MARKET SUMMARY 03-04-2022

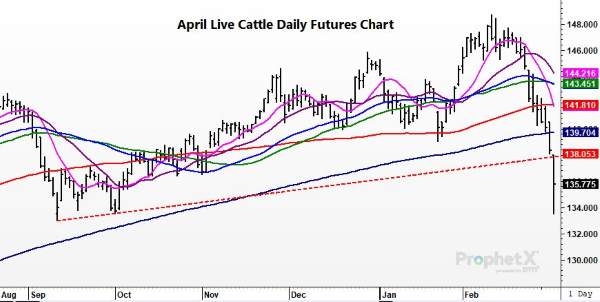

While grain markets have been racing to new highs, the cattle markets have been seeing strong selling pressure. The impact of strong grain markets, money flow, and technical selling have pressured the livestock markets. Apr cattle traded to its lowest level since September, as price broke through key support levels. Along with the pressure in grain markets, a softer live cattle cash trade and ongoing demand concerns have weighed on cattle prices. Cash trade this week was $138-140, $2-4 under last week, and choice beef carcasses have been on a steady decline, worried that consumer disposable income will be tighter, affecting beef demand. Apr cattle are trading $13.00 off the most recent highs as the market is searching for a near-term bottom.

Like what you’re reading?

Sign up for our free daily TFM Market Updates and stay in the know!

CORN HIGHLIGHTS: Corn futures again had a large trading range with futures finally settling 6-1/2 firmer in May at 7.54-1/4 and 17-1/2 higher in Dec at 6.29-1/2. It was quite a week with a wild ride. For the week, May futures added 98-1/2 cents and Dec 49-3/4. May reached a new high today at 7.82-3/4. Frontline in news is shipping concerns and the upcoming planting season for Ukraine. South American weather and crop conditions are considered “ok” so far for the Brazilian second crop (Safrinha) corn, yet expectations for a smaller Argentine crop on next week’s USDA report suggest there is little room for error with corn production in either hemisphere for the year ahead.

The expectation for next week’s report is Brazil corn crop at 112.9 mmt. The February estimate was 114 mmt. Argentina is expected to produce 52 mmt versus 54 last month. While these drawdowns are relatively small, both reflect the small crops are getting smaller. Prices were volatile today giving up limit gains, yet into a weekend this was no surprise. Traders will start over on Sunday night, first reflective of the war in Ukraine and secondly weather in South America. Although early, one cannot help but keep an eye on the U.S. drought monitor map as well. Conditions are said to be very similar to 2012 for this same time. Potentially capping the market is the Biden Administration considering waivers for bio energies due to food inflation concerns. We are not sure what exactly that could mean, but likely higher energy prices and negative for corn and soybean prices.

SOYBEAN HIGHLIGHTS: Soybean futures experienced another large trading range with volatile price action throughout the session. May soybeans closed 4-0 cents lower at 16.76-1/4 after reaching a daily high of 17.00-1/4. Nov lost 3-3/6 to close at 14.50-1/4. For the week, May gained 76 cents and Nov added 35-1/4. The Ukraine and Russia war continues to be the main driver, however, soybean oil finished on a week, not for the second consecutive session, on news the Biden Administration is considering waivers for bio-energies due to food inflation. For the week, however, soy oil still posted new contract highs and finished positive.

It appears declines to the South American crop are leveling off with most analysts estimating Brazilian production somewhere near 122 to 125 million metric tons. However, the average pre-report estimate is 128 mmt, which is the expected figure the USDA will release for February. Argentina’s soybean production is estimated at 42.9 mmt, also down from last month’s 45 mmt estimate from the USDA. The big mark mover this week is, of course, the war in Ukraine. Shipping has been stopped and much-needed supplies of vegetable oils, as well as other grains and oilseeds, are not moving. Just as important is the potential for spring planting to be delayed. Announced sales of over 300,000 tons was supportive.

WHEAT HIGHLIGHTS: Wheat futures closed sharply higher again, after being mixed at one point in the day. Though we feel like a broken record at this point, it is all tied to the war and uncertainty. May Chi gained 75 cents, closing at 12.09 and Jul up 59 at 11.75. May KC gained 64-1/4 cents, closing at 12.14-1/2 and Jul up 41-1/2 at 11.74-1/2.

The latest news in the war saga is that Russian troops fired upon the largest nuclear power plant in Ukraine. This reportedly caused damage and a fire which has since been contained, but the Russians have taken control of the area. There was concern that if a meltdown occurred it could be perhaps 10 times worse than Chernobyl. NATO met again today to discuss the situation and held a press conference in which they reiterated that they are “not seeking a war with Russia” but will defend members of the alliance. The markets are of course still reacting to the war, and after quite a wide trading range ended up posting solid gains. Chi and KC wheat have had limit-up moves for several days in a row now. For the week, May Chi gained 3.49-1/4 and May KC gained 3.23-1/2. In addition, Paris milling futures, though closing off their highs, traded over 40 Euros per metric ton higher overnight. That is roughly the equivalent of $1.20. Currently, world wheat importers are looking for alternative sources as Black Sea ports have been closed, with some of that demand likely to shift to the U.S. The fact of the matter is that millions of Ukrainian citizens are fleeing the country. This leads to the question of how much winter wheat will get harvested, not to mention the planting of any other crops. Next week, the USDA Supply and Demand report will be released but it is not known if or how much of this war will be factored into those numbers.

CATTLE HIGHLIGHTS: Triggered by strong grain prices, and a softer cash market tone, cattle futures saw strong selling pressure, crossing below technical support to end the week. Apr cattle lost 2.575 to 135.775, and Jun live cattle were 2.625 lower to 132.525. For the week, Apr cattle traded 6.150 lower. In feeders, Mar feeders lost 3.225 to 153.125 and were 6.900 lower on the week.

Apr cattle futures traded lower for the 8th consecutive session. Prices gapped lower on the open and traded through support, bringing a round of long liquidation and technical selling on Friday. Price did reject the session low of 133.500, but technical damage was done to the charts. Additional selling pressure will likely be in front of the market next week Monday. With the exception of some light clean-up trade, cash trade was quiet today, with a good portion of business done for the week. The majority of trade was at $140, down $2 from last week, which was disappointing to the market. Expectation will be for softer cash again next week. Retail values stayed soft. At midday, boxed beef prices were lower, (choice: -0.38 to 253.97, select: -0.84 to 246.95) with demand light at 76 midday loads. Choice carcasses at $253.97 at midday were trading over $4.00 off last Friday’s close. The grain markets were sharply higher most of the trading day, and that pushed feeder markets to triple-digit losses and broke technical support in most charts. Feeders traded in a wide trading range, and finished mid-range for the day, rejecting session lows, but technical chart damage was done. The Feeder Cattle Cash Index was 1.59 lower to 156.19 and trading at a small premium to the futures market. The direction of the grain markets on Sunday night will have a large impact on feeder cattle price direction next week. The near-term trend is still lower in cattle markets, but markets overall are still in an uptrend, but now challenging that trend while trying to find a near-term low.

LEAN HOG HIGHLIGHTS: Hog futures broke technically as strong move in grains and overall selling pressure in the livestock market pushed front end lean hog contracts limit lower on the session. Apr hogs were 4.750 lower to 100.450 and Jun hogs were also the 4.750 limit-down to 111.750. Hog futures will have expanded limits of $7.000. For the week, Apr hogs lost 3.225.

The Apr chart was building a “bear flag” pattern with a series of higher highs over the past few sessions, and that broke to the downside on Friday. With expanded limits on Monday, the next technical downside target will be the $98.000 level down to the $96.000 and the 50-day moving average. The hog market is being technically driven to the downside, and there is still some room to go. In market fundamentals, pork cutout values were firmer. At midday, pork carcasses gained 1.54 to 107.95. The midday value is trading $4-5 below Monday’s retail close. Load count was moderate at 158 loads. Cash was supportive with the National Direct morning trade, marking a base price of 94.66, up 0.18 from Thursday, and the Cash Lean Hog Index was 0.14 lower to 99.70 but was 1.66 higher on the week. The Apr futures lost the majority of premium to the cash market with the price move today, currently is still holding a 0.750 premium to the index, which could limit selling pressure. Technically, the hog market broke lower and is technically challenged at the end of the week. The fundamentals stay supportive overall, but the technical selling will likely drive the market.

DAIRY HIGHLIGHTS: Class III prices pushed to new highs to begin March, led by a $1.20 gain in the April contract with a close at $23.68. That contract held a daily high on Friday of $24.00, eclipsing the July 2020 peak on the second month chart and sitting just beneath the November 2020 high of $24.09. Spot cheese was a winner this week with its first push over $2.00/lb in a year and a half, gaining 13.75 cents in total with a close at $2.06/lb. The block/barrel spread, after spending seven weeks within a nickel of even, has pushed to 18 cents as blocks have led the way higher. On the negative side, spot whey was lower for the fourth straight week with a 2.25 cent drop to $0.7575/lb.

Total Farm Marketing and TFM refer to Stewart-Peterson Group Inc., Stewart-Peterson Inc., and SP Risk Services LLC. Stewart-Peterson Group Inc. is registered with the Commodity Futures Trading Commission (CFTC) as an introducing broker and is a member of the National Futures Association. Stewart-Peterson Inc. is a publishing company. SP Risk Services LLC is an insurance agency. A customer may have relationships with all three companies. TFM Market Updates is a service of Stewart-Peterson Inc. Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition.