MARKET SUMMARY 01-10-2022

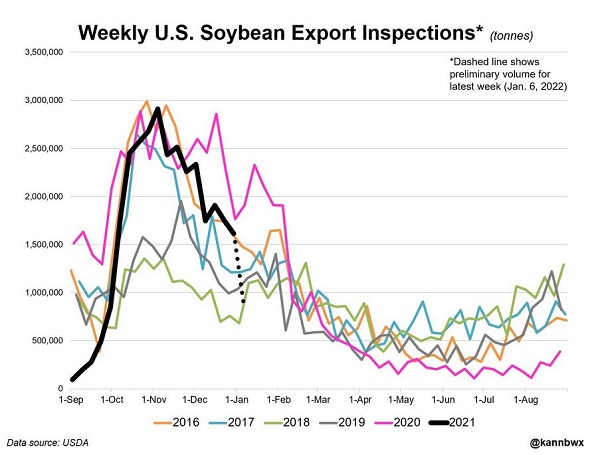

Weekly soybean export inspections saw a strong drop week over week. Total inspections reported on Monday’s USDA Export Inspections report were just over 905,000 MMT, down sharply from the 1.6 MMT reported last week. This puts soybean numbers well below last year, down approximately 23% from last year, while the USDA was predicting a 9% drop. With the holiday week, there is a chance these numbers could see some late adjustments to improve the total, but that will show up on next week’s report. Regardless, with the main soybean export window starting to close for U.S. soybeans, as fresh South American supplies are starting to come online. The question for the market is the possible impact of the South American weather, and some of the reductions being seen in the crop estimates. Will it be enough to help bring some additional sales and exports of U.S. soybeans past the normal export windows?

Like what you’re reading?

Sign up for our free daily TFM Market Updates and stay in the know!

CORN HIGHLIGHTS: Corn futures were under pressure throughout the entire session, trading mostly 5 to 10 cents lower before finally finishing 7 cents lower in March at 5.99-3/4. New crop December closed 0-3/4 lower at 5.57. Sharply lower soybean futures, weaker equities, and some improved chances or rain by the weekend for parts of South America were reasons for traders to trim positions. In addition, the next WASDE report is due for release on Wednesday.

Export inspections at near 40 mb were termed neutral. Today appeared to be a risk off day for many markets. Not only is the USDA report out on Wednesday, but the market is also factoring in weather developments practically hourly in the southern hemisphere. The near-term forecast suggests Argentina key growing areas as well as parts of southern Brazil and Paraguay will remain hot and dry this week with temperatures over 100 degrees each day. Saturday has a 50% chance of rain showers. Expectations for the USDA report are little change to yield at 177 bushels an acre. An increase in ethanol usage is expected and many are anticipating export figures to be slightly reduced. Bottom line we’re not sure we expect any surprises, and neither is the market the way prices have consolidated. The key will be South American weather. We doubt that the USDA will make significant reductions on the January report so attention will focus on private forecasts.

SOYBEAN HIGHLIGHTS: Soybean futures gave back Friday’s gains finishing with sharp losses of 21-1/4 to 26-3/4. March lost 25-1/2 cents to close at 13.84-3/4 and November lost 21-1/4 to end the session at 13.00-1/2. A slightly cooler forecast with increasing chances of rain by the weekend had the market on the defensive today. Export inspections at near 35 million were termed neutral.

The forecast may be slightly cooler but each day this week north Argentina is expected to remain well above 100 degrees. In addition, there’s little chance of rain over the next five days. So, bottom line is part of the key growing regions of both northern Argentina and southern Brazil will remain stressed as well as Paraguay. Traders may have been quick to exit after buying late last week when overnight prices did not continue their surge. With a USDA report out Wednesday and continuing changes to forecast the market volatility is likely to remain high with traders quick to move in either direction. If behind on sales get current with cash recommendations. We stay balanced between cash sales and ownership with fixed risk call options coupled with 20% old crop cash.

WHEAT HIGHLIGHTS: Wheat futures closed the session with small gains – this comes in the face of pressure from lower prices in both corn and soybeans and a poor export inspections number. This may have been in part due to a correction from a technical bottom. March Chi gained 3-1/2 cents, closing at 7.62 and July up 3-1/4 at 7.60-1/4. March KC gained 3-1/4 cents, closing at 7.78-1/4 and July up 2-1/2 at 7.78.

Today’s export inspections data totaled 8.6 mb for wheat – a relatively poor number with total exports still down 19% from last year. Despite this and a number of other items weighing on the wheat market, both Chi and KC managed to close in the green. Minneapolis wheat did not fare as well as its counterparts however, with noted bear spreading. The March contract lost 9 cents, closing at 9.14-1/4. Being technically overbought and due for a correction may have helped Chi and KC today, but that does not explain why MPLS, which is also very oversold did not have the same reaction. While much is pressuring wheat right now, there are two main factors will impact the grain markets this week – South American weather and Wednesday’s WASDE report. General report expectations for wheat are a slight increase in carryout as the result of poor exports. With that said, if the USDA does raise carryout by the predicted 10-12 mb, carryout would remain the lowest in eight years. South American weather did not change much over the weekend but does show some rain forecasted a week from now. Harvest pressure from both Argentina and Australia may pressure the market further. Remaining bullish for wheat is weather in the US southern plains which remains dry. Additionally, Russia’s export tax is close to $100 per metric ton, slowing down their exports.

Total Farm Marketing and TFM refer to Stewart-Peterson Group Inc., Stewart-Peterson Inc., and SP Risk Services LLC. Stewart-Peterson Group Inc. is registered with the Commodity Futures Trading Commission (CFTC) as an introducing broker and is a member of the National Futures Association. Stewart-Peterson Inc. is a publishing company. SP Risk Services LLC is an insurance agency. A customer may have relationships with all three companies. TFM Market Updates is a service of Stewart-Peterson Inc. Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition.