MARKET SUMMARY 02-24-2023

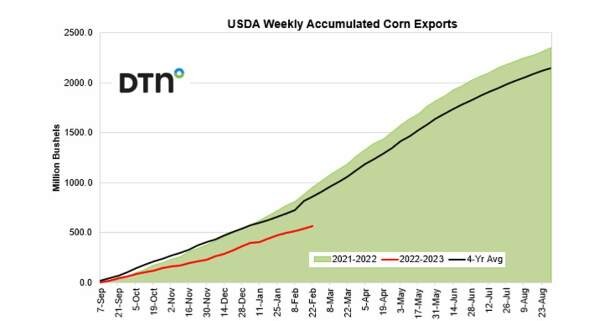

As the calendar turns away from February into March next week, the corn market is keeping a close eye on corn export sales and shipments. Last week, cumulative corn shipments for the marketing year total 565 million bushels with new shipments of 27.1 million bushels for the week of February 16. This total is still running 41% below last year and well below the 4-week averages. This week’s Export Sales report was still less than stellar, but improving with new sales of 32.4 million bushels of corn sold for the current marketing year. The next weeks are the time frame when the U.S. corn export program should make some big strides, but the amount of sales and shipments are lacking. This could be tied to the tight corn supplies and the competition globally in price versus U.S. bushels. The price beak this week may help export goals, but the market will be watching for new demand to surface at these lower prices.

Like what you’re reading?

Sign up for our free daily TFM Market Updates and stay in the know!

CORN HIGHLIGHTS: Corn futures wasted little time with follow-through selling in the morning hours after yesterday’s price plunge. Mar corn lost 10-1/4 cents to close at 6.50. For the week, Mar corn lost 27-3/4 cents or 4.1%. Dec corn lost 9-1/4 5.76-1/4 and gave up 19-1/4 cents on the week. Heavy technical selling, coupled with sharp losses in the wheat market, also weighed on futures. Mar closed lower 30 cents today and down 57 cents for the week. Additionally, another day of sharp losses in equities may be suggesting that managed money is reducing long exposure in the grains and oilseeds.

Despite a drop in Argentine corn ratings to 3% good to excellent according to the Buenos Aires Grain Exchange, an all-time low, the market shrugged off this supportive news taking a defensive tone. The USDA Outlook Forum did raise supplies and lowered the average farm price, yet their numbers are preliminary. Carryout is anticipated to grow from 1.267 bb to 1.887 in the year ahead. The average farm price is expected to decline from 6.70 to 5.60. Bulls had a difficult week. The question is now – Is there more downside to come or is this a buying opportunity? With the dollar rising, now up four weeks in a row, it will take something new or concerning to generate an about-face for prices. The drought map in the U.S. is shrinking, technicals look weak, and exports remain slow. Today’s export figure was 32.4 mb. While not a poor number, it is the lowest in four weeks.

SOYBEAN HIGHLIGHTS: Soybean futures closed lower today continuing the generally negative outlook since the outlook forum numbers were released, but Mar option expiration added some pressure and volatility as well. Mar soybeans lost 5-1/4 cents to end the session at 15.29, and Nov lost 13-3/4 cents at 13.74. For the week, Mar gained 1-3/4 cents while Nov lost 12-1/4 cents.

Soybeans were pulled lower by a decline in bean oil, Brazil’s forecast drying up, and general bearishness in the grains that came after the USDA’s outlook forum numbers. Today, the U.S. dollar rose to its highest level since early January which has added to the pressure on grains. Bean oil was the biggest loser today despite higher crude which dragged beans down and posted the biggest losses in the Nov contract. Bean meal was bull spread with May gaining slightly while the deferred contracts moved lower. With Brazil’s drier forecast, they are able to speed up harvest which has added some pressure with their beans nearly ready to ship. In spite of that, U.S. export sales were surprisingly good for last week. The USDA reported an increase of 20.0 mb of soybean export sales for 22/23 and an increase of 0.4 mb for 23/24 and were up 20% but down 18% from the prior 4-week average. Last week’s export shipments were 63.9 mb and were above the 17.5 mb needed each week to achieve the USDA’s export estimate. In Argentina, the Buenos Aires Grain Exchange adjusted the ratings for their bean crop to just 3% good to excellent after early frost and drought damaged their crop. The upward trend remains intact for May beans, while Nov beans have posted a sell signal crossover in the stochastics and may have formed a temporary top.

WHEAT HIGHLIGHTS: Wheat futures plunged today without much in the way of fresh news. Managed funds are suspected of adding to short positions. Mar Chi lost 30 cents, closing at 7.08-1/4 and Jul down 27 at 7.29-1/4. Mar KC lost 20 cents, closing at 8.41-3/4 and Jul down 23 at 8.28.

The funds appeared to be out in full force today. Given the fact that the Commitments of Traders report has been delayed for a few weeks now, it is difficult to know for sure. But today’s action in the grain room certainly seems like fund selling. There were also rumors today that this was the case, as they were said to be exiting long grain positions and adding to wheat shorts as the U.S. dollar rallies. The U.S. Dollar Index has been climbing since the February 2 low and is currently above the 105 mark. The last COT report on January 24 showed the funds net short 369 mb of Chicago wheat; this is more than the U.S. produced in 2022. Export sales also offered no support today with the USDA reporting an increase of only 12.4 mb of wheat sales for 22/23 and 2.9 mb for 23/24. For the week, May Chi wheat was down 54-1/2 cents while May KC lost 60-1/2 cents. Alongside these two classes, today MPLS futures and Paris milling wheat were also sharply lower. Also potentially weighing on wheat is news that China supposedly has an initiative to negotiate with Russia to end the Ukraine war. This would stop Russia’s advance and they would retain Ukraine territory. Also, China suggested that the west would drop sanctions against Russia. At this point in time, it seems that neither Ukraine nor western countries are likely to accept that, but it could have added to today’s pressure nonetheless.

CATTLE HIGHLIGHTS: Live cattle futures were choppy on the session as the market prepared for the USDA Cattle on Feed report on Friday after the market close. Feb cattle were 0.050 higher to 165.200, and Apr cattle added 0.050 to 165.350. Mar feeders slipped 0.150 to 189.075. For the week, Feb cattle added 1.625 and Apr was 0.725 higher. Mar feeders traded 2.550 higher on the week.

Another day and another new contract high in Feb and Apr live cattle, as prices reacted to the building cash trade, but after hitting the early session strength, prices faded in position squaring before the report. Going into the close, the market worked higher to trade nearly unchanged on the day. The USDA Cattle on Feed report was slightly friendly to within expectations. Total cattle on feed were 96% of last year versus a 96.3% expected. On February 1, 11.7 million head of cattle were on feed in lots of more than 1,000 head capacity. Placements in January were slightly below expectations at 96% vs 97.1% of last year, and marketing remained strong at 104%. The numbers were supportive given the total lining up with the lower end of expectations. The cattle market has moved strongly into these numbers, so some values are likely priced in. The market will get back to the cash market as the driver next week. Cash trade this week was tending higher as packers are looking for cattle. Most southern cash trade was $162-164, which is $1-3 higher than last week. Northern dress traded was getting completed at $262, up $5 higher than last week. Choice carcasses traded 0.40 higher at midday to 288.31 and Select beef added .78 to 276.65. The load count was light at 57 midday loads. Weekly export sales stayed supportive at 15,400 MT as China, South Korea, and Japan were the top buyers of beef last week. The feeder cattle saw some profit taking before the Cattle on Feed report. The Feeder Cash Index was up 0.13 on the day at 182.70. Mar feeders are holding a premium to the cash index which could be a limiting factor. The grain market may be the biggest driver in feeder prices in the near future and today’s price break represents the crossover impact on the feeder market. Cattle futures overall look strong, fueled by the cash market being the driver, as front-month futures moved to new contract highs again on the day. Be cautious, the market is getting overbought, and may be due for some correction if the fundamentals were to cool. The Cattle on Feed report was friendly to neutral and will keep prices supported, but a pull back given the strength is not out of the question.

LEAN HOG HIGHLIGHTS: Lean hog futures finished lower to end the week as prices faded, influenced by a negative tone in the outside markets, despite a strong week of export sales again for hogs. Apr hogs lost 0.175 to 86.025, and Jun hogs slipped 0.475 to 103.475. For the week, Apr hogs finished 0.750 higher and Jun hogs also added 0.750.

The Apr hog contract consolidated again on Friday as prices are still held in check by the premium over the cash market. A more negative tone in outside markets limited the hog market on the day as equity markets saw strong selling pressure and the U.S. Dollar Index traded the highs for the year. The hog market saw early strength from a strong export sales report before the open. Last week, USDA reported new pork sales totaling 51,900 MT for 2023 were up 16% from the previous week and 39% from the prior 4-week average. Mexico, China, and Japan were the top buyers of U.S. pork last week. Pork Exports totaled 29,200 MT were down 4% from the previous week and 8% from the prior 4-week average. The direct cash hog trade was 0.46 higher to 77.83 and the CME Lean Hog Index gained 0.20 to 77.73. For the week, the index traded 1.88 higher. This was the 6th consecutive week the index has traded higher, but despite the strength, the index is still trading at an 8.295 discount to the Apr futures. Retail corn prices were 1.47 lower, to 84.56, which pressured the trade on the day. The load count was moderate at 193 loads. The hog market is still being held in check by the premium to the cash market. The strong export sales tone and firm shipment number bring some additional optimism to the market. The cash market needs to stay firm and work on closing the gap to the futures.

DAIRY HIGHLIGHTS: Prices during the middle of the week for both Class III and Class IV found some nice gains, but were unable to hold as prices plunged to finish the week. Some of those gains early in the week could have been attributed to a GDT auction event that saw an increased value in cheese, which influenced the domestic spot cheese market higher on Tuesday and Wednesday. The factor likely influencing prices lower starting Thursday was the Milk Production report showing January year-over-year production up 1.3%, while the US dairy herd grew by 9,000 cows. The dairy herd size growing lines up with a report showing US weekly dairy cow culling for week ending Feb 11th was -3.7% YoY. On top of Milk Production and GDT auction was today’s Cold Storage report for January, yet to influence the markets as it was released at 2PM CST, showing cheese stocks in refrigerated warehouses were down slightly from previous month and year ago levels. Butter inventories have made a drastic turn from 5 year lows this past summer to up 21% from last month and up 20% from year ago levels.

Total Farm Marketing and TFM refer to Stewart-Peterson Group Inc., Stewart-Peterson Inc., and SP Risk Services LLC. Stewart-Peterson Group Inc. is registered with the Commodity Futures Trading Commission (CFTC) as an introducing broker and is a member of the National Futures Association. Stewart-Peterson Inc. is a publishing company. SP Risk Services LLC is an insurance agency. A customer may have relationships with all three companies. TFM Market Updates is a service of Stewart-Peterson Inc. Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition.