MARKET SUMMARY 01-05-2023

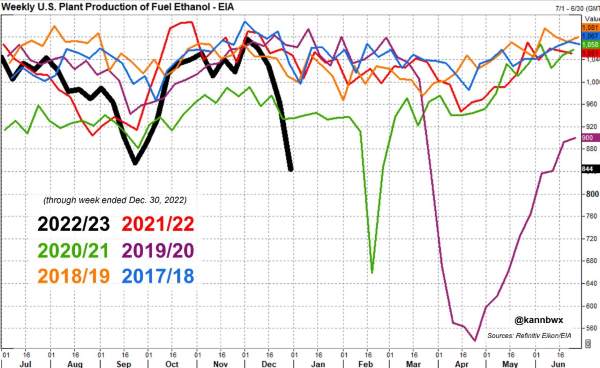

In a market concerned with demand, the weekly ethanol production numbers were disappointing on today’s EIA report. Weekly ethanol production dropped by 18% in the past two weeks ending on December 30. This was the 5th largest 2-week fall on record. Besides impacts from the holiday season, the production of ethanol was strongly affected by the weather in the Midwest. The extremely cold and wintry weather during this time period likely caused plant shutdowns and limited transport in that region of the country. Most likely, the production will bounce back as conditions improve, but it was still two weeks of limited production in a corn market pushing for positive demand news.

Like what you’re reading?

Sign up for our free daily TFM Market Updates and stay in the know!

CORN HIGHLIGHTS: Corn futures started weaker on the heels of a sharp gain in the U.S. dollar and follow-through technical selling. A poor weekly ethanol grind for the second week in a row did not provide support either. Yet, prices bounced back from losses of five or more cents to close 1 cent lower in Mar at 6.52-3/4 and 3-1/2 lower in Dec 2023. Snug world supplies suggest it might be difficult to be bearish prices, yet concern is growing that the big picture could eventually mean more South American supplies, and importing countries only buying as needed hoping for lower prices and more supply by late winter.

A higher U.S. dollar (now trading at its highest level since the first week of December) may have added to the cause of lower prices today. Today’s ethanol stats indicated that only 85 mb were used last week. Keep in mind this was a holiday-shortened week again, yet on paper, not a good number. On a positive note, China’s internal corn prices have been moving higher, suggesting they could soon be a buyer of U.S. corn. South American weather is supportive for price when just viewing Argentina’s dryer weather pattern, yet Brazil could be on the verge of a record first and second (winter) crop. It is challenging to anticipate where friendly news from the USDA WASDE report could come from (the report is out next Thursday). Feed usage is not likely to grow as both the cattle and hog herds have been on the decline and exports remain sluggish. A slight bump in dairy cows has been noted and poultry numbers may be up, yet appreciable change in higher feed is not expected. Another revision to exports is expected. That leaves yield. August and September reports reduced yield and November indicated a slight increase. Large changes are not expected as the tweaking was well underway in October and November.

SOYBEAN HIGHLIGHTS: Soybean futures closed lower again for the third consecutive day on continued worries about Brazil’s record crop and a potentially bearish upcoming USDA report. Nearby bean meal was the only soy contract to close higher today as bean oil slipped despite slightly higher crude. Jan soybeans lost 11-1/2 cents to end the session at 14.66-3/4, and Mar lost 12-3/4 cents at 14.70-3/4.

The soy complex continued its new year descent as the same bearish influences spurred more selling. Argentina appears to have better rain chances, Brazil is looking at a record crop, the U.S. is facing export demand concerns, and traders are concerned about a possible recession. One velvet lining to this sell-off is that soybeans have fallen at a greater rate than meal and bean oil, so crush margins are improving which gives processors a bigger incentive to buy cash beans thus supporting basis. Today’s report from the DOE said that supplies of ultra-low sulfur distillates totaled 108.2 million barrels which is down 8% from last year and provides a strong argument for the need for more bean oil as renewable diesel going forward. Based on Mar futures, the value of crushed soy products exceeds the value of uncrushed by 3.47 a bushel. New crop ratings came in from Argentina today with good-to-excellent ratings down to just 8% and 82% of the crop harvested, but recent and upcoming rains may help those numbers. Next week, on January 12, will be the first WASDE report of the year, and the feeling is that it may be bearish with possible increases in production estimates, and these fears could be prompting selling beforehand. Mar beans have broken down lower and now sit just above their 40-day moving average which has been support since the beginning of November.

WHEAT HIGHLIGHTS: Wheat futures settled with mixed results. The heavy losses this week may have been a step too far and traders may have been willing to buy back into the market on this break. Mar Chi gained 1-1/4 cents, closing at 7.46-3/4 and Jul up 1-1/4 at 7.59-1/4. Mar KC lost 1 cent, closing at 8.39-3/4 and Jul down 1-3/4 at 8.30-3/4.

After a couple of down days, wheat managed to ease up on that trend today. Chi closed mixed with small gains in the front months but small losses in deferred contracts. KC was down slightly all the way out to 2024, but MPLS did post gains of about three to six cents. Paris milling wheat also stopped the bleeding today with the Mar contract gaining 2.75, to 301.75 euros per metric ton. Today’s session began with a similar pattern as the past two, with prices drifting lower as time advanced. But with crude oil turning positive, and up about a dollar at the time of writing, some pressure was relieved on the grains. Chi wheat, in particular, finished about 10 cents off the daily lows. There still seems to be a lot of talk (and concern), however, about a recession in 2023. Fundamentally, there is not a lot different today than at the beginning of the week, but outside market worries may have taken their toll for now. If one turns their attention to the weather, the U.S. drought monitor shows reduced drought conditions in parts of the Midwest which may help the SRW crop in spring. Many are still uneasy about the drought in the southern Plains though, which is expected to remain mostly dry for the next week or so. Also on the mind of many traders, is next week’s USDA report. Currently, there are no major changes expected for wheat on that report, which will be released a week from today.

CATTLE HIGHLIGHTS: Cattle futures posted mostly lower trade with the exception of Feb live cattle, which stayed tied to the cash market as some trade developed on Thursday. Feb cattle were 0.075 higher to 157.350, but Apr cattle slipped 0.150 to 161.275. In feeders, Jan feeders dropped 1.425 on profit taking to 183.800.

Live cattle charts are looking a little tired as prices consolidated at the bottom of yesterday’s trading range. This will keep the downside in play if prices were to break support off the low from Tuesday’s trade. For Apr, a further pullback could see futures drift to the $155.000 level of support. The cash market saw some initial trade develop on Thursday. In the south, cash trade began at $157, which was steady with last week’s averages. This likely limited the upside in live cattle futures on the day. Northern trade saw bids to $159, and dress bids to $252. This was slightly higher than last week’s averages. Trade was still developing into the afternoon and will see additional business tomorrow. Today’s slaughter totaled 127,000 head, 1,000 more than last week, and 15,000 greater than a year ago as animals backed up with the weather came to market. Even though animal numbers were higher, dressed weights were softer week over week, possibly reflecting the difficult weather conditions of the Christmas window in the Midwest. Retail values were mixed at midday. Choice carcasses lost 0.33 to 282.56 but select gained 1.42 to 257.82. The load count was light at 78 loads. Feeder cattle saw some profit taking after Wednesday’s strong gains, back testing the support levels prices broke through on the rally. The discount to the cash index limits nearby rallies in the Jan feeders. The cash index traded 0.42 lower to 180.31 and holds a 3.49 discount to the front month futures. The live cattle market may be looking to take a pause, especially if friendly news slows. Overall, cattle markets are still well supported by the tight cattle supply and still good demand tone. If that demand tone were to slip, the cattle market is set up for some correction.

LEAN HOG HIGHLIGHTS: Lean hog futures stay in sell mode as the weakening cash market and technical selling continue to pressure the hog market. Feb hogs lost 1.550 to 82.525, and Apr hogs slipped 1.375 to 91.525.

Feb hogs showed additional weak price action as prices broke to test the December lows at 81.525. This area did hold during the session and prices firmed going into a close. This could signal a technical bottom on the chart, but the trade action of Friday and early next week will be key to see if further downside is a possibility. The cash market is still on a downward slide, and that pressures the hog futures. The Lean Hog Cash Index is trading at 79.06, losing 0.39 on the day. Feb hogs are running a 3.465 premium to the cash index. At midday, direct trade was 1.35 higher to an average of 74.47 and a 5-day average of 74.01, but still nearly $8 under the Feb futures prices. The direction and weakness in the cash will need to find some footing to build a potential hog market rally. The estimated slaughter was 490,000 head, 10,000 over last week, and 18,000 head over last year. With the heavy supply numbers, demand is at a premium for pork products to keep the product moving. Pork carcass values were 0.167 higher after a disappointing close on Wednesday afternoon. Carcasses are valued at 85.99 with a load count at 174 loads. For the hog market, it is all about the weak cash market and its discount to the futures. Retail values are trying to find support, but the market is looking to work lower in the short term. Typically, hog markets may be looking for a seasonal bottom in this time frame, but the lack of fundamentals still keeps that key low out of the picture.

DAIRY HIGHLIGHTS: Class III prices rebounded while Class IV was mixed to lower. January and February Class III futures gained more than a quarter each while all contracts through July were in the positive; a nice reversal from the past three days of negative trade. Class IV contracts were unchanged for January and February, while March through May were lower. Spot powder was the only dairy spot market that was lower today with just over a penny loss, butter and whey were unchanged, while cheese found gains and buyers.

Total Farm Marketing and TFM refer to Stewart-Peterson Group Inc., Stewart-Peterson Inc., and SP Risk Services LLC. Stewart-Peterson Group Inc. is registered with the Commodity Futures Trading Commission (CFTC) as an introducing broker and is a member of the National Futures Association. Stewart-Peterson Inc. is a publishing company. SP Risk Services LLC is an insurance agency. A customer may have relationships with all three companies. TFM Market Updates is a service of Stewart-Peterson Inc. Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition.