Market Summary 06-03-2021

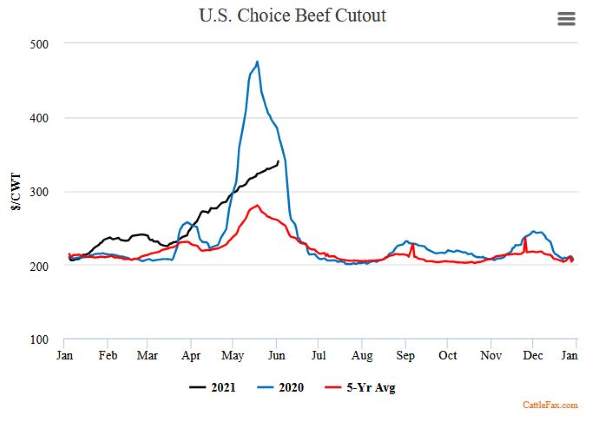

The beef cutout market has been trending strongly higher since the start of the year, as the demand for beef products has stayed robust. A strong domestic meat market and growing export market have helped support beef choice carcass prices to their highest levels in years. Typically, the beef product market peaks and has some pullback into the summer months, typically peaking after the Memorial Day holiday. The product market is working into that window currently. This year may be different given the strong demand tone and the need for beef both domestically and overseas. The cattle market may be cautious in this window, possibly expecting that turn softer in the product market. The futures market has been held in check by a stagnant cash market, and any weakness in the beef retail prices could pressure cattle futures lower.

CORN HIGHLIGHTS: Corn futures rallied with strong gains on the overnight trade but gave way to a changing forecast late morning ending the day with losses of 13 cents in Jul and 6-1/4 in Dec. Jul closed at 6.62 yet had a high of 6.85 and low of 6.52-3/4 or a range of 32-1/4 cents. Dec closed at 5.66-1/4. Much of the Midwest will experience above normal temperatures with the Dakotas expected to reach into the upper 90s or low 100s. This will dry ground out quickly. Yet by mid-morning forecasters were adding moisture into the forecast and this seemed to temper bullish enthusiasm. It appeared that managed money was likely rolling out of the Jul contract and either moving to the sidelines or purchasing deferred months. Bear spreading was a primary feature in today’s trade. Export sales, typically out today, will be released tomorrow as the Monday holiday has pushed back many of the USDA reports by one day. Volatility is high and the market will take direction from the next forecast. The bigger picture perspective looks somewhat troubling to us from a production perspective if high temperatures do occur and rainfall does not measure up to expectations.

SOYBEAN HIGHLIGHTS: Soybean futures reversed after strong overnight gains losing 9-3/4 to 13-1/4 cents weaker with Jul leading today’s drop closing at 15.49-1/4. Nov lost 10-1/4 cents to close at 14.04-1/2 after reaching a high of 14.38-3/4. Jul finished 39-2/4 cents from its daily high. To say the market was volatile may be an understatement. Changes in the weather outlook suggested more chances of rain than what was forecasted overnight. In addition, high temperatures for the next three to five days are expected to give way to cooler temperatures and additional chances for moisture. It is that time of year where volatile trade takes place, especially at high prices. Both bulls and bears have strong arguments. We are a bit surprised at today’s reversal, however, as we would argue that weather the last several days has been less than ideal as extreme cold has created some issues and now extreme hot will likely create additional issues where soil conditions are relatively dry to begin with. In the frame of one week, some farmers will have experienced frost damage and temperatures nearing 100 degrees. Soybean oil prices posted new contract highs and then reversed posting a hook reversal. This is not the friendliest signal at the top of a market. Palm oil prices may be moderating. Soybean meal also worked lower with futures trading near 390/ton, down from near 4.50 just a month ago. Expectations that enough meal will be available for end users through the summer has prices on the defensive.

WHEAT HIGHLIGHTS: Jul Chi down 11-1/4 cents at 6.76-1/4 & Dec down 11-1/2 cents at 6.88-1/2. Jul KC wheat down 9-1/2 cents at 6.24-1/4 & Dec down 9-1/2 cents at 6.44. Improved rain models for 6-10 day forecast pressured grains today. Scattered showers are falling on SRW wheat areas, however, many are still without any rain at all. The drought monitor showed improvement in the southwestern Plains but of course, worsened conditions in areas such as Washington and South Dakota. 100 degrees and higher are expected for much of the Midwest and key growing areas this weekend. Newer weather models are looking for temps to hopefully start to cool on Sunday with hopefully some moisture hitting the middle of next week. However, this is good news for grains with the glaring exception of spring wheat growing areas. The northern Plains are still suffering from extreme drought with no hope in sight. We’ll see what next Monday’s crop ratings project but even this week the crop rating was only 43% good/excellent and that area certainly won’t improve from last week after this heat moves through over the weekend. Globally, wheat conditions still remain pretty favorable. Despite the fall in the U.S. dollar, U.S. wheat is still not competitive on a global scale. Tomorrow’s export report will likely be weak as Russia is expected to garnish most of the business this week with their temporary lift on export taxes, which remains in effect through June 8th.