MARKET SUMMARY 03-22-2022

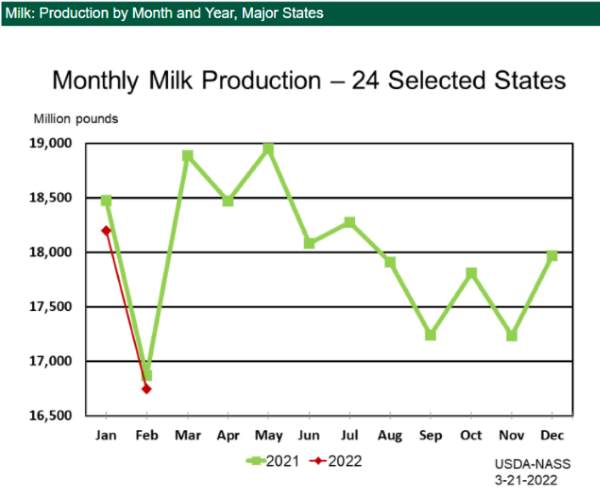

Tighter milk production and a strong demand tone may set milk prices up for a test of all-time highs. The USDA released the February milk production report on Monday afternoon, and total milk production in February was down 0.7% in the major 24 production states. The total number of milk cows on farms was estimated at 8.88 million head, down 77,000 from last year, but up 3,000 from January. The impact of high feed cost has tightened cow supplies, but the strength in milk production, plus moving through winter months may have producers pulling a few extra animals into the herd to take advantage of the current price levels. Milk futures are pushing all-time highs after trading above 2020’s COVID market highs. The all-time high on continuous charts is $25.30 established in September 2014, and with the strength seen in demand for dairy products, the potential test of those levels is a potential in this market.

Like what you’re reading?

Sign up for our free daily TFM Market Updates and stay in the know!

CORN HIGHLIGHTS: Corn futures finished mixed with the back months again firming. May lost 3-1/4 cents on a lackluster news day while Dec corn added 6-0 cents as traders continue to buy the much-discounted new crop, anticipating a lack of significant planted acres in Ukraine. Dec closed the session at 6.70, another new contract high. Grains in soybeans and wheat were also viewed as supportive.

When viewing the primary fundamental elements affecting corn price, we continue to see strong export activity, concern over Ukraine, and what appears to be expected normal production out of Brazil for the second crop corn. The U.S. dollar continues to trend in an upward fashion and while it hasn’t made much of a move over the last two weeks, it is still within striking distance of its highest value for the year, and this could act as an anchor on corn exports. However, with the world supply continuing to tighten we don’t think it’ll be much of a factor. The bottom line is that end users need corn and there is a likely autonomous level of demand, which means no matter what the price is, there will be a certain amount needed, at least over the next several months. The next big market-moving report is on March 31 and this will give the world a peek at expected acres in the U.S. We don’t know how much one should weigh this report as there are too many uncertain variables that could yet steer acreage direction. Quarterly stocks will be released as well. This could also be of interest. Strong basis levels this past fall would suggest that carry-in was less or, yield may not have been as high as forecasted.

SOYBEAN HIGHLIGHTS: Soybean futures firmed today gaining 5-1/2 to 8-0 cents as Nov led today’s gainers closing at 14.98, a new contract high close. May added 5-1/2 to end the session at 16.96-3/4. An announced export sale of well more than 200,000 mt for the 2021/2022 marketing year was supportive.

Like the corn market, there really wasn’t a lot of new news, yet the overall bias remains firm for price as Ukraine remains a major question mark for world commodities. Rain in parts of the Plains and central Midwest is highly welcomed yet forecasters appear split after this outlook. Some suggest the pattern may be changing, while others are indicating this will be short-lived and a return to dryness and warmer temperatures are on tap for April and May. One thing for certain, there is little room for error for the U.S. crop this season. The March 31 stocks and acreage figures will loom large and potentially be a strong guide for price direction just prior to northern hemisphere weather. Argentina, which had suspended export licenses on meal and oil, reinstated registrations but did increase export taxes on meal and oil from 31% to 33%.

WHEAT HIGHLIGHTS: Wheat futures closed higher with the exception of May Chicago which had a 67 cent range today. Settling relatively quietly compared to recent moves, the market may have been taking a breather by the close today. Ultimately, the war is likely still the main driving force and remains a bullish factor. May Chi lost 1 cent, closing at 11.18-1/4 and Jul up 8 at 11.01. May KC gained 3-1/4 cents, closing at 11.16-1/2 and Jul up 6-1/2 at 11.09-3/4.

Ukraine and Russia seem to have entered somewhat of a stalemate, as neither side is backing down. Russia continues its attacks and Ukraine continues to fight back with not much sign of peace in sight. As we get closer to spring each day, the concern that their winter wheat harvest will be disrupted becomes more and more legitimate. To play devil’s advocate, even if they harvested all of the crop, their ban on exports (including wheat) is vital to their food security. So what is harvested likely won’t get shipped. With these worries, world buyers are looking for alternatives. Egypt, for the first time ever, announced that they will look at importing wheat from India to meet their needs (though it might be a logistical challenge). Russian exports on the other hand seem to be taking place as no food sanctions have been placed against them. Another key item of note is the upcoming weather in the U.S. southern plains which have chances for moisture for the next 10 days or so. Drought conditions down the road will be critical but the outlook in April has somewhat conflicting forecasts.

CATTLE HIGHLIGHTS: Cattle futures lost 17.5 to 65 cents in a low volume lack-luster trading session. Apr closed at 139.42. Feeder cattle finished mixed with front month Mar gaining 22.5 points closing at 156.32 and Oct losing 37.5 to end the session at 97.525. Though futures were softer today, firming cutout values were noted, suggesting futures are well supported. Choice cuts gained 1.47 and are priced at 259.77 while select cuts lost 61 cents to end the session at 251.89.

We believe that good export activity along with limited supply will provide long-term underlying support for the live cattle market. Weight gain has been good this winter and supplies on an immediate basis mostly ample. Yet, the big picture perspective looks continuously supportive as supplies tighten. We also expect demand to remain strong as consumer dollars for services and things like restaurant activity remain historically high, as COVID created a significant environment for consumers to save dollars. Apr futures find support at 1.39 and resistance at 1.41. With high feed prices, we expect feedlots to remain relatively current.

LEAN HOG HIGHLIGHTS: Hog futures had a mixed to higher close. Fundamentally supplies are expected to tighten throughout the year, which is supportive to the market in deferred contracts but not necessarily supportive to nearby. Apr hogs lost 0.375, closing at 100.250, and Jun hogs gained 0.250 to 120.075.

With inflation on the rise for food, fuel, goods, and raw materials there is still concern about demand for pork products. With less disposable income, consumers may purchase less meat. With that being said, support may still come from the anticipation of tightening supplies, and somewhat offset this. Yesterday, hogs seemed to rally on technical buying as there was no support from lower cash and cutouts. The National Direct Afternoon report was down 1.61 and cutouts were down 3.34. Though a much quieter trade today, some of that technical buying may have followed through (with the exception of the Apr contract). Apr did bounce off the 50-day moving average though, which may act as an area of support. The CME Lean Hog Index was up 0.44 at 101.80. In Europe, there are also concerns about the number of hogs available to the market, which could ultimately make the U.S. more competitive and increase exports.

DAIRY HIGHLIGHTS: Class III prices shot higher today led by the April contract which closed up 57 cents at $24.31. That contract’s intra-day high of $24.72 is a new high for the second month contract on the move and is just 58 cents beneath the all-time high from 2014. As a reminder, we have a target at $24.99 to take some additional action on Q2 milk. On top of yesterday’s supportive February milk production report, spot cheese traded an impressive 10.25 cents higher today to $2.1925/lb, breaching the previous high of $2.15875/lb from March 9. In 2014, the block/barrel average topped out in the $2.30-$2.40/lb region which is behind only the Food Box Program-led rallies of 2020.

Total Farm Marketing and TFM refer to Stewart-Peterson Group Inc., Stewart-Peterson Inc., and SP Risk Services LLC. Stewart-Peterson Group Inc. is registered with the Commodity Futures Trading Commission (CFTC) as an introducing broker and is a member of the National Futures Association. Stewart-Peterson Inc. is a publishing company. SP Risk Services LLC is an insurance agency. A customer may have relationships with all three companies. TFM Market Updates is a service of Stewart-Peterson Inc. Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition.