The CME and Total Farm Marketing offices will be closed Friday, April 15, 2022, in observance of Good Friday

MARKET SUMMARY 04-14-2022

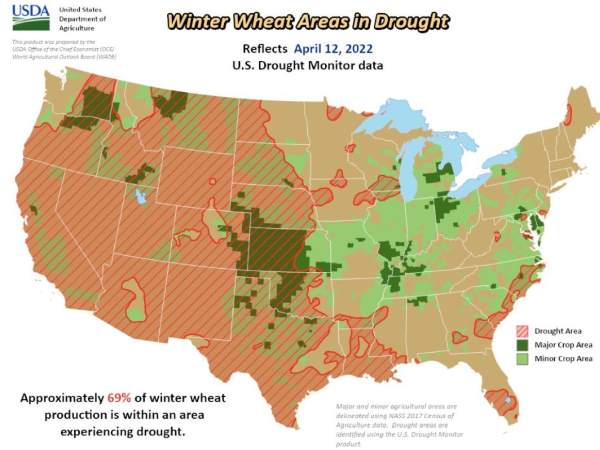

Crop ratings for the U.S. winter wheat crop have been historically low, as dry conditions have gripped a large portion of this principal winter wheat acres. The USDA weekly crop ratings tabbed the current winter wheat crop at 32% good/excellent, one of the lowest ratings in years. In addition, 36% of the crop received a poor to very poor rating. Dry weather and drought conditions have impacted the development of this year’s winter wheat crop. As of April 12, 69% of the acres of winter wheat production are within an area experiencing drought. Unfortunately, long-range forecasts are staying on the dry and warm side, showing little relief in this region of the country. The weekly crop rating will still be the guide, but these acres are starting to enter the key grain filling stages, and if weather stays unsupportive, winter wheat production will likely be limited going into harvest this summer.

Like what you’re reading?

Sign up for our free daily TFM Market Updates and stay in the know!

CORN HIGHLIGHTS: Corn futures finished mixed with nearby May gaining 6-3/4 cents, Jul adding 5-3/4, and Dec giving up 0-1/2 to end the session at 7.35-1/4. Jul closed at 7.83-3/4, yet another new contract high close. For the week, Jul gained 23 cents and Dec added 19-1/4. Export sales were solid at 52.5 mb old crop and 15.9 mb for the 2022/2023 marketing year.

Year-to-date sales are now 2.195 mb or 87.8% of expected sales of 2.5 bb. It will be some time before the second crop Brazil corn is available for the market. Therefore, anticipate export activity to remain continuous and steady from the U.S. With high priced corn we anticipate end users to aggressively purchase. China has been a recent buyer likely filling the void left by a shortfall of Ukrainian corn. Our bias is supportive based on Ukraine, high energy prices, fertilizer costs and availability, and strong-looking technical activity on charts. Weather in Brazil will be critical from this point onward, and with each passing day, the U.S. becomes more critical for planting progress, which is likely not off to the most ideal start, or at least what farmers may have perceived several weeks ago. On April 14 it is still a challenge to get overly confident in analysis that would suggest anything but normal yield. Yet, critically dry areas stay dry, and areas that really don’t need moisture stay on the wet side.

SOYBEAN HIGHLIGHTS: Soybean futures ended quietly with nearby May futures gaining 6-1/4 cents to end the session and week at 16.82-1/4 down 6-3/4 cents from last week. New crop Nov dropped 4-1/4 cents to finish the session at 15.01-1/2. For the week, Nov futures added 6 cents. An announced export sale of 132,000 tons for China in the current marketing year gave prices a boost.

On the one hand, there wasn’t much of a weekly change, yet on the other hand, with a less than ideal weather market developing in the U.S. and expectations that soybean acres could be on the rise, the weekly closes were relatively uneventful or neutral. That might be a victory for the bulls heading into a three-day weekend. Farmer selling remains mostly light, and we don’t expect farmers have much of the old crop left on hand due to better selling opportunities throughout the winter months. Expect a continued downgrade to the South American crop. While the downgrades may be minimal it still spells a tightening inventory in the long run. A jump in corn prices since March 31 could mean more corn acres and less soybeans, yet given the availability of fertilizer and inputs that may not be the case. Expect soybean oil to remain strong due to Black Sea export problems, as well as a smaller sunflower crop in Ukraine.

WHEAT HIGHLIGHTS: Wheat futures closed sharply lower after a day of heavy selling pressure. The market may have seen some profit-taking ahead of the three-day weekend. May Chi lost 17 cents, closing at 10.96-1/2, and Jul down 16-3/4 at 11.04-1/2. May KC lost 20 cents, closing at 11.54, and Jul down 20-3/4 at 11.57-1/4.

Today the USDA reported an increase of 3.5 mb of wheat export sales for 21/22 and an increase of 8.3 mb for 22/23. These numbers are unremarkable and may have added to the pressure seen in the marketplace today. Though some moisture is forecasted for the southern Plains, it remains to be seen if that will materialize. So far, most of the rains have missed the HRW wheat areas and the crop ratings are expected to remain low. North Dakota and Minnesota have the opposite problem with recent heavy rain and snowfall which will likely delay spring wheat seeding. Paris milling futures were lower today as well, but new crop contracts are still near contract highs. Egypt’s recent purchase of French wheat was at a record high price, which may signify the wheat out of the Black Sea and Baltics comes with increased risk. In regard to the Ukraine war, there is not much fresh news, but it does not seem likely that it will come to an end any time soon. In other news, the U.S. ag attaché in India estimates their wheat crop to be record-large at 110 mmt; India’s ag minister is estimating it larger at 111.3 mmt. The ag minister also said exports could be 10 mmt (compared to the USDA’s 8.5 mmt estimate) so they may end up picking up some of the slack out of the Black Sea.

CATTLE HIGHLIGHTS: Cattle futures saw some end-of-the-week profit-taking going into the holiday weekend, after trending higher this week, supported by an improved cash market. Apr live cattle gained 0.050 to 140.675, but Jun was 0.450 lower to 136.425. For feeders, May slipped 0.175 to 161.775. On the week, Apr cattle were 2.850 higher, while Jun added 2.600. May feeders were 2.400 higher on the week.

The Jun live cattle futures consolidated on Thursday, and back-tested recent support. The mid-range close keeps the trend friendly with more upside potential available, especially with the improving cash trade. A strong resistance barrier will be at the 50-day and 100-day moving averages near $137.500. A break of this area will likely trigger additional technical buying. The cash market was the trigger to price support this week. Some very light trade triggered in the South from $138-140, with most trade at $139, up $1 over last week, and Northern dress trade today was $225-227, $2-4 higher than last week. There has been individual regional talk of firmer price levels, pushing values into the low $140 as packer inquiry has been stronger this week. Expectations will be for the cash market to stay firm going into next week as well. Beef cutouts were mixed at midday (Choice 271.77 -0.59; Select 259.79 +0.42), with light box movement of 62 loads. The trend in Choice boxes this week has been firmer, gaining nearly $2.00 from Friday’s close, helping support the cash trend. The cattle market is expecting to see a tick up in retail demand as stores prepare for May and the Memorial Day holiday, and the expected uptick in grilling demand. The USDA reported weekly export sales for beef this morning, and posted new net sales of 117,200 MT, up 23% from last week. South Korea, Japan, and Canada were the top buyers of U.S. beef last week. The feeder market saw mild losses on end-of-week profit-taking. Apr feeders are likely tied to the index, which gained 0.09 to 155.95 but is running at a discount to front-month futures and could be a limiting factor. Cattle prices are turning the corner in the near term, as a firmer cash tone and improved demand prospects going into the late spring are bringing some buying optimism and positive money flow. The softness to end the week was manageable and squaring positions going into the Easter holiday. If cash stays strong next week, cattle prices are looking to trend seasonally higher.

LEAN HOG HIGHLIGHTS: Hog futures finished mixed to mostly higher supported by the firmer retail carcass values and the expiration of Apr futures and options. Apr futures, which expired on Thursday, closed softer, losing 0.025 to 99.875, but May hogs were 1.225 higher to 112.750, and Jun hogs traded 0.875 higher to 118.475. For the week, Jun hogs were 3.900 higher.

The more actively traded Jun hogs traded near the top of the week’s range, supported by the 40-day moving average. If the upward momentum can continue next week, prices will be looking to test the price gap on the Jun chart at 120.225 from earlier this month. The cash market is still the largest concern in the short term. National Direct midday values showed some gains on Thursday, adding 0.23, the weight average price was 96.70 but the 5-day average worked lower to 96.44, reflecting the overall trend this week. The Lean Hog Index was firmer, gaining 0.09 to 99.19, but was 1.49 lower on the week. The deferred futures premium over the index is concerning and could be a limiting factor, as May takes over the new front month next week and is trading at a 13.56 premium to the index. Pork carcasses showed strong midday trade after a firm Wednesday close, helping limit price pressure. Pork carcasses were 0.41 higher to 108.94 on a load count of 153 loads. Midday retail values were trading over $5.00 higher compared to last Friday’s afternoon close. Weekly export sales were released on Thursday morning, and the USDA reported new net sales of 24,000 MT, down 42% from last week. Mexico, Japan, and China were the top buyers of U.S. pork last week. Daily hog slaughter is estimated at 478,000 head, up 12,000 head from last week, and mostly steady to last year. The hog market numbers are still expected to tighten, and the rate of slaughter may be our first indicator of supplies tightening. Unfortunately, with the premium in the futures market to cash markets, that tighter supply may already be figured in. The hog market has shown some overall strength this week in the recent move higher but will need to see a stronger tone in the cash market to lead. Overall, hog numbers are still looking to tighten going into the summer months, but the hog market likely hit a value point recently to trigger money flow into the group.

DAIRY HIGHLIGHTS: U.S. cheese continues to be the main driver of higher milk prices so far this week, with buyers getting aggressive again on Thursday. Buyers pushed up blocks another 4.25c to $2.3725/lb on 5 loads traded. The barrel market added 6c to $2.44/lb on a whopping 10 loads traded. Demand is still very strong for U.S. cheese. The bidding in cheese took Class III milk futures higher and the May 2022 contract retested the all-time high Class III price of $25.55 intraday. May finished the session up 29c to $25.46 on 366 contracts traded. Most Class III contracts closed up double-digits and there was some heavy bidding out into the 2023 strip. April 2023 added 35c, May added 43c, and June added 20c. The market continues to keep a hefty premium out in those contracts.

Total Farm Marketing and TFM refer to Stewart-Peterson Group Inc., Stewart-Peterson Inc., and SP Risk Services LLC. Stewart-Peterson Group Inc. is registered with the Commodity Futures Trading Commission (CFTC) as an introducing broker and is a member of the National Futures Association. Stewart-Peterson Inc. is a publishing company. SP Risk Services LLC is an insurance agency. A customer may have relationships with all three companies. TFM Market Updates is a service of Stewart-Peterson Inc. Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition.