MARKET SUMMARY 2-28-2022

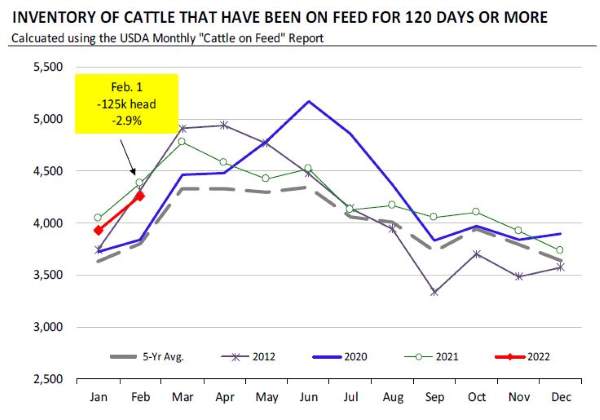

The USDA’s latest Cattle on Feed report brought very few surprises according to analyst expectations. Total cattle on feed was just slightly above last year’s levels at 12.199 million head, and well within market expectations. Within those numbers, the market is looking at the cattle on feed for 120+ days to get a reflection of the heavier cattle on feed. This number was down 125,000 head or 2.9% from last year, but this number is still trending 11.9% higher than the 5-year average. The slow down in slaughter during January, due to COVID concerns, impacted the flow of cattle keeping the front-end supply a little heavier than expected. The heavier supply was likely the reason the cash market moved slowly while the retail values spiked. Feedlots getting more current as we move into a heavier demand window in the second quarter, will be something the cattle market will be watching closely.

Like what you’re reading?

Sign up for our free daily TFM Market Updates and stay in the know!

CORN HIGHLIGHTS: Corn futures firmed on the overnight as increased concerns with the war between Russia and Ukraine dominate the trade. Sharply higher energy prices were also supportive with crude oil futures trading near 99.00 early in the session. Sharp gains in soybean and wheat futures, along with traders covering shorts and going back on the buy-side after exiting last week, aided in today’s future contracts strength. Mar corn closed 38 cents higher at 6.97-1/2 and Dec added 27-1/2 to end the session at 6.07-1/4.

What is termed as an ok start to the second crop Brazil corn season may keep prices in check, yet forecasters seem to be leaning toward a warmer dryer pattern in parts of central and northern Brazil. The harsh sell-off between Thursday morning and Friday’s close was nearly breathtaking. Yet, the trade was buying today, pushing prices back toward their highest closes for the year. If a war were to drag out in Ukraine it does make it a challenge to understand how normal type field work can occur. Ukraine is a very important player in the agricultural world and supplies would be sorely missed.

SOYBEAN HIGHLIGHTS: Soybean futures gained back some of Friday’s stunning losses with Mar futures closing 54 cents firmer at 16.44-1/2 and Nov adding 20-3/4 to end the session at 14.35-3/4. Heightened concern with the war between Ukraine and Russia, along with strong energy prices, aided soybeans today, as did announced sales of 136,000 mt to China for the 2022/2023 marketing year and sales of 120,000 mt from unknown destinations for delivery in the 2021/2022 season. Strong gains in wheat and soybeans were noted at well.

With an escalation to the Ukraine/Russia conflict over the weekend and again today, traders are back on the offensive, and end-users wanting to hold actual product. Export sales continue to indicate that end users are willing to buy high-priced beans to secure inventory likely filling the void from a smaller South American crop. Export inspections near 27 mb are solid but not outstanding. Nonetheless, attention will be directed to the remainder of Brazil’s growing season and if the small crops get smaller. Reports of scattered rain in the central and northern growing areas may help alleviate some dryness but total forecasted amounts remain light, not ideal for this time of year.

WHEAT HIGHLIGHTS: Wheat futures were sharply higher as the war rages on in Ukraine. Trying to outguess what may happen is futile but that won’t dissuade people from trading – the world will still need grain and grain markets. May Chi gained 74-1/4 cents, closing at 9.34 and Jul up 67 at 9.17. May KC gained 67-1/4 cents, closing at 9.54-1/4 and Jul up 59-1/2 at 9.40-3/4.

Volatility continues to be the name of the game and it is all tied to the war in Ukraine. As Russian troops advance towards the capital, resistance is strong. The Ukrainians are doing a good job defending their home but it is somewhat of a David and Goliath situation. Reportedly, there are peace talks in the works but Russia wants a surrender and Ukraine wants a ceasefire – neither of which are likely to occur. Perhaps more worrying is the fact that Putin declared a nuclear alert. If and when these types of weapons are to be used is not yet clear, but could quickly turn this situation into one much more grim. As it relates to the wheat market, Sov Econ estimates that Russia has as much as 275 mb, and Ukraine 220 mb left to ship. With these two countries accounting for roughly 30% of world wheat exports, any disruptions or supply loss could greatly impact prices. Here in the U.S., President Biden will hold the State of the Union Address tomorrow, at which he is expected to speak on Russia. Sanctions are being issued by many countries, but it may not be enough to stop what has been set into motion.

CATTLE HIGHLIGHTS: The cattle market saw selling pressure as grain market strength pressured the feeder market and that limited the gains in the live cattle market. Feb cattle finished its trading life today, closing 1.225 higher to 140.500. Apr cattle is the new lead month, lost 0.500 to 141.425, and Jun live cattle were 0.600 lower to 137.700.

The weak technical picture keeps the selling pressure in the front end of the live cattle market. Apr live cattle closed under the 100-day moving average, keeping the negative picture intact. The USDA Cattle on Feed report released last Friday was well within expectations, but the totals of heavier-weight cattle are going to limit the near-term market. Cattle on feed at 120+ days was slightly below last year, but 11.9% above the 5-year average. This build-up was reflective of the slaughter slowdown in January, which limited the cash market despite the strong retail values. This larger supply may still act as a limit on the front end in the near term. Fundamentally, cash trade was typically quiet to start the week with bids and asking prices undefined. The cash trade trend will be closely watched this week. Retail values have been trending lower last week, as choice carcasses were over $10 lower. At midday, boxed beef prices were mixed, (choice: +0.07 to 258.34, select: -0.13 to 255.28) with demand light at 40 midday loads. The strong price move in the grains pressured the feeder market. The Mar feeders were 2.300 lower to 157.725. With the close today, the Mar contract posted its lowest close since November. The market will stay extremely volatile this week, watch headlines and outside markets. Cattle markets overall are still in an uptrend, the market has experienced a pullback, and searching for a near-term low.

LEAN HOG HIGHLIGHTS: Hog futures selling pressure slowed on Monday, but the market saw some additional technical selling pressure and long liquidation. Apr hogs were 0.175 lower to 103.500, and Jun hogs finished 0.450 lower to 113.425.

Apr hogs tested the 20-day moving average near $103 and held this point today as the technical selling pressured the market. This may be a key level of support, which could open a strong downside move is breached. The fundamentals stay supportive in the hog market, and that could limit the downside pressure. Pork cutout values are still trending higher Monday and saw additional upside at midday with pork carcasses trading 7.60 higher to 120.92. Load count was moderate at 153 loads, helping support the market. Cash was supportive with the National Direct morning trade, marking a base price of 88.37, up 1.88 from Friday and the Cash Lean Hog Index was 0.36 higher to 98.40. The Apr futures is still holding a 5.100 premium to the index, but that total has narrowed quickly with the recent moves in futures and cash markets. Technically, the hog market may be looking for some support in the near term. The fundamentals stay supportive, on a tighter hog supply overall, supported by strong retail and improving cash values. The market is still in a strong uptrend, but watching the depth of this correction.

DAIRY HIGHLIGHTS: Class III milk contracts were all higher today, with the exception of a flat front-month trade. April will take over as the second month this week and closed out the day at $22.75. It will attempt to break resistance at $23.00 on that chart that has held for two months now. The block/barrel average was 4 cents higher today to push back to $1.9625/lb following a lower close last week. Just like at the beginning of January, both the second month Class III contract and spot cheese are struggling to break over a resistance point, although it has shifted from $20.00 milk and $1.84/lb cheese to $23.00 milk and $2.00/lb cheese. Spot whey has struggled after its recent push to all-time highs, dropping two cents today, on top of a drop of three cents last week. It sits at $0.76/lb, 9.25 cents off its February 8 high.

Total Farm Marketing and TFM refer to Stewart-Peterson Group Inc., Stewart-Peterson Inc., and SP Risk Services LLC. Stewart-Peterson Group Inc. is registered with the Commodity Futures Trading Commission (CFTC) as an introducing broker and is a member of the National Futures Association. Stewart-Peterson Inc. is a publishing company. SP Risk Services LLC is an insurance agency. A customer may have relationships with all three companies. TFM Market Updates is a service of Stewart-Peterson Inc. Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition.