MARKET SUMMARY 03-14-2023

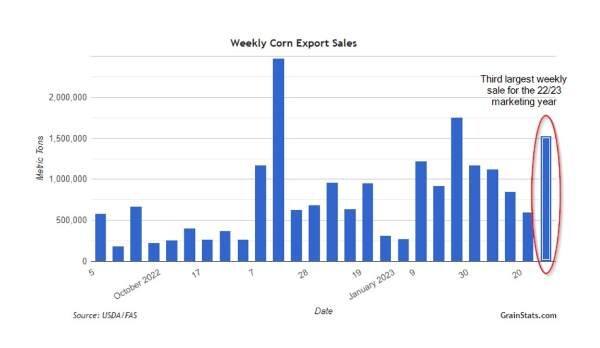

The corn export window is not wide open for U.S. corn. Corn export sales last week totaled 1.412 MMT, which was the 3rd largest weekly sale total for the 2022-23 marketing year, and export inspections have been trending near or above the top end of analyst expectations the past couple weeks. This morning, the USDA announced a sale of 612,000 mt of corn to China for the marketing year. This was the first reported sale to China since last August and the largest single purchase since Apr by the Chinese of U.S. corn. Even with the recent activity, the U.S. corn export program is still lagging behind the pace of recent years, and Chinese purchase of U.S. corn is minimal. The corn market can’t help but be encouraged that the recent break in prices has helped trigger some much-needed demand.

Like what you’re reading?

Sign up for our free daily TFM Market Updates and stay in the know!

CORN HIGHLIGHTS: Corn futures found support on a lack of farmer selling, a technical bounce, more confidence in the banking industry, and an announced sale of over 600,000 mt to China. May added 7-1/4 cents closing at 6.20-3/4 while Dec added 2-0 to end the session at 5.59-1/4. Short covering was a noted feature as reports confirmed that China was a buyer of over 20 mb. The hope is that this is just a tipping point.

Today marked the second time in the last three sessions that futures posted a hook reversal. A hook reversal is when the market moves below the previous day’s low but closes positive. This may be signaling that the market is trying to find a low up. Sellers who were aggressive over the last three to four weeks may be looking to exit sooner than later, as the market will need to focus on South American weather. It appears somewhere between 30 and 40% of the Brazilian crop may be planted outside the optimal planting time zone due to wet conditions slowing bean harvest and planting of second crop corn. On the surface, this may mean little but could mean a lot if less-than-ideal weather 60 days from now affects crop growth or maturity. Brazil is the number two exporter of corn in the world only second to the U.S.

SOYBEAN HIGHLIGHTS: Soybeans and both soy products closed a bit higher today as markets turned around after a bearish Monday. CPI data was released that came in with trade expectations today which gave the stock market a boost along with most commodities. May soybeans gained 2-1/2 cents to end the session at 14.93-3/4, and Nov lost 3/4 cent at 13.38-1/2.

Both the commodity markets and the stock market got a bit of a boost from today’s CPI data that was in line with trade expectations showing inflation rising by 0.4% for all items in February. Between the good CPI data and the recent financial issues with certain bank failures, there is talk that the Fed may not raise rates at all this month which is unlikely, or that they will only raise rates by 25 basis points. The rise in stocks today suggests that traders believe that the Fed will be more lenient. Bean oil posted the highest percentage gains with the May contract gaining 0.57% despite a big selloff in crude that brought Apr down to lows not seen since January 2022. The gains across the board in soy were small and the Nov contract closed lower as bullish sentiment struggles against the record crop being harvested in Brazil and export sales that are quickly dropping off. OPEC’s monthly report said it expects world oil demand to increase by 2.3 million barrels a day in 2023 to 101.9 million barrels per day, and it expects Russia’s production to fall 700,000 bpd in 2023. May beans respected the 100-day moving average again today bouncing off of it, while Nov closed at the bottom of its Bollinger Band.

WHEAT HIGHLIGHTS: Wheat futures led the way higher with double-digit gains. The recent downtrend in the U.S. Dollar and the fact that much of the U.S. winter wheat crop is in drought are supportive to futures prices. May Chi gained 11-3/4 cents, closing at 6.96-1/4 and Jul up 11-1/4 at 7.06-3/4. May KC gained 17-1/4 cents, closing at 8.17-3/4 and Jul up 15-3/4 at 8.05-1/2.

Good gains in the wheat market today may indicate that it has finally found a bottom. Lending support is the fact that 55% of the U.S. winter wheat crop is said to be in drought conditions. Additionally, Kansas HRW crop ratings remained at just 17% good to excellent, but Oklahoma dropped from 39% to 30% good to excellent. Starting in April, the Crop Progress report will tell the bigger picture story vs what traders are getting now from select, individual states. In other headlines, Russia is said to be leaning towards a 60-day extension of the Black Sea export corridor. Apparently, the original deal stipulated an automatic 120-day extension if Russia does nothing, so it will be interesting to see what the outcome is. The current deal expires on Saturday. There was also breaking news this afternoon that a U.S. MQ-9 drone was downed by Russia in the Black Sea. It is currently unknown how or if this will affect markets. There is still concern that Russian wheat exports will continue to dominate, with the recent Saudi Arabia tender price from Russia as low as 280 dollars per ton.

CATTLE HIGHLIGHTS: Cattle futures stayed under pressure again on Tuesday, as additional long liquidation and technical selling pressured the market. Apr live cattle lost 0.500 to 163.550, and Jun cattle dropped 0.450 to 157.750. Feeders followed live cattle lower, pressured by a firmer grain market trade. Mar feeders lost 0.900 to 189.925 and Apr fell 1.325 to 195.750.

The technical picture and price action are soft in the cattle markets as the prospects of a winter high seem to be in place. The Apr contract has now slipped nearly $4.00 off the recent high as the market corrects from overbought conditions. Charts are still weak and this could open the door for some further price correction, technically, as the week goes on. The cash market has stayed quiet so far this week as bids are still undefined. Asking prices are $166+ in the south. North asking prices are still quiet. Cash trade will likely hold off until the end of the week. Retail values were higher at midday with Choice gaining 1.24 to 286.10 and Select adding 1.72 to 275.34. The load count was light at 50 loads. Feeder cattle saw profit-taking and long liquidation again on Tuesday. Feeder charts were overbought and poised for some correction. Now that the correction is occurring, the price action is weak, leaving room for additional selling pressure. The Feeder Cash Index has been trending higher, as the cash market stays supportive. The index is still at a discount to the front-end futures but talk on strong countryside cash markets has been lifting the index to the futures market. Technically, cattle charts are struggling, and the market was overbought, and now seeing some correction. Prices are still trending higher in the long-term view, but the winter highs may likely be in the charts and some more correction is possible.

LEAN HOG HIGHLIGHTS: Lean hog futures saw modest losses on the session as selling pressure in the livestock markets in general limited the hog market. Apr hogs lost 0.825 to 85.400, and Jun dropped 1.025 to 101.575.

The livestock markets are seeing selling pressure as prices are slipping from recent highs. The hog market in general is still trending higher but trade remains extremely volatile and open to swings in price. The direct cash hog market seems to have cooled in the past few sessions. Midday direct trade on Tuesday was softer, slipping 0.36 to a weighted average of 74.62. The CME Lean Hog Index gained 0.24 to 79.86, continuing its trend higher, but the rate of climb seems to be slowing. That may be reflecting the recently softer tone in the direct cash market. The recent weaker tone in the direct cash trade likely helps limit gains on the front-end Apr contract. Pork retail values failed to hold the strong buying strength on the midday trade Monday, closing softer on the day, and seeing additional weakness at midday today. Carcasses were 0.08 lower to 92.49. The load count was light but improved at 198 midday loads. Hog slaughter is still running heavy, and that has limited the front-end futures market. Estimated slaughter today was 485,000 head, even with last week, but 8,000 head over last year. The hog market fundamentals continue to be very choppy. Cash markets looked to have slowed and retail values can’t hold on to mid-session strength. It may be a choppy time in the futures market for lean hogs.

DAIRY HIGHLIGHTS: An 8.00 cent jump in spot cheese got the milk market going today, led by a limit up close in April Class III futures. This leaves just the front month March contract, which jumped 17 cents to $17.95, under $18.00 as the overall 2023 average squeaked back above the $19.00 mark. A 1.50 cent jump in spot powder, unchanged butter trade, and the Class III rally did spill over into the nearby Class IV contracts as April and May gained double digits while the rest of the complex was unchanged.

Total Farm Marketing and TFM refer to Stewart-Peterson Group Inc., Stewart-Peterson Inc., and SP Risk Services LLC. Stewart-Peterson Group Inc. is registered with the Commodity Futures Trading Commission (CFTC) as an introducing broker and is a member of the National Futures Association. Stewart-Peterson Inc. is a publishing company. SP Risk Services LLC is an insurance agency. A customer may have relationships with all three companies. TFM Market Updates is a service of Stewart-Peterson Inc. Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition.