MARKET SUMMARY 5-24-2022

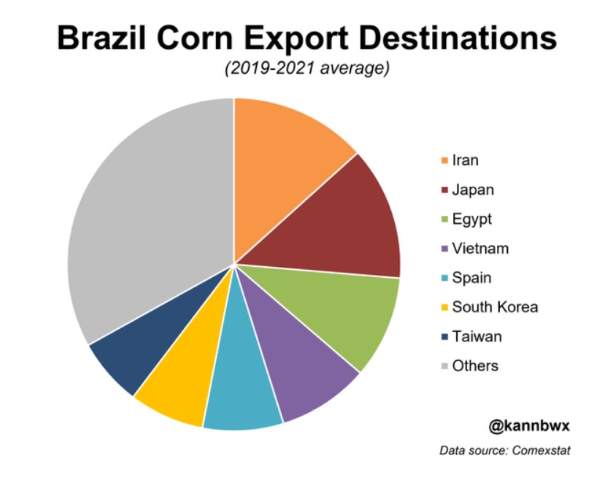

The corn market saw strong selling pressure during the session on Tuesday as the market reacted to weather and global export news. A key news item announced this morning was an agreement between Brazil and China on finalizing the protocol on Phytosanitary requirements for Brazilian corn to be exported to China. This agreement has been in the works, but reaching a conclusion opens the door for access to Brazilian corn exports into China. Currently, Brazilian corn is running a discount to U.S. prices, and the prospects of this export competition likely brought selling pressure into the corn and wheat markets on Tuesday. China is still looking for grain, and with the Ukraine supply extremely limited, needs to have other options for supplies. Brazil has a limited supply of corn bushels to export, and in the long run, could equal just a reshuffling of supply. Current imports of Brazilian corn to other countries may be forced to look to other exporters, still holding global demand. Time will tell the impact of this agreement and the movement of corn globally.

Like what you’re reading?

Sign up for our free daily TFM Market Updates and stay in the know!

CORN HIGHLIGHTS: Corn futures closed lower today as planting concerns in the U.S. begin to ease, and as the stock market continues to fall. Demand is strong for ethanol production and exports, and there has been talk that China may have purchased Brazilian corn to offset the lack of Ukrainian exports. Jul corn lost 14-1/2 cents, closing at 7.71-3/4, and Dec lost 13-3/4 cents at 7.25-1/4.

Corn is lower following the USDA’s report that 72% of the U.S. corn crop is planted. Their number was above the average trade estimate and shows how much work got done, while weather has been suitable for planting. Corn is still behind last year’s 89% at this time, but more notably, only 39% of the crop has emerged compared to last year’s 61%. In the first two weeks of June, NASS will gather information about this season’s crop production, supplies of grain in storage, and livestock inventory. Rain is forecast today and tomorrow that will include Minnesota but should miss North Dakota, two states that need drying out the most with only 60% and 20% planted, respectively. A second rain chance returns to the central and northern Midwest on Sunday, and Brazil remains dry, stressing its second corn crop. Argentina’s corn crop ratings remain unchanged at only 17% good to excellent.

SOYBEAN HIGHLIGHTS: Soybean futures closed higher today despite bearish outside influences with the stock market falling lower. Front month beans showed their strength yet again with help from higher bean meal, good crush incentives, and tight old crop supplies. Jul soybeans gained 6 cents, closing at 16.93, and Nov lost 1-1/4 cents at 15.17-1/2.

Jul soybeans led the way higher today showing that strong demand for beans is now. Soybeans and bean meal were the only two main commodities unaffected by the sell-off in the stock market, which shows how strong the fundamentals and demand are. There was an active China soybean meal trade yesterday of 540,000 tons, and Chinese demand, in general, is strong with Jul closing on the Dalian exchange at the equivalent of $21.95 a bushel. There are rumors that China may have bought Brazilian corn. Crush premiums are now at 2.90, down from a much richer 3.95 from the previous week, but still incentive for processors to buy more soybeans. The USDA has said that 50% of the U.S. soybean crop has been planted, down from 73% last year. Planting may be difficult in the next 5 days with broad coverage of rain in the forecast. If the crop gets planted, we may indeed see record acres as the March intentions report suggested, but that production will likely be needed after South America’s crops were hit by drought this year.

WHEAT HIGHLIGHTS: Wheat futures traded sharply lower today, in a similar pattern as last week, with corn finishing lower and soybeans lower most of the day. Fundamentals for wheat remain overall bullish, but the technical picture looks weaker and may have contributed to the selloff. Jul Chi lost 35-1/4 cents, closing at 11.54-3/4, and Dec down 33-3/4 at 11.70. Jul KC lost 38-3/4 cents, closing at 12.37-3/4, and Dec down 37-1/2 at 12.47-1/4.

It was a poor day for wheat with all three U.S. contracts closing sharply lower, and Paris milling futures down hard as well. Despite being higher overnight, wheat just struggled to hold on to any gains. This is somewhat surprising given that yesterday’s Crop Progress report was mostly supportive. Winter wheat conditions did improve 1% to 28% good to excellent, but are still well behind the 47% rating last year. Texas remains in very dismal condition with 79% of the crop rated poor to very poor. Additionally, spring wheat planting was reported to be 49% complete, well behind the average of 83% (and 93% at this time last year). Minnesota and North Dakota account for two-thirds of spring wheat production but are the farthest behind when it comes to planting progress. MN is 11% done vs 90% average and ND is 27% complete vs 80% average. Looking at weather, there are actually flood concerns in parts of Kansas and Oklahoma. This rain is likely too late to offer much benefit to the crop, however. Eastern parts of Europe also have chances for rain this week.

CATTLE HIGHLIGHTS: Live cattle futures finished mixed to mostly higher on Tuesday, as concerns about heavy available cattle supplies and slightly lower cash bids limited the front end of the market. Feeders used a drop in grain prices to help fuel strong triple-digit gains. Jun cattle finished 0.050 lower to 132.725 and Aug live cattle were 0.225 lower to 132.750. In feeders, Aug feeders gained 2.525 to 168.150.

Jun cattle futures saw quiet trade during the day waiting for the cash market to develop. Prices consolidated just under the 20-day moving average and softened, as late afternoon trade was reported. Cash trade started to develop late on Tuesday with light southern trade starting at $137, down $1 from last week’s totals. Northern trade was undeveloped, and overall trade was light. At $137, the cash market is still holding a premium to the futures, but the softer trend will limit gains in the front month overall. Retail beef prices had a firm close on Monday, and at midday, prices held the tone with Choice gaining 0.64 to 264.92 and Select was 1.91 higher to 246.14. Load count was light at 77 midday loads. The combination of a softer cash tone, but a supportive retail market, limited the movement in the front month futures on Tuesday. Feeders saw strong gains as prices recovered from recent losses and followed through to the upside, supported by weakness in the corn and wheat markets. The May feeder contract expires this week, on 5/26, and the premium of front month contracts to the Feeder Cash Index was a limiting factor. The Feeder Cash Index was 0.33 lower to 152.72. The past couple sessions have been encouraging, but the cattle market is not out of the woods. The front-end supply picture and concerns regarding demand and the outside markets can limit the move higher in cattle. The keys will be money flow, the cash market, and potential follow-through trade higher over the next few sessions.

LEAN HOG HIGHLIGHTS: Hog futures saw some profit-taking, triggered by a buildup of pork supplies seen on the USDA Cold Storage report released on Monday afternoon. Jun hogs finished 1.350 lower to 109.025, and Aug hogs dropped 1.800 to 109.050.

Jun hogs market failed the 100-day moving average at 111.00, which is a key short-term barrier, and with the USDA Cold Storage report showing a pork supply build, triggered some profit-taking in the hog complex. Despite the weakness, the hog market still found some underlying support, led by the fundamentals. The USDA Cold Storage report on Monday afternoon reflected a slower demand pace and those larger slaughter numbers as frozen pork supplies were up 9% from the previous month and up 16% from last year. Stocks of pork bellies were up 3% from last month and up 67% from last year. With ample supplies of hogs seeming readily available in the near term, the market was set for some setback. The recent strength in the hog market has been tied to money flow backed by the improved direct cash hog trade, and those variables stayed supportive on Tuesday. The midday cash market had no comparison to yesterday’s confidential trade, but the rolling average was firmer at 111.39 on Tuesday, and the 5-day average moved higher to 110.27. The CME Lean Hog Index started to reflect the higher trend gaining 0.91 to 102.08. Retail values trended higher at midday with carcass values 0.81 higher to 107.86. Movement was good at 164 loads. The CME Pork Cutout Index added 1.20 to 104.42 reflecting the recent strength. the trend to watch most closely is the hog slaughter numbers. On Tuesday, estimated slaughter was 473,000 head, down 4,000 from last week and 9,000 from last year. If the hog market is working through the current supply picture, the market may be poised for more recovery.

DAIRY HIGHLIGHTS: Nearby Class IV milk futures are within a few pennies of breaking over the March highs and putting in a new high of the year. The June through September contracts rallied anywhere from 21c to 31c on Tuesday as bidding in powder and butter has been steady. In fact, the spot butter market has been bid higher for seven sessions in a row and hasn’t posted a down day since May 10. Spot powder hasn’t posted a down day since May 11. Spot butter tacked on another 2c today to $2.8850/lb on 8 loads traded. This is just 5c away from the high of the year. Powder’s close of $1.82/lb is a new high for the month. The steady demand for these Class IV products is keeping Class IV futures elevated.

Total Farm Marketing and TFM refer to Stewart-Peterson Group Inc., Stewart-Peterson Inc., and SP Risk Services LLC. Stewart-Peterson Group Inc. is registered with the Commodity Futures Trading Commission (CFTC) as an introducing broker and is a member of the National Futures Association. Stewart-Peterson Inc. is a publishing company. SP Risk Services LLC is an insurance agency. A customer may have relationships with all three companies. TFM Market Updates is a service of Stewart-Peterson Inc. Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition.