MARKET SUMMARY 2-22-2022

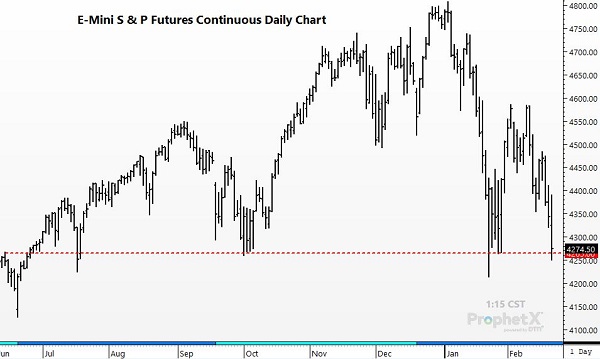

The escalating tensions in the Ukraine have the equity market testing its lowest point in months. The S &P 500 futures were trading over 1.5% lower on the day and are currently pushing a 10% correction for the high established on January 4th. The S &P 500 futures is looking to post its lowest close going back to July 19th this past summer. The concerns over sanctions on Russia that could be arising as tension in the Black Sea region have escalated this week. The potential impacts could result in strong energy and commodity prices, which will likely erode corporate profits. The equity markets were already on the defensive as the Fed has been signaling a tighter monetary policy to help curb inflation pressures in the U.S. Regardless, the S &P 500 futures are challenging some key support levels, that could open the door to s round of technical selling if prices don’t hold support.

Like what you’re reading?

Sign up for our free daily TFM Market Updates and stay in the know!

CORN HIGHLIGHTS: Corn futures priced firmer again to start the week, with March gaining 20-1/2 to close at 6.74-3/4. New crop December added 8 cents to end the session at 6.05-3/4. Skyrocketing wheat and sharply higher soybean prices spilled into the corn pit where prices, despite strong gains, appeared to be more of a follower than leader. Russia’s increase aggressiveness sending troops in Ukraine was a bullish factor. It is thought that Ukraine has as much as 600 million bushels or more to export.

Export inspections at 62.1 mb were termed supportive, bringing the year-to-date total to 852 mb, still down well over 10% from a year ago. Expect both sales and inspections to be firm in the weeks ahead as a drawdown to first crop corn production for Brazil and a shorter crop in Argentina keeps the world looking for supply. Although most futures contracts are considered overbought, there are no sell signals yet and the market is gaining upward momentum. This is a rather rare event in history when you have a weather event in a major producing region along with a very significant political event also in major grain producing regions that are also significant suppliers of energy. Couple that with fertilizer shortages and inflation and it is easier to understand the recent acceleration in prices.

SOYBEAN HIGHLIGHTS: Soybean futures continued their trek higher with another round of strong gains, closing at their highest prices for the year as March added 33-1/2 cents to close at 16.35, and November up 9-1/2 to finish at 14.73-1/4. Ukraine/Russia news, higher energy, and short covering all helped to drive prices higher today. Rain delays are keeping some acres in Brazil form timely harvest while a short crop in the southern region is creating a near-term supply dilemma. Surging soybean oil prices were noted today as March oil futures broke into new high contract high closes. Another daily sale for the 22/23 season of 132,000 mt was announced this morning.

Export inspections at 35.8 mb were supportive and likely further evidence that future cuts to projected carryout are likely. Total inspections to-date are still about 20% behind a year ago, but as indicated before, sales take a different form when prices are high. A year ago, lower cost allowed for large purchases. This past year, higher prices create a just in time inventory approach. The gulf was shut down for some time also affecting immediate supply availability. With smaller production in South America expect more supportive business to head to the US with steady sales and inspections. Bioenergy prices are also aiding in price support.

WHEAT HIGHLIGHTS: Wheat futures closed sharply higher on news that the Russian invasion of Ukraine has started. March Chi gained 47-1/4 cents, closing at 8.44-1/4 and July up 46-3/4 at 8.47-1/2. March KC gained 46-1/2 cents, closing at 8.81-3/4 and July up 45-3/4 at 8.86-1/2.

Wheat rocketed higher as the fears of a Russian invasion of Ukraine have come to fruition. They have reportedly annexed two states which have been declared as independent. New information is coming out of that region almost constantly, but the Russian people have apparently been told that Ukrainians are attacking these states and Putin sent in troops for protection. Ukraine’s president also apparently stated he is still looking for some type of peaceful, diplomatic solution. President Biden addressed the news this afternoon by saying this was “the beginning of a Russian invasion” and that there would be economic sanctions against Russia. Additionally, Biden said he would move equipment and troops to European allies of the US, but said that the US is still open to the possibility of a talks and a peaceful solution to avoid war. While the news out of the Black Sea region has been the main focus of the headlines, there are other factors impacting the wheat market too. Wheat inspections were pegged at 19.8 mb with total inspections now at 553 mb. Private exporters reported 120,000 mt of HRW wheat for delivery to Nigeria – half for delivery during the 21/22 marketing year and the other half during the 22/23 marketing year. This highlights the dryness that has been seen in northern Africa, which also remains a concern in southwest Europe and the US southern plains. On that weather note, below freezing temperatures this week are reaching as far south as the Texas panhandle.

CATTLE HIGHLIGHTS: Live cattle futures fought off early session selling pressure to finish with small gains to start the week, as spill over strength from the hog market and cash market optimism kept buying support in the front month contracts. February cattle gained .500 to 143.750, and April cattle added .150 to 146.025.

The April contract moved to the bottom of the $3.00 trading range and testing support at the 20-day moving average. April price has traded within this range for the past 15 days. A potential head and shoulders pattern is still forming on the chart, but prices held the bottom of that pattern on Tuesday. If a downside break were to occur, it could have the market testing 142.500 and trend line support. February expires on 2/28 and is directly tied to the cash market. Cash trade was undeveloped to start the week, but asking prices were firmer at $144-145 on the country side. Bids were still undeveloped, but the market is anticipating a firmer trend overall. Retail values have been trending lower and could be getting close to a seasonal low. At midday, boxed beef prices were mixed, (Choice: -2.07 to 262.02, Select: +.94 to 262.78) with demand light at 57 midday loads. The weaker demand tone is noticeable in the Choice/Select spread, which has turned to a negative .76 with the strength of Select beef versus Choice. Weekly beef production was up by .9% to 559 million pounds last week, as slaughter ticked higher. The additional product only helped pressure retail beef prices. Feeder cattle finished lower, limiting gains in the live market, as a strong surge higher in gain market pressured the feeder market. March feeders were 1.200 lower to 164.225. The Feeder cash index traded .42 lower at 162.14. Cattle markets overall are still in an uptrend, but momentum has slowed. Prices may be reaching winter highs, and a potential pull back may be in front of the market as charts have turned more negative. Despite holding support on the April contract on Tuesday, the price action overall was soft in the cattle market.

LEAN HOG HIGHLIGHTS: Hog futures surge to new highs, taking out top side targets, as strong retail and cash market support money flow into the hog market. April hogs were 2.675 higher to 112.075, and June hogs gained 2.300 to 115.650.

It has been a historic run higher for April hogs, which have gained over $25.00 since the start of the year. The strong tone stays in the market, keeping buyers active as April broke through the $110.00 and may be targeting long-term resistance near $116, as the contract is moving into uncharted territory. Pork cutout values are still trending higher, gaining $2.5 at midday to 112.24. Load count was moderate at 160 loads, and the expensive primal loin cut show strong historical strength as that cut has added $9.00 of value over the past week. Year-to-date, pork production is down 8.4% versus last year, that combined with strong demand tones helps support the hog market. The strong retail values have carried over into the cash market. Cash was supportive with the National Direct morning trade a weighted average price of 83.64. The Cash Lean Hog index gained 0.99 to 95.23. Technically, buyers stay active as they anticipate tightening supplies through the year. Prices pushed and closed at new contract highs this afternoon, opening the door for more money flow and a challenge of the longer-term trendline highs still looks to be in order.

DAIRY HIGHLIGHTS: The dairy market began this shortened Holiday trading week with steady bidding out of the gates in most products. News over the extended weekend about Russia invading Ukraine spiked the fuel and grain markets, which supported higher dairy prices. The dairy trade didn’t gain much momentum out of the 11am dairy spot trade, however, and most futures retreated back to neutral for the day. The market is likely in a “wait and see” mode at this time as the USDA is set to release monthly cold storage data after the market closes today. There is also a much anticipated milk production report that will be released tomorrow. The USDA pegged November production down 0.40% year-over-year while December production was down 0.10% year-over-year.

Total Farm Marketing and TFM refer to Stewart-Peterson Group Inc., Stewart-Peterson Inc., and SP Risk Services LLC. Stewart-Peterson Group Inc. is registered with the Commodity Futures Trading Commission (CFTC) as an introducing broker and is a member of the National Futures Association. Stewart-Peterson Inc. is a publishing company. SP Risk Services LLC is an insurance agency. A customer may have relationships with all three companies. TFM Market Updates is a service of Stewart-Peterson Inc. Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition.