MARKET SUMMARY 2-24-2022

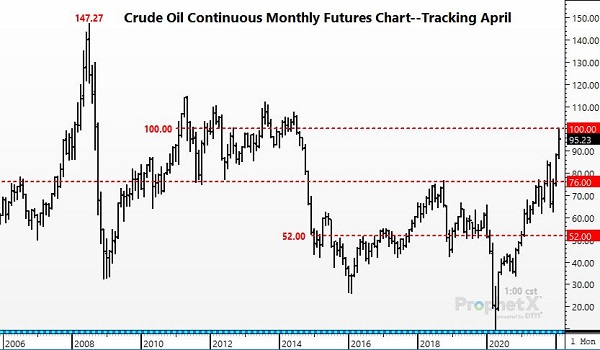

Crude oil prices have pushed back to touch the $100/barrel price level. The military actions by Russia in the Ukraine have exploded the volatility in the world markets, and the energy sector saw strong buying strength. In early session trade on the overnight, April crude oil futures traded to the $100 level, and the highest price point since 2014, the last time crude oil traded over $100. With the military action in the Ukraine, the crude oil market is concerned about supply disruptions, further tightening of tight global supply in the face of improving demand. The length and severity of the conflict in Ukraine will have a longer-term impact on energy prices, but the sellers did step forward at the $100 level today, as prices traded well off the early session highs. The energy market and prices have been on a steady uptick, and now have a new target to retest at $100.

Like what you’re reading?

Sign up for our free daily TFM Market Updates and stay in the know!

CORN HIGHLIGHTS: Corn futures closed mixed in a volatile session on Thursday, with March gaining 11 1/4 cents, closing at 6.95, while December lost 6 ½ cents, closing at 6.04-3/4, The March close was another contract high close. The beginning of military action by Russia in the Ukraine sent corn and wheat prices limit higher in the overnight session. Prices fell off their highs by the end of the trading session, with Dec corn posting a hook reversal lower.

The impact of the start of military action by Russia in the Ukraine sent corn prices limit higher during the overnight session. March corn peaked at 7.18-3/4 on the session high. Prices faded back as the market may be looking towards the end of the month. In addition, first notice day for March grain contracts is Monday and that may have added to selling pressure and profit taking. Corn future were still supported on the front months by the strength seen in the wheat market, with Chicago wheat closing limit higher on the March and May contracts. Additional strength may still be on tap for Friday in the wheat market and that could carry over and support grains. The USDA release their 2022-23 outlook forum numbers this morning. the USDA has baseline projections of 92 million acres of corn with a trend line yield of 181 bu/acre for next year. Those numbers may have brought some additional selling pressure in the deferred corn contracts. Today was a volatile day, with a lot of unanswered questions. Weekly export sales tomorrow may help provide direction, along with the impact of the outside markets.

SOYBEAN HIGHLIGHTS: Soybean futures reached new highs today before closing over a dollar lower than those highs. March lost 13-1/2 cents, closing at 16.61-1/2. November lost 36 cents, closing at 14.51-1/2. Profit taking on the recent strong rally and due to uncertainty over the conflict in the Black Sea region likely played a part.

The volatility seen in soybeans today was astounding as the market responded to the Russia situation. Headlines around the world are talking about the full-scale Russian attack on Ukraine. Reports are that Russian rockets and artillery have fired upon areas all around Ukraine, signaling that this is the beginning of a war, and Putin has no intentions of backing down. President Biden addressed the situation this afternoon saying that new, strong sanctions will be imposed to weaken the Russian nation. Reportedly these sanctions include limits on technology exports and sanctions on Russian banks. Time will tell if these have an impact, but the market today was a roller coaster ride as traders tried to manage their positions and outguess the geopolitical circumstances. As to why soybeans closed with losses – profit taking after such a strong start to the session could have played a big part along with general uncertainty about world events. In other soybean related news, the USDA recently hosted their outlook forum in which they gave unofficial numbers – soybean planted acres at 88 million, with a crop of 4.490 bb, and a carryout of 305 mb. In China, March soybeans on their Dalian exchange are around the equivalent of $23.36 per bushel (their highest domestic price since 2008). Also, the Buenos Aires Grain Exchange lowered their soybean crop rating to 24% good to excellent from 31% last week.

WHEAT HIGHLIGHTS: Wheat futures shot straight up on news that Russia launched a full-scale attack against Ukraine. March Chi gained 50 cents, closing at 9.26 and July up 46-1/4 at 9.25. March KC gained 49-1/2 cents, closing at 9.63 and July up 40 at 9.56-1/4.

With the breakout of war in Ukraine, limit up moves in wheat were observed. Though deferred contracts closed off their highs, the front months in both Chi and KC closed at or near the 50 cent limit. Perhaps more impressive, Paris milling wheat futures left a large gap on the charts with a close of 29.50 Euros per ton higher – recent trading ranges for this contract have varied from roughly 2 to 9 Euros so this is an impressive move. It is not hard to imagine why, though, when you consider that European markets will be most directly impacted by any disruption of wheat out of the Black Sea area. On that note, Russian artillery fire and rockets are reported to have hit several areas throughout Ukraine, damaging military bases and air defense systems. Russian troops and tanks have also moved in, and there are talks that Putin will target the Ukrainian capital, Kyiv, for a takeover. President Biden spoke this afternoon, stating that new sanctions would be issued, including sanctions on Russian financial institutions and limiting technology exports to Russia. While these headlines have been the market movers today, there is other wheat related news. The recent USDA outlook forum gave some unofficial numbers – 48 million wheat planted acres, a crop of 1.945 bb, and a carryout of 731 mb. Additionally, drought remains a concern in the US plains.

CATTLE HIGHLIGHTS: The cattle market saw strong selling pressure on Thursday, which was influenced by a weakened technical picture, steady cash market, and the market turmoil caused by the Russian military action in the Ukraine. February cattle lost 2.252 to 140.525 and April cattle dropped 2.450 to 142.300.

The weak technical close on Wednesday opened the door for follow through selling and with turmoil in the outside markets, set cattle up for a day of long liquidation. April cattle followed through on the head and shoulders pattern, and are testing the bottom of the trading range and the 100-day moving average. Additional selling pressure is likely, but the market may look to square positions before the USDA Cattle on Feed report. On Friday, the USDA will release the next Cattle on Feed report, and the market is positioning for those numbers. Expectations are for: Total cattle on feed to be at 100.8% of last year, marketings at 97.3% of last year, and placements at 99.2% of last year. Fundamentally, cash trade was starting to develop, and bids softened, helping pressure the market in general. Early cash trade was slotted at $142, steady with last week, while the market was targeting higher trade. The weakness in futures and retail values allowed packers to soften their bids on Thursday. Retail values have been trending lower and at midday, boxed beef prices were lower, (Choice: -.12 to 260.76, Select: -3.48 to 255.48) with demand was moderate at 101 midday loads. Feeder cattle finished sharply lower, pressured by the weak cattle complex. March feeders were sharply lower losing 3.675 to 162.775, and April feeders fell 4.475 to 163.800. Feeder cattle posted a strong gap lower, and failed to see prices find any footing, opening the potential for further downside trade. Cattle markets overall are still in an uptrend, but a potential pull back may be in front of the market as charts have turned more negative. The price action overall is soft in the cattle market and prices are trending lower in the short-term.

LEAN HOG HIGHLIGHTS: Hog futures saw follow through selling as prices saw additional long liquidation led by money flow and pressure for weak cattle and outside markets. April hogs were 2.500 lower to 105.525, and June hogs dropped 2.675 to 116.100.

After yesterday’s key bearish reversal in April hogs, the market was poised to see additional follow through selling/long liquidation. The first level of support under the April contract is the 10-day moving average at $106.000, which the market tested on Thursday. The technical weakness was seen in multiple futures contracts and the hog market may be due for a needed correction. The impact of the outside market news, and the fact that Monday is the last day of the month and the quarter may have help bring extra money flow out of the hog market. Fundamentals were supportive in the market again on Thursday. Pork cutout values are still trending higher, and jumped $8.05 at midday to 117.17. Load count was moderate at 128 loads as ham and belly primal cuts again supported the market. Friday will bring the weekly exports sales numbers, and they could help set the tone into the weekend. The strong retail values have carried over into the cash market. Cash was supportive with the National Direct morning trade was marking a base price of 87.58 and the Cash Lean Hog index were unchanged at 98.16. The April futures is still holding a 7.365 premium to the index, setting up some profit taking as the market nears the end of the month. Technically, the hog market is looking to change direction, or at least see some needed profit taking. The depth of the correction and follow through going into the end of the week will be key. The fundamentals stay supportive, on a tighter hog supply overall. The market is still in a strong uptrend, but end of month trade will likely bring some correction.

DAIRY HIGHLIGHTS: In one of the wildest days in recent memory for commodities and world news, milk prices rallied in the overnight and kept most of that strength into the afternoon’s close. Of course the invasion of Ukraine by Russian troops had the grain and energy markets wildly higher, at least in the overnight trade as the soybean complex and most of the energy markets closed well off their highs, but there was likely some spillover strength into milk as well given the higher input markets. That being said, we do not want to downplay yesterday’s milk production report with US production down 1.6% YoY. Historically, a lower January milk production report often points to higher milk trade into the spring when price action has been positive entering the report. Production will eventually pick up given the current prices but there are some short-term limiting factors, especially feed costs, that may slow the pace a bit.

Total Farm Marketing and TFM refer to Stewart-Peterson Group Inc., Stewart-Peterson Inc., and SP Risk Services LLC. Stewart-Peterson Group Inc. is registered with the Commodity Futures Trading Commission (CFTC) as an introducing broker and is a member of the National Futures Association. Stewart-Peterson Inc. is a publishing company. SP Risk Services LLC is an insurance agency. A customer may have relationships with all three companies. TFM Market Updates is a service of Stewart-Peterson Inc. Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition.