MARKET SUMMARY 2-15-2023

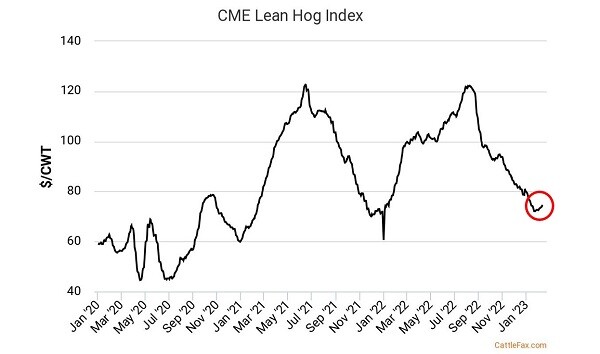

The hog cash market may have found its seasonal low and is beginning to turn higher, lifting the futures market. Since mid-January, the CME Lean Hog Index has begun to trend higher, possibly indicating a cash market bottom. Despite the volatility and selling pressure, the April futures have started to respond to the improving cash. The past couple of winters, the cash market has found a bottom on the late December and January window, then proceeded to run to the summer highs for cash. This lifted the futures market in sympathy. After the recent sell-off, a turn higher in the futures prices is a positive development. The biggest concern is the premium of the futures to cash. That situation of a strong futures to cash market nay keep upside limited in the short-term until that spread between the two narrows.

Like what you’re reading?

Sign up for our free daily TFM Market Updates and stay in the know!

CORN HIGHLIGHTS: Corn futures started the day softer on weaker energy and competing grains and stayed as such with March losing 6 cents to close at 6.76-1/4 and December dropping 2-1/2 to end the day at 5.95-1/4. A higher dollar didn’t help matters either as market talk suggests interest rates may have to increase to tame inflation as yesterday’s CPI numbers were slightly higher than expected.

Today’s corn use for grind in ethanol was encouraging and supportive at 101.9 mb, the highest in four weeks. Yet, without strong exports, the market, while factoring in poorer Argentine crop expectations is not exciting bulls to the point of where they want to buy at higher prices. In other words, more sideways trade. Farmer selling is light on setbacks unless basis firms. We would not be surprised to learn that farmer selling is ahead of normal this year. Many have suggested prices are too good and inputs for the upcoming year priced to high to hold large inventory only to find prices are sinking by spring or early summer. export sales will be released tomorrow and if not in line with the average of over 50 million bushels the previous two weeks, prices will likely struggle. The last two weeks saw exports at over 100 mb and if annualized this would equate to 2.6 billion. Yet the pace was so slow this fall and early winter than many believe the current estimate of 1.925 bb is still too generous and further cuts are coming. Time will tell. Our bias is that front loading purchases was not likely as fall prices were historically high and that, over time, exports will improve. The current estimate is not too generous.

SOYBEAN HIGHLIGHTS: Soybean futures closed lower today dragged by a sharp drop in meal as the size of Brazil’s ongoing harvest sets in and today’s crush report came out much smaller than anticipated. Crude fell hard this morning after the inventory report, but closed higher. Mar soybeans lost 11-3/4 cents to end the session at 15.25-3/4, and Nov lost 8 cents at 13.75.

Bean meal really put a damper on the soybean party today with a nearly 2% fall in March meal bringing beans down by 12 cents in March. While beans remain in their upward trend for the moment, they are leaning back closer to the bottom of that range. Argentina’s forecast hasn’t significantly improved so the selling is likely due to the reality of Brazil’s record harvest setting in and what that will mean for exports down the road, especially as China appears to not want to buy anything from the US if possible. Another unfriendly figure today was the NOPA crush report numbers in which a big crush was expected, but only 179 mb were crushed in January, far below the 181.6 mb estimate. This is slightly concerning because the thought has been that if the US loses out on exports, domestic crush demand would make up for some of those bushels. In Brazil, the main production area, Mato Grosso, is now over 44% harvested and the entire country has harvested nearly 40 mmt. Prices in Paranagua are over a dollar less expensive than offerings in the US gulf, so export sales should be expected to drop significantly in the coming weeks. If the current range in March beans holds, support is around 15 dollars while resistance is around 15.55.

WHEAT HIGHLIGHTS: Wheat futures closed with double digit losses on a lack of friendly news, a higher US dollar, and spillover from lower corn and soybeans. Mar Chi lost 16-3/4 cents, closing at 7.69-1/4 and Jul down 14-1/4 at 7.85-1/4. Mar KC lost 11-1/2 cents, closing at 8.94-1/2 and Jul down 11 at 8.70.

Wheat took a hit today in all three US futures classes, as well as Paris milling wheat futures. Pressure likely came from a few different sources. First, the US Dollar Index was sharply higher today and is closing back in on the 104 level. Talk of higher global interest rates and some lower currencies in importing countries could slow their demand for US wheat. Competition from Ukraine and Russia remains a concern as well. The deadline for the Black Sea grain deal is set to expire in mid-March and if it does close that would certainly lend a bullish hand to the wheat market. However, if it continues, the perception would be negative to prices. In addition to these factors, wheat is at or near overbought levels on some technical indicators and a lack of fresh news may have led to long liquidation today. The lower corn and soybean markets also offered little support. As far as weather goes, some precipitation did hit the HRW areas of the southern plains but drought remains a concern overall; more moisture is definitely needed in those areas.

CATTLE HIGHLIGHTS: Live cattle futures saw mixed trade on the day as the market waited for cash trade to develop this week, and feeders were supported by weaker grains. February cattle were .400 higher to 162.550, and April cattle slipped 0.075 to 164.600. March feeders gained .675 to 187.325.

Packer bids have stayed quiet for the most part, but potential for higher cash trade supported the Feb contract, pushing it to a new contract high on the day. The trend in cash is still higher, and the market was likely anticipating that during the session. Feder Cattle Exchange reported 7 lots with only one trading at $158.75. The remaining lots failed to meet reserve prices and went unsold. Countryside cash markets are still quiet this week, but packer inquiry will likely pick up over the next day or so as asking prices trended higher at $163 in the South. Trade will likely hold off until the end of the week in general. The cash market will likely be the driver in the cattle future’s prices in a window where prices are seasonally challenged, typically after Valentine’s day. In the retail market, a firming choice market will help support cash optimism. Choice carcasses added 3.66 to 275.72 and select was 2.83 higher to 261.61. The load count was light at 80 loads. Weekly export sales will be watched again on Thursday morning for continued good product movement. Feeder cattle moved moderately higher supported by a weak grain market on the day. The Feeder Cattle Cash Index traded .01 higher to 183.07 and the March feeders are tied to the cash index. Overall, the cattle market is well supported by the lack of cattle supplies and a potentially firming cash market. Cash will be king and will likely be the driver in the cattle market going forward.

LEAN HOG HIGHLIGHTS: Lean hog futures traded lower on Wednesday as the front end of the market consolidated, and the premium of the April contract to the cash market limited gains. April hogs lost .750 to 86.500, and June hogs lost .525 to 104.300.

The concern will still be the premium of the futures to the cash market. April will now be the new lead month this week and hold a $12+ premium to the cash market, and that was likely a limiting factor, but at least the cash market is trending in the right direction. The Lean Hog Index gained 0.54 to 75.18, reflecting an improving cash market. The cash index turned the corner higher in mid-January and has lifted nearly $3.00 in that time window. The direct cash hog trade has now started to follow the index trend. At midday, it was .39 higher to 75.65, as the cash market seemed to build its seasonal bottom. Historically, cash markets will run to their spring/summer highs from the winter lows. This typically pulls the futures values with it. Retail values were .95 higher to 82.83 as prices rebounded off a weak afternoon close on Tuesday. Movement was light at 168 loads. Retail values are starting to move away from the $80 area, which could support cash bids as well. It will still take the fundamentals to sustain any rally; at least cash is starting to try to help, and now the retail market is stepping up as well. The trend looks higher in the hog market, but so is the possible volatility.

DAIRY HIGHLIGHTS: Offering in both the spot butter and spot cheese markets kept class III and IV milk futures on the defensive once again on Wednesday. In the spot trade, butter fell 3.75c to $2.42/lb, while cheese blocks fell a penny and cheese barrels lost 1.75c. Milk futures remain in steady downtrends, despite recent attempts both markets have made to rally higher. Seasonals are weighing on prices along with a lack of new catalysts. Reports are that cheese production has been strong of late and export demand is slowing. In regard to butter, reports say that cream supplies are readily available for production in all regions. Butter makers throughout the country are operating busy production schedules. In Wednesday’s trade, March class III fell 8c to $17.66 while March class IV was unchanged at $18.93. Expect the spot trade to dictate much of the price action this week, as news is expected to be light.

Total Farm Marketing and TFM refer to Stewart-Peterson Group Inc., Stewart-Peterson Inc., and SP Risk Services LLC. Stewart-Peterson Group Inc. is registered with the Commodity Futures Trading Commission (CFTC) as an introducing broker and is a member of the National Futures Association. Stewart-Peterson Inc. is a publishing company. SP Risk Services LLC is an insurance agency. A customer may have relationships with all three companies. TFM Market Updates is a service of Stewart-Peterson Inc. Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition.