MARKET SUMMARY 01-11-2023

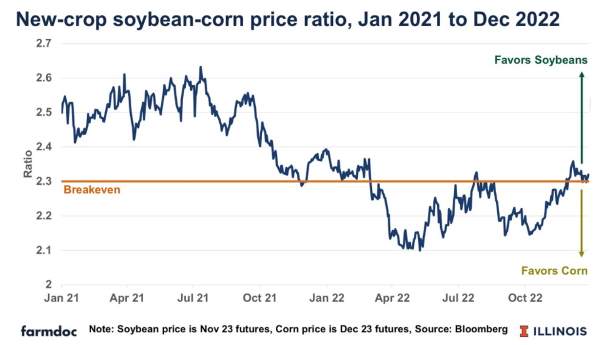

As the grain market is heading into the next round of USDA numbers after the report on Thursday, the focus will start shifting to the battle for acres between corn and soybeans for the 2023 crop. In evaluating current price ratios between corn prices and soybean prices, the market is currently more supportive of soybean acres over corn acres. Soybeans are benefiting from a good demand tone, South American weather, and a tight U.S. supply picture to help support prices. Corn, on the other side, is having some demand issues which have weighed on prices despite a relatively tight global supply picture. The price relationship in this ratio can be supportive of both the corn and soybean markets for the first half of the 2023 calendar year.

Like what you’re reading?

Sign up for our free daily TFM Market Updates and stay in the know!

CORN HIGHLIGHTS: Corn futures traded quietly with a range of near 6 cents before closing 1 higher in Mar at 6.56 and no change in Dec at 5.89-1/4. Consolidation in front of tomorrow’s reports was a primary feature today. For a lack of better words, there will be a data dump tomorrow with both U.S. and world numbers and quarterly stocks.

Pre-report estimates for tomorrow’s USDA WADSE have corn yield at 172.5 bpa, with no change expected. Production will also remain unchanged at 13.922 bb. Projected ending stocks are 1.302 bb which is expected to be 45 mb more than last month. The key figure tomorrow could be quarterly stocks. Have strong basis levels reflected tighter than anticipated supplies or is that more of a reflection of stingy selling by farmers? No change is expected to world ending stocks for 2022/2023 at 298 million metric tons. Weather in Argentina is becoming increasingly important. Vegetation maps show most key growing areas behind on moisture. Rain of an inch or more and coverage greater than 50% is expected by the end of the week. Will this be enough in a generally dry forecast for the week after? Summer temperatures are also a factor with most of the country expecting 90 degrees or warmer the next 10 days. The question is whether the USDA is prepared to make significant adjustments to Argentina. We doubt they will as it is yet early enough in the growing season that rain could be helpful producing an average crop. The likeliest changes tomorrow are in the form of reduced exports and perhaps a slight change in Argentina’s corn crop. The quarterly stocks number is the wild card.

SOYBEAN HIGHLIGHTS: Soybean futures closed higher today as reports of rain in Argentina for the coming week vary, but the European model calls for more dryness. Tomorrow’s WASDE report is not expected to be supportive, but it has caused prices to stay rangebound over the past few days. Jan soybeans gained 5 cents to end the session at 15.15, and Mar gained 8 cents at 14.93.

Soybeans and bean meal moved higher today while bean oil slid despite higher crude, but the gains in meal are likely tied to Argentina’s drought. Argentina is a top exporter of bean meal, and their severe drought has left the crop in poor condition with little hope of reprieve. European models have forecast more dryness, while American weather models have forecast multiple days of rain over the next week. Whatever losses Argentina sees due to the drought, Brazil is likely to make up for with its record crop. Tomorrow’s WASDE report at 11 AM Central is the thing to watch and may have a bearish tone. The average estimate for U.S. soybean production is 4,360 mb which is up slightly from last month’s 4,346 mb. U.S. ending stocks for 22/23 are estimated at 236 mb which would be up from 220 mb last month and may be adjusted for changes in exports. The average trade estimate for world ending stocks is 101.9 mmt compared to the USDA’s 102.7 mmt last month. The feeling has been that this report will be a bit bearish, but prices have slipped from the beginning of the year, and it is possible that the bearish aspects of the report are priced in unless there is a significant surprise. Mar futures have been relatively rangebound over the past week and will likely get a kick one way or the other after tomorrow’s report.

WHEAT HIGHLIGHTS: Wheat futures posted gains today in what feels like the first time in a long time. A combination of positioning ahead of the report, higher crude, corn, and soybeans, and a lower U.S. dollar all played a part. Mar Chi gained 9 cents, closing at 7.40 and Jul up 8 at 7.52-1/4. Mar KC gained 10-1/2 cents, closing at 8.22-1/4 and Jul up 9-3/4 at 8.16-1/2.

Paris milling futures, alongside all three U.S. futures classes, closed higher today to stop the bleeding. There was not a lot of fresh news to trade today, however, the market may have seen some positioning before tomorrow’s numbers. In addition to the USDA report, CPI data and export sales will also be released tomorrow so there will be a lot for traders to consider. But all eyes will likely fall on tomorrow’s USDA report as the main market mover. The average pre-report estimate for U.S. wheat ending stocks comes in at 582 mb, up from 571 mb in December. The average world wheat ending stocks number is projected at 268.3 mmt, compared to December’s 267.3 mmt. Quarterly stocks for wheat are estimated at 1,347 mb and all winter wheat acreage is pegged at 34.5 million acres (vs 33.3 in 2022). In terms of world numbers, production for both the Russian and Australian crops could be increased, while Argentina may be reduced. In other news, and on a bullish note, Japan and South Korea are tendering for wheat which could be sourced from the U.S. and Canada.

CATTLE HIGHLIGHTS: Live cattle futures finished lower on the day, as cash trade bids started to develop and position squaring before the round of USDA grain production numbers on Thursday. Feb cattle were unchanged at 157.750, and Apr cattle slipped 0.325 to 161.325. In feeders, Jan feeders were 1.175 lower to 183.125.

Cash trade was starting to see some bids on Wednesday to get trade rolling for the week. Early bids in the south were at $157, while asking prices were $158-159, so bids were passed over initially. At $157, that would be steady with last week, and this is a disappointment to the market. Cash and the Feb contract are tied together and fairly priced with each other at this time. Apr is holding a potential premium to those early bids and weighed on the deferred contracts. In other fundamentals, retail values are still supportive. At midday, carcass values were mixed with choice losing 1.17 to 283.36 but select was 0.18 firmer to 258.51. The load count was light at 71 loads. The weekly export sales report will be on tap for Thursday morning as the market watches export demand, which has been good but has slowed as of late. Feeders were pressured by the weak live cattle prices and seeing profit taking before the USDA reports on Thursday. Grain prices can impact the feeder market aggressively, and some long liquidation stepped in on Wednesday before tomorrow’s USDA numbers. Cattle charts look tired at this point, despite a relatively strong fundamental picture. Recently, live cattle futures failed to take out the most recent high, and price action looks concerned that the market could see some pull back to test lower support levels. This would change if the cash market were to trade higher week over week, but that looks like steady trade at this moment at best.

LEAN HOG HIGHLIGHTS: Lean hog futures saw additional selling pressure and long liquidation continue, triggered by the heavy slaughter numbers and the struggling cash markets. Feb hogs were 0.500 lower to 79.300, and Apr lost 1.125 to 88.400.

Hogs fell lower for the 9th time in the last ten days as the cash market tone still holds buyers to the sidelines. With today’s close, Apr hogs are trading nearly $9.00 of the most recent highs as sellers are in control. The cash market stays as a disappointment to the market in general. The CME Lean Hog Index traded 0.35 lower to 76.44, reflecting the weak cash tone. Feb hogs are still nearly a $3.00 premium to the index. Direct cash trade stayed disappointing, slipping 0.24 to 71.99 and a 5-day rolling average of 73.48. Estimated hog slaughter stayed on the heavy side with today’s estimate at 490,000 head, up 15,000 from last week and 59,000 over last year. The market is hoping to see peak slaughter soon, which could turn the cash market around. Weekly export sales will be released on Thursday morning, and that could provide some support. Weekly sales numbers have been strong recently as exporters are taking advantage of lower-cost U.S. pork supplies. Daily retail prices were softer at midday as carcasses lost 0.25 to 81.48. The load count was good at 236 midday loads. Finding a bottom is still a process, and the hog market is still struggling to build that base. The downtrend is both technical and fundamental at this time. Until the market can find some support fundamentally in terms of stronger pork values or improvement in cash prices, the hog market is still searching for its low.

DAIRY HIGHLIGHTS: The dairy trade has started to stabilize after a strong sell-off into the end of 2022 and a continuation lower right at the start of 2023. For the month of January, spot cheese is down just 0.50c and spot butter is up 5c. This has brought some support back into the trade. Market conditions have also leaned oversold in the short term, so there could be some technical buying as well. The markets still look to be in a downtrend, though, with weakness stemming from global dairy products at 12-month lows. The corn and fuel markets have also dropped some too, making inputs a bit cheaper. In Wednesday’s trade, spot cheese and butter both held unchanged so it was a quiet day of trade. Second month Class III gained 19c to $19.29, while second month Class IV added 5c to $19.13. All eyes will be on tomorrow’s Quarterly Grain Stocks report and Supply and Demand report. The market is looking for very small changes in the USDA’s final yield estimates for 2022.

Total Farm Marketing and TFM refer to Stewart-Peterson Group Inc., Stewart-Peterson Inc., and SP Risk Services LLC. Stewart-Peterson Group Inc. is registered with the Commodity Futures Trading Commission (CFTC) as an introducing broker and is a member of the National Futures Association. Stewart-Peterson Inc. is a publishing company. SP Risk Services LLC is an insurance agency. A customer may have relationships with all three companies. TFM Market Updates is a service of Stewart-Peterson Inc. Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition.