The CME and Total Farm Marketing offices will be closed Monday, January 16, 2023, in observance of Martin Luther King Jr. Day.

MARKET SUMMARY 01-12-2023

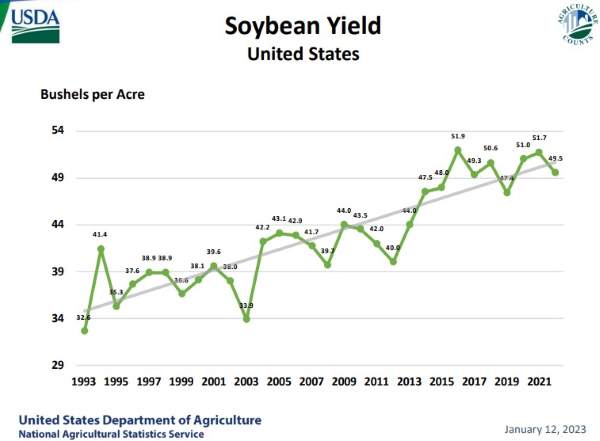

As usual, the USDA Crop Production reports can bring some surprises. The January data dump by the USDA brought two changes that the market was not expecting. The first was a drop in harvested corn acres, removing 1.6 million acres for the November totals. The second was a cut in soybean yield, lowering that number by 0.6 a bushel to 49.5 bushels/acre. Both moves brought overall production lower on the 2022 crops, dropping corn production by 200 million bushels, and soybeans by 69 million bushels. This reduced production lowered ending stock projections for both grains, while market analysts were expecting end stock totals to rise. For corn, even with a 185 million bushel drop in corn demand, corn ending stocks were lower by 15 million bushels to 1.242 billion bushels, well below market expectations. In soybeans, the lower production absorbed a 55 million bushel demand cut to drop ending stocks by 10 million bushels to 210 million bushels, again well below expectations. The lower ending stock totals are what helped provide the buying strength in the market on Thursday as the U.S. supply-side got a little tighter.

Like what you’re reading?

Sign up for our free daily TFM Market Updates and stay in the know!

CORN HIGHLIGHTS: Corn futures closed higher today after a surprisingly bullish WASDE report was released. U.S. corn production was reduced and world ending stocks were lowered as well. Weekly export sales results were released and were below the 4-week average. Mar corn gained 15 cents to end the session at 6.71, and May gained 14-1/4 cents at 6.69-1/2.

Corn had a strong move higher today after the USDA’s supply and demand data was released, which was very friendly to both corn and soybeans. Export sales were also released this morning and were on the lighter side with net sales of 255,700 mt for 22/23 down 20% from the previous week and 62% from the prior 4-week average. Exports of 387,100 mt were down 49% from the previous week and 53% from the prior 4-week average. The U.S. Crop Production report pegged corn yield at 173.3 bpa which is up from the prior estimate of 172.3 bpa, but harvested area was reduced leading to a lower production number overall of 13,730 mb. The USDA lowered corn demand by 150 million bushels but also cut corn production by 200 mb lowering ending stocks. World ending stocks were lowered as well to 296.4 million metric tons from last month’s guess of 298.4 mmt. Essentially every aspect of the WASDE report was friendly today. Corn exports have been lagging lately, but that may change as Brazil runs low on supplies and the U.S. becomes more competitive with Brazil. Argentina continues to deal with drought and currently has a good-to-excellent rating for their crop of just 13%. Mar corn touched the 100-day moving average today and then closed just below it, while Stochastic showed a buy crossover.

SOYBEAN HIGHLIGHTS: Soybean futures closed higher, along with corn, following the friendly WASDE report. The report was slightly more friendly towards corn, but it was bullish all the same. Export sales also came out this morning and were decent but have slipped from the past few weeks. Jan soybeans gained 14-1/2 cents to end the session at 15.29-1/2, and Mar gained 25-1/2 cents at 15.18-1/2.

All three soy products closed higher today after the USDA released the WASDE report which was friendly nearly across the board. Weekly export sales were released and were not terrible but show that business has been slowing down. Net sales of 714,400 mt for 22/23 were down 1% from last week and 41% from the prior 4-week average. Exports of 1,620,700 mt were up 10% from the previous week but were down 7% from the prior 4-week average. The U.S. crop production pegged yields at 49.5 bpa, lower than the last estimate of 50.2 bpa, and harvested acres were reduced as well lowering U.S. production to 4,276 mb for 22/23. The most significant bullish aspect to the report was the U.S. ending stocks number which was reduced to just 210 mb from 220 mb last month. The only bearish element was the world ending stock estimate which was increased to 103.5 mmt from 102.7 mmt due to a large Brazilian crop. Mar beans remain in their upward trending channel and closed right at the top of their Bollinger Band. Mar bean meal made a new contract high today and closed at 481.3.

WHEAT HIGHLIGHTS: Wheat futures rallied off early session weakness as buying strength in the grain markets helped pull wheat futures higher. Mar Chi gained 2-3/4 cents, closing at 7.42-3/4 and Jul up 2 at 7.54-1/4. Mar KC gained 12-3/4 cents, closing at 8.35 and Jul up 11 at 8.27-1/2.

A lot of USDA data hit the wheat market on the day. The morning started with a disappointing Export Sales report before the market opened. The USDA reported new sales of 90,800 MT, which was up from last week’s numbers, but still down 73% from the 4-week average. The lack of demand for U.S. wheat has been the anchor to this market as wheat prices struggle in competitiveness against global supplies. The USDA WASDE report and Winter Wheat Seeded Acres report brought the majority of data for the day. The 2023 winter wheat planted acres was up 11.1% over last year’s totals at 36.95 million acres. This number was above expectations, but wheat prices started to find footing. The majority of those new acres were planted in the key states of Texas, Oklahoma, and Kansas, which are still dealing with drought conditions and poor early wheat crop ratings. In the supply/demand tables, wheat ending stocks were lowered to 567 million bushels, down slightly from last month and below expectations. The USDA left export demand stable, but increased feed usage due to the competing price for corn triggering more possible feed demand to reach the lower carryout totals. Global wheat stocks were raised to 268.4 MMT, up 1.1 MMT from December, but still down 8.4 MMT from last year. The wheat market stabilized off the USDA numbers, but it took strong gains in corn and soybean to move all three classes of wheat higher into the close. The closing price action was encouraging and could trigger some additional short covering as long as the other grains want to lead.

CATTLE HIGHLIGHTS: Live cattle and feeder futures finished mostly lower as prices consolidated along yesterday’s trading range, and feeders were pressured by strength in the grain markets. Feb cattle were 0.200 at 157.550, and Apr cattle slipped 0.400 to 160.925. In feeders, Jan feeders were 1.000 lower to 182.125.

Cattle futures stayed under pressure as the livestock sector as a whole is on the defensive. Feb and Apr live cattle are still holding support but buying momentum seems to be fading without fresh news. Cash market bids have picked up, but trade is still light overall. Southern bids were $156-157, and northern bids at $158 against asking prices of $158-159. Most lower bids are being passed, but trade will likely develop late in the day and into tomorrow to get a true trend for the week. At these levels, trade is looking steady overall, which is disappointing to the market. Retail values are under pressure as choice carcasses were soft on the Wednesday close and slipped another 2.61 at midday trade to 278.12. Select was also 1.03 lower to 257.07 as carcass values have softened this week. The load count was light at 92 midday loads. Weekly export sales were quiet with the USDA reporting new sales of 13,300 MT for U.S. beef with Japan, China, and South Korea as the top buyers last week. Feeder cattle slipped under the pressure of the strong grain market after a friendly USDA Crop Production report. Jan feeders expire on the 20th and have pulled in line with the cash index. The Feeder Cash Index traded 0.04 higher to 182.36. Feeder charts are looking defensive, holding support, but a strong move higher in grain markets could trigger additional long liquidation. The price action looks concerned that the market could see some pull back to test lower support levels. Despite the overall friendly fundamental picture, momentum seems to be slipping in the cattle markets as some further price erosion could be on the horizon.

LEAN HOG HIGHLIGHTS: Lean hog futures saw additional selling pressure in the front end of the market as bear spreading pushed the near-term contracts lower. This was triggered by the heavy slaughter numbers and the struggling cash markets. Feb hogs were 0.550 lower to 78.750, and Apr lost 1.225 to 87.175. Deferred contracts may have found some values as Jul and later futures were higher on the day.

Feb hogs fell lower for the 10th time in the last eleven days as the cash market tone still holds buyers to the sidelines. With today’s close, Feb hogs have tested and held trend line support at the bottom of the market, while Apr futures are trading at their lowest point since October. The selling pressure in Apr still looks to have room to fall, but Feb could be reaching a seasonal bottom. The big problem in the hog market continues to be the eroding cash market. The CME Lean Hog Index traded 0.48 lower to 75.96 and is still at a discount to the Feb and Apr futures. This keeps the selling pressure intact. In addition, the direct cash market has stayed weak as well. Midday direct trade today was firmer, gaining 0.39 to 72.39 and a 5-day average of 72.93. Retail values have trended lower this week but were 0.39 higher at midday to 81.07. The load count was moderate at 180 loads. Weekly export sales have been supportive with cheaper pork values. USDA released weekly export sales on Thursday morning and posted new sales of 13,100MT with Mexico, Japan, and South Korea as the top buyers of U.S. pork last week. The hog market is still stuck in sell mode as the front-end contacts are still looking to find the bottom. Finding a bottom is still a process, and the hog market is still struggling to build that base. The downtrend is both technical and fundamental at this time. Until the market can find some support fundamentally in terms of stronger pork values or improvement in cash prices, the hog market is still searching for its low.

DAIRY HIGHLIGHTS: After a few days of recovery, Class III futures broke hard today with the February contract closing down 51 cents at $18.78, threatening to make two weeks in a row that the second month chart has closed under $19.00 support. Despite large gains in the grain/feed markets, spot cheese dragged futures negative with a 8.50 cent drop to move to $1.90625/lb. Despite that move, spot cheese enters Friday up just over a penny and one potential positive was that blocks and barrels had only 0 and 3 loads trade, respectively. Class IV action was unchanged to quietly lower on the heels of a quiet spot trade so far this week. Overall, market direction remains choppy to lower as the calendar ticks towards the halfway point in January.

Total Farm Marketing and TFM refer to Stewart-Peterson Group Inc., Stewart-Peterson Inc., and SP Risk Services LLC. Stewart-Peterson Group Inc. is registered with the Commodity Futures Trading Commission (CFTC) as an introducing broker and is a member of the National Futures Association. Stewart-Peterson Inc. is a publishing company. SP Risk Services LLC is an insurance agency. A customer may have relationships with all three companies. TFM Market Updates is a service of Stewart-Peterson Inc. Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition.