MARKET SUMMARY 03-28-2022

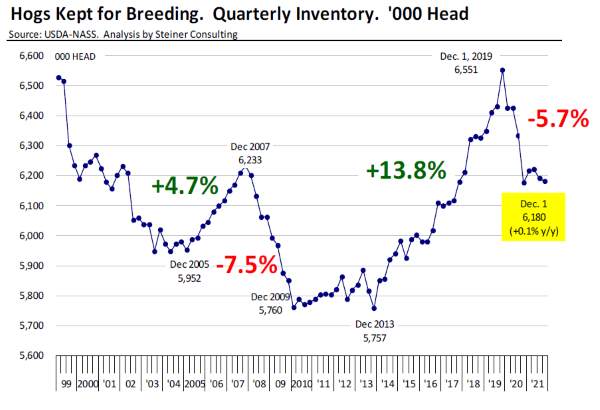

Hog market pushed to new highs for summer contract again on Monday, as the trade will be looking at the USDA Quarterly Hogs and Pigs report on March 30. A key metric the hog market will be watching in the report will be the “hog kept for breeding” numbers. The hog market is very aware of the tight current supply picture, but will be focused on possible expansion and growth in numbers going into 2023. Despite strong hog prices, the impact of high feed costs, and potential uncertain demand tone due to inflationary pressure, the market is lacking clarity on the direction of the hog herd into the end of the year. In December’s quarterly report, breeding hog inventory moved .1% higher than 2020, slowing the pace that producers have been moving breeding stock to slaughter. In addition, current breeding stock slaughter data, the pace of slaughter of breeding animals has slowed. Expectations are for hog numbers to flatten and possibly start building, as the strong hog market has incentivized producers to grow production, despite the strong grain prices.

Like what you’re reading?

Sign up for our free daily TFM Market Updates and stay in the know!

CORN HIGHLIGHTS: Corn futures weakened on the overnight, as the energy complex moved lower in response to more lockdowns in China due to Covid and talks between Russia and Ukraine. A lack of new positive news was noted, which may have traders nervous and trimming long positions in front of the USDA Quarterly Stocks and Acreage reports on Thursday. May futures lost 5-1/2 to close at 7.48-1/2 and December gave back 4-1/2 to close the session at 6.64-1/2.

Export inspections were supportive at over 63 mb, bringing they year-to-date total to 1.143 mb, or 45.7%, or expected sales of 2.5 bb. Consistent export sales are supportive for prices. Attention will focus on the second crop in Brazil and now that the end of March is here conditions become more critical. On Friday, we ended the week indicating there didn’t seem to be much weather concern on a large-scale basis. We reiterate the same sentiment to start this week. On Thursday, the Stocks and Acreage report will have information for the market and likely provide some direction. The acreage number is perhaps the biggest wild card with rising fertilizer costs and worries about availability, since last fall, suggesting farmers may have made some switch to soybeans. Yet, probably not many. Those who have a rotation they wanted to stay with likely didn’t make any changes. There are, however, enough fringe areas or a large enough percentage of farmers who may not have locked in fertilizer costs that a switch to more soybeans should not be a surprise.

SOYBEAN HIGHLIGHTS: Soybean futures followed wheat, corn, and energies lower, ending the session with losses in a rather slow volatility session. More lockdowns in China due to Covid, this time Shanghai and potential peace talks in Ukraine had the market on the defensive. A reported export sale to China for 132,000 mt for the 2021/2022 marketing year was noted this morning, but seemed to do little to spark support.

Export inspections at 23.1 mb were termed supportive and brings the year-to-date total to 1.596 bb, or 76.36 % of expected sales of 2.090 bb. Support on futures is being tested at the 21-day moving average, a level that has provided good support since late fall. We’ll see if the investment community wants to buy this area or are willing to stay on the sidelines for the reports on Thursday. Expect more soybean acres. Stocks should confirm strong demand through crush and exports. Both palm and soybean oil prices are showing weakness this past week, potentially suggesting the market is priced high enough to keep additional buying at higher prices in check. Bulls could be growing impatient after the market finally cracked the 17.00 mark in May and then failed to hold gains.

WHEAT HIGHLIGHTS: Wheat futures finished the day sharply lower as news of new rounds of peace talks will take place. Additionally, China is locking down Shanghai due to covid outbreaks. May Chi lost 45-1/4 cents, closing at 10.57 and July down 41 at 10.51-1/2. May KC lost 40-1/4 cents, closing at 10.70-1/2 and July down 37-1/2 at 10.69-1/2.

Today’s inspections report pegged wheat inspections at 12.5 mb, with totals now at 621 mb. This was not a stellar number but was also probably not what was weighing on the markets. Rather, the news of peace talks set to take place between Russia and Ukraine were taking some war premium out of the markets. It appeared to be a risk off day with corn, soybeans, and crude oil also trading lower. The peace talks may take place tomorrow in Turkey. It sounds like Russia still wants to annex parts of Ukraine, which they likely won’t agree to. And with Russian missiles still being fired over the weekend, one might question how much they actually want peace. Also pressuring the markets today were reports that China is locking down Shanghai due to Covid outbreaks. This is their largest city with a population of over 26 million people. As far as weather is concerned, beneficial moisture hit the US southern plains last week, and there are chances for more this week. Forecasts however are only calling for light to moderate amounts overall. By mid-April this region could return to a warm and dry pattern. This week’s stock and acreage reports are due out on Thursday and should help provide the market with some direction.

CATTLE HIGHLIGHTS: Cattle futures traded moderately lower to start the week, as the market digested Friday’s Cattle on Feed report and selling pressure in grain markets on Monday. April cattle finished .175 lower to 140.300, and June cattle slipped .600 to 136.775.

April cattle prices stayed relatively choppy, consolidating at the top of last week’s strength on Monday. The Cattle on Feed report was in line with expectations, except for the heavy placement numbers. With total cattle on feed at 101% of last year, and still the largest March 1 totals on record, the cash market has been pressured, holding relatively steady as packers are working through this supply. Cash trade was quiet as usual to tart the week, as bids and asking values were undefined. Expectation will be for mostly steady cash, supported by a firming retail tone. The majority of cash trade last week was at the $138 level. April cattle, and June will likely stay tied to the cash market, as April option expires this week on Friday, and the futures is getting in its last stages of trade. Choice carcasses gained $5.36 last week on an improving demand tone. At midday, beef retail prices traded higher, with choice carcasses gaining 1.02 to 263.66 and select was 1.50 higher to 253.64. Load count was very light at 25 midday loads. Feeder cattle had the most to lose, with Friday’s Cattle on Feed report, but selling pressure in the grain markets help support feeders in general. April feeders were still .750 lower to 160.825, but prices did firm off early session lows. The market may have been anticipating the heavier placement numbers on the USDA report, as the larger total may be due to dryness in the southern Plains where wheat pastures and the need to move those cattle onto the feedlot. The grain trade will likely have some impact on the cattle markets this week, so expect some volatility as that market moves towards a key USDA report on Thursday, with grain stock and planting intentions numbers. Cattle price are still range bound and choppy, and that will likely be the trend in the near-term.

LEAN HOG HIGHLIGHTS: Hog futures saw mixed bull spreading trade on Monday, as the buyers stayed active in the front end of the market. A strong demand and overall cash tone support the market, as it looks towards Wednesday’s USDA quarterly Hogs and Pigs report. April hogs gained .100 to 107.575, and June added .200 to 126.050. June and July hogs closed the day with new contract highs.

April futures held their price gains from the end of last week, still keeping the door open for further upside move. April futures are holding a strong premium to cash, and with expiration around the corner, could be limited to the upside in the near-term. Summer hogs added to their gains from Friday and the strong fundamentals could push the market even higher in the near term. Summer hogs are looking at challenging historical highs established over those contracts from the 2014 year. The USDA will release the quarterly Hogs and Pigs report on Wednesday., which could see some choppiness build into the market on position squaring. Pork retail values were trending higher last week and got additional support at midday today. Pork values traded 3.50 higher to 113.40 on a load count of 150 midday loads. The afternoon close will likely help the direction of the market on the open tomorrow. Cash markets have stayed firm in response to the strong retail values and trading at historical strength. National Direct Trade at midday was 7.17 lower to 103.11, with the 5-day average at 104.79. The cash trend may be starting to soften and will need to be watch. The lean hog cash index was higher, gaining 0.75 to 102.25. The Apr contract has a premium of 5.325 over the index, which could be limiting on the front month with only three weeks of life left in the Apr contract. Things are pointing higher in the hog market, as the technical picture and fundamental picture are staying supportive in the near term. Prices are likely going to be looking to establish a new near-term top, but could quickly turn if the cash market were to cool.

DAIRY HIGHLIGHTS: Class III milk futures were expanded today due to a deferred block cheese contract being bid limit up on Friday and unfortunately, those expanded limits were utilized to the downside as we began the last week of March. During today’s trade, the April contract fell 77 cents to $23.53 while the calendar year average dropped 37 cents to $22.98. March futures will settle tomorrow bringing May into focus as the second month. Spot cheese, which has rallied to what would be the fourth-highest annual move in its history, dropped 0.75 cents today to $2.255/lb, a modest break compared to milk futures. Spot whey has only traded higher five times in the last 33 trading days, falling a quarter-cent today to $0.7175/lb. Given the strength in the milk market as of late, a selloff like today does not raise any major alarm bells by itself. Fundamentals and seasonal patterns remain on the market’s side for now.

Total Farm Marketing and TFM refer to Stewart-Peterson Group Inc., Stewart-Peterson Inc., and SP Risk Services LLC. Stewart-Peterson Group Inc. is registered with the Commodity Futures Trading Commission (CFTC) as an introducing broker and is a member of the National Futures Association. Stewart-Peterson Inc. is a publishing company. SP Risk Services LLC is an insurance agency. A customer may have relationships with all three companies. TFM Market Updates is a service of Stewart-Peterson Inc. Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition.