn, soybeans, and crude oil did not help. At the time of writing, crude oil is down roughly four dollars per barrel and seems to be the anchor on the commodity markets over the past two sessions. This itself could be tied to concerns about China’s economy, as well as fears of a global recession in 2023. There is also the fact that Russia has been aggressively selling wheat, with their exports for December estimated to be a record large 4 to 4.5 mmt. Ukraine wheat is also cheaper compared to the U.S., but due to the war, their exports are still running 47% behind last year at 8.4 mmt. Here at home, the southern plains forecast for the next 10 days remains dry and may provide some price support. In the Southern Hemisphere, there is talk that due to the drought, Argentina may have only half of their normal wheat exports.

CATTLE HIGHLIGHTS: Cattle futures saw buyers return, finishing with moderate gains in live cattle and strong triple-digit gains in the feeder market. A sell-off in grain markets, a strong retail market, and the potential development of cash trade on the week supported cattle futures. Feb live cattle gained 0.425 to 157.275 and Apr cattle added 0.550 to 161.425. In feeders, Mar feeders finished 3.450 higher to 188.225.

Live cattle prices consolidated with the trading range of Tuesday’s trade, as the market is looking for some overall direction. The retail market supports this, but the live cattle market is looking towards cash trade for the final direction on the week. The strong buying in feeders helped support the live cattle gains. Cash trade is still undeveloped and remains quiet overall. With the strong retail values, packer margins are improved and the market is expecting steady to higher cash bids again this week. Trade will likely develop over the next day or so going into the weekend. Beef cutouts are trading well off the December lows but were mixed at midday. Choice carcasses slipped 2.22 to 284.73, but select carcasses traded 2.07 higher to 256.70. The load count was light but improved at 91 midday loads. The choice/select spread remained supportive of the demand tone trading at $28.03 at midday. In feeders, technical buying pushed the market higher, as prices used the weakness in grains to break out the most recent trading range. Mar feeders used the strong price action to close at its highest price levels since September. The feeder cattle index was 0.29 lower to 180.73 and is trading at a discount to the Jan futures, which could be a limiting factor. Feeder cash market prices are still trending higher as competition for physical cattle, due to tight supplies, elevates the market. Good price action in cattle markets as fundamental factors and technical strength helped push prices higher on Wednesday. Live cattle are likely looking for confirmation of cash trade, but feeders look strong technically and are targeting high levels with the price strength today.

LEAN HOG HIGHLIGHTS: Lean hog futures struggled again on Wednesday, as the weakening cash market and technical selling pressured the hog market to work through adequate hog supplies. Feb hogs lost 1.000 to 84.075, and Apr hogs slipped 0.900 to 92.900.

Feb hogs have slipped to technical trend line support working off the recent lows, but the price action stays negative, leaving the market open to a test of lower levels. The December low for Feb futures is 81.525, and that looks like a possible target if prices don’t hold today’s closing levels. The cash market is still on a downward slide, and that pressures the hog futures. The lean hog cash index is trading at 79.45, down 0.79 for today. Feb hogs are running a 4.625 premium to the cash index, but that premium is even larger compared to direct cash trade. At midday, direct trade was 1.04 lower to an average of 73.12 and a 5-day average of 74.38, nearly $0 under the Feb futures prices. The direction and weakness in the cash will need to find some footing to build a potential hog market rally. Estimated slaughter was 475,000 head, 9,000 under last week, but 13,000 head over last year. With the heavy supply numbers, demand is at a premium for pork products to keep the product moving. Pork carcass values were 5.06 higher at midday to 91.06, supported by a strong move in the belly primal. The retail strength at midday will need to be maintained in order to support the market. The load count was good with 220 midday loads. For the hog market, it is all about the weak cash market and its discount to the futures. Retail values are trying to find support, but the market is looking to work lower in the short term.

DAIRY HIGHLIGHTS: Class III and IV milk futures remain under heavy selling pressure as the market is stuck in a strong downtrend and can’t seem to find support. On Wednesday, several 2023 Class III contracts hit their lowest level since December 2021. Pressure for dairy is coming from weaker global prices, a lack of demand domestically, seasonality after the holiday buying rush, and greater milk production across the country. The market can’t seem to shake out of this funk, and similar sell-offs this time of the year historically could point to the market weakening into March or April. Commodities in general had a rough day on Wednesday as corn fell 16c, wheat fell 30c, soybeans were down 9c, and fuel fell 10c. Money flow appears to be moving out of commodities and into equities. The spot dairy trade saw cheese fall 2.75c, powder fall 1.25c, and butter hold steady at $2.38/lb.

Total Farm Marketing and TFM refer to Stewart-Peterson Group Inc., Stewart-Peterson Inc., and SP Risk Services LLC. Stewart-Peterson Group Inc. is registered with the Commodity Futures Trading Commission (CFTC) as an introducing broker and is a member of the National Futures Association. Stewart-Peterson Inc. is a publishing company. SP Risk Services LLC is an insurance agency. A customer may have relationships with all three companies. TFM Market Updates is a service of Stewart-Peterson Inc. Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition.