MARKET SUMMARY 03-08-2023

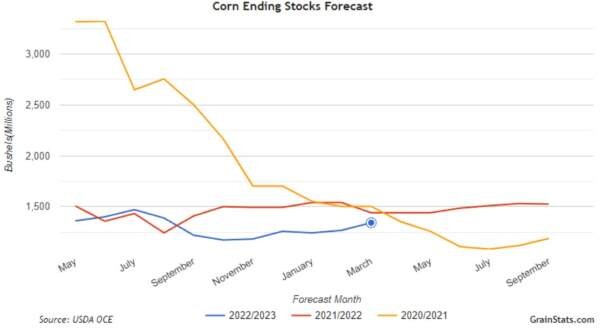

The USDA released the latest WASDE report on Wednesday, and the report brought the market a few surprises. One of the more negative pieces to the report was the cut in U.S. corn export demand by 75 mb, lowering the expected U.S. corn export total to 1.850 billion bushels for the marketing year. This revision added 75mb to the ending stocks forecast, raising that projection to 1.342 billion bushels. This was slightly higher than the expectations of analysts before the report. The larger-than-expected ending stock added to the pressure on corn futures during the session. The biggest concern, despite the numbers, is the trend. Even though corn supplies are still below last year’s levels and at historical lows, the past USDA reports have been showing a trend of increasing supply and demand concerns. This trend has weighed on the market prices as bullish news has been hard to find in recent weeks.

Like what you’re reading?

Sign up for our free daily TFM Market Updates and stay in the know!

CORN HIGHLIGHTS: Corn futures finished lower with May dropping 8-3/4 cents on the session to close at 6.25-1/2, its lowest close since mid-August. Dec lost 9 cents to close at 5.58, its lowest close since late July. An increase in both the U.S. and world ending stocks on today’s WASDE report and double-digit losses in wheat all weighed on prices today, as did technical selling.

Projected carryout rose to 1.342 billion bushels from last month’s 1.266. The average pre-report estimate was 1.299. A 75 million bushel reduction in exports was directly applied to an increase in US carryout. World carryout rose from 295.3 million metric tons on the February report to 296.5 million today. The pre-report estimate was 293.7 million. The Argentine corn crop was reduced but the USDA also reduced world feed demand. It looks like more wheat will go into the feed pipeline. From a big picture perspective, today’s drop confirms bears are now in charge and unless something changes in the weather for Brazil or the U.S. it will be more and more difficult for prices to rally. The bottom line is energy prices are stagnant, fertilizer prices have come down in value, and expectations are for more acres and less exports. All of these are signals to the end user to continue to buy only as needed.

SOYBEAN HIGHLIGHTS: Soybeans closed slightly higher today following a WASDE report that was neutral to friendly. Another supportive factor was a blocked highway in Brazil that is the only access to the closest port. May soybeans gained 2-1/4 cents to end the session at 15.17-3/4, and Nov lost 2 cents at 13.71-1/2.

Today’s WASDE report held very few surprises but was slightly friendly toward soybeans while a bit bearish for corn. Highlights included a drop in the U.S. carryout of 15 mb to 210 mb due to an increase in exports by 25 mb but a surprising decrease in crush by 10 mb. Crush has been running very strong lately, so it was a bit unexpected for the USDA to make that adjustment. Argentina’s production was finally revised lower due to the intense drought and the USDA brought their production lower than trade estimates, but far more in line with private analysts at 33 mmt, down from their previous lofty prediction of 41 mmt. World ending stocks were decreased from last month’s estimate and are now pegged at 100.01 million tons which is slightly lower than the average trade guess. In Brazil, a main highway that connects a large growing region to the only nearby port of Paranagua was blocked today and will hold up some export shipments. As Nov beans were the only contract to close lower on the day, the May/Nov spread continues to widen and is now 1.46 wide. Bean meal closed lower today while bean oil moved a bit higher despite another drop in crude of a dollar a barrel. Both May and Nov beans have been rangebound for the past few days and may be consolidating. The most likely big market mover this month will be the USDA’s estimates of 2023 acres on the 31st.

WHEAT HIGHLIGHTS: Wheat futures closed lower as the USDA report gave traders nothing to get excited about. May Chi lost 10-1/2 cents, closing at 6.87-1/2 and Jul down 9-1/2 at 6.97. May gained 1 cent, closing at 8.00-1/4 and Jul down 2-1/4 at 7.91.

With the exception of March and May KC, wheat closed lower across the board. Paris milling wheat futures were also lower today as Europe is receiving good rains that may continue next week. But today all eyes were focused on the monthly WASDE report. The USDA kept wheat ending stocks unchanged at 568 mb, still the lowest level in 15 years. U.S. wheat exports were also left unchanged at 775 mb. The world carryout was decreased slightly, from 269.3 mmt last month, to 267.2 mmt this month. There were production increases in Australia and India, but this was offset to some degree by a 4 mmt higher China demand projection. Ultimately, the report was not very unfriendly to wheat, but it sank into the close nonetheless. This is likely for that very same reason – it lacked any fresh bullish news. Technically, wheat remains in a downtrend and may continue to stay that way unless friendly information becomes available.

CATTLE HIGHLIGHTS: Cattle futures saw mixed trade in live cattle, but a stronger tone in feeders as weakness in the grain market after the USDA WASDE report pressured the corn market. Apr cattle slipped 0.525 to 165.450, but Jun cattle gained 0.100 to 160.650 as all deferred contracts traded slightly higher. The feeders added triple-digit gains with Mar feeders adding 1.625 to 193.750 and Apr gaining 1.400 to 200.075.

The front end of the cattle market is still trying to find some footing, waiting for the cash cattle trade to develop this week. Apr futures are in consolidation trade, working in a sideways fashion the past few sessions. Jun is also in this holding pattern, still under the influence of the technical reversal on the charts from last week. The development of cash trade will likely be the key to price direction by the end of the week. Cash trade is still slow to develop again this week. Bids are still undefined, but asking prices are $166-167+ in the south, and live cattle cash trade will likely hold off until the end of the week. Retail values were lower at midday with Choice slipping 1.58 to 286.35 and Select dropping 0.91 to 276.58. The load count was light but improved at 73 loads. The feeder market was strong again on Wednesday, fueled by a negative reaction to the USDA Supply/Demand report for grains and corn and wheat futures fell in price. Feeder cattle charts are strong and money flow is following suit as cash prices are strong on the countryside. The Feeder Cash Index is up 0.28 at 188.32 continuing its climb. The index is still at a discount to the front-end futures but talk on strong countryside cash markets has been lifting the index to the futures market. Wednesday’s WASDE report brought some news for the cattle market. Beef production in 2023 was raised by 170 million pounds, which relates to the increase in beef cow slaughter. The USDA raised price projections for each quarter throughout the year as cattle numbers and demand will stay supportive. The live cattle market is holding out for cash trade. Expectations are for firmer trade, but the packers are taking their time again this week. The producers have the leverage and will be patient. Feeder cattle are seeing strong money flow and technical buying, as prices keep hunting new highs.

LEAN HOG HIGHLIGHTS: Lean hog futures traded mostly higher as cash trade supports the front end of the market, and the bull spreading lifts the entire complex. Apr hogs gained 0.950 to 85.750, and Jun gained 0.200 to 100.275.

Apr hogs found recovery for the second straight as price pushed nearly triple-digits higher. The price action in Apr was strong on the close and set prices up to possibly trade to the next level of resistance near the 50-day moving average near 87.345. This strength has tightened the spread between Apr and Jun futures, as the cash market has been the leader of price strength. The CME Lean Hog Index gained 0.18 to 79.09. Midday direct trade was firmly higher, gaining 1.13 to 78.49, and the 5-day rolling average was also higher to 78.07. The trend higher in the cash market and the tightened premium of Apr to the cash has helped the buying strength in the past couple sessions. Deferred contracts are still holding a relatively large premium, limiting their gains. Pork retail values also provided support, gaining 1.49 at midday to 88.51 as the retail market has also trended higher. The load count was light at 137 midday loads. The CME pork cutout index has also trended higher, and gained 0.27 to 85.67. Hog slaughter could still be a limiting value. Daily slaughter is estimated at 481,000 head, up 13,000 over last week and 4,000 over last year. The hog market is looking to work higher in the near term, supported by the cash and retail trend as the market is finding some balance between front and deferred futures.

DAIRY HIGHLIGHTS: Three out of the four U.S. dairy spot market products hold downtrends and buyers don’t seem anxious to get orders filled at this time. Spot butter currently sits 93.75c off of its 2022 peak, while spot powder is down 73.50c from its peak last year and holds a strong downtrend. The weakness in these two products is pressuring class IV futures lower, as the second month contract is close to giving up the $18 handle. The Global Dairy Trade auction this week didn’t help matters, and production is flowing well in the Midwest at this time. For now, the dairy trade remains under pressure as it looks for a catalyst and a reason to go higher. Seasonally, the market is still in the window where it could find a bottom in March or April. Additionally, second month class III milk is down from nearly $26 last April to its current price of $17.51. The market is oversold and could be due for a bounce. In Wednesday’s trade, sellers pushed both III and IV futures lower.

Total Farm Marketing and TFM refer to Stewart-Peterson Group Inc., Stewart-Peterson Inc., and SP Risk Services LLC. Stewart-Peterson Group Inc. is registered with the Commodity Futures Trading Commission (CFTC) as an introducing broker and is a member of the National Futures Association. Stewart-Peterson Inc. is a publishing company. SP Risk Services LLC is an insurance agency. A customer may have relationships with all three companies. TFM Market Updates is a service of Stewart-Peterson Inc. Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition.