Market Summary 06-04-2021

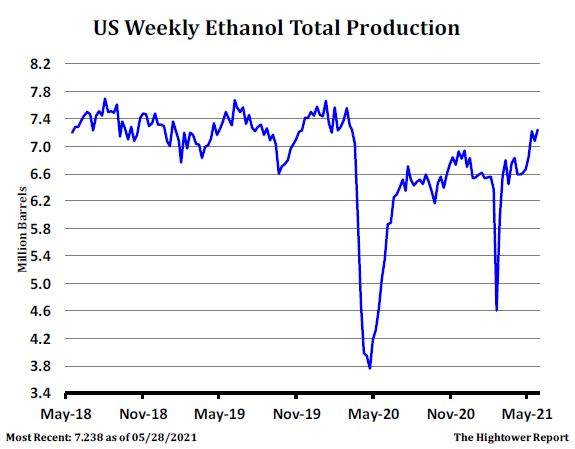

Thursday’s weekly ethanol report shows the growth in the production of biofuel as the industry has recovered from COVID restrictions. Last week, ethanol production was up 2.27% to 1.034 million barrels/day, and over 35% higher than last year. Some of this growth in production was due to building stockpiles for the Memorial Day holiday anticipated travel. Weekly stock grew by 3.2% to 19.588 million barrels, but still at multi-year lows. The trend in stocks next week will be closely watched to see the demand in the driving for the holiday weekend. Most importantly, total corn used for production last week was 104.47 mb, which was ahead of the average needed to meet the USDA target of 4.975 bb of corn used for the 2020-21 marketing year. This makes the 4the consecutive week that bushels used was ahead of pace. This strong corn demand could open the door for adjustments on the USDA supply/demand balance sheet, tightening up the corn supply picture.

CORN HIGHLIGHTS: Corn futures firmed on the overnight with double-digit gains and continued to gain strength throughout the session finishing sharply higher. Jul closed 20-3/4 cents firmer at 6.82-3/4 and Dec 25 higher at 5.91-1/2. For the week, Jul gained 26 cents and Dec 46 cents. Forecasters are keeping high temperatures and wind in the outlook for the western Corn Belt, in areas where dry soil is already a major factor. Most producers would argue their corn looks good yet might be reluctant to say it looks great if hot and dry conditions continue. The extended forecast indicates the western Corn Belt to remain warm with temperatures in the 90s or even above 100 while the eastern Corn Belt, mainly Illinois, Indiana, and Ohio, warm but with above-normal precipitation. This outlook from the latest National Weather Service 6-10 day view. The technical picture looks stronger this week than any time in the last three. If in fact weather stays a factor look for Dec to bridge 6.00 and likely test the contract high of 6.38. Export sales were released today and came in at 20.9 million bushels. This brings the total export sales to date to 2.721 bb, 98% of the expected total sales of 2.775 bb.

SOYBEAN HIGHLIGHTS: Soybean futures, like the corn market, firmed on the overnight trade and continued to firm during the day as traders were willing to either buy or hold long positions into the weekend. Hot and dry for the northern regions, especially the Dakotas, along with freeze damage last weekend have provided support for prices. For the week, Jul soybeans gained 53.25 cents and Nov 62.75 cents. Export sales were a non-event at 0.7 mb old crop and 6.6 new crop. This brings year-to-date total sales to 2.261 bb or 99.2% of total forecasted sales of 2.280 bb. Soybean oil raced into new highs negating yesterday’s bearish reversals. Continuous tight supplies and firming world energy markets lead to expectations for more biodiesels also has traders continuing to add to long positions or covering shorts. Soymeal also participated in today’s rally gaining near 5.00. Brazil’s strong export pace would also suggest that supplies from that part of the world could diminish sooner than expected. With projected carryout for U.S. soybeans for next year at 140 million bushels, long-term supplies remain tight.

WHEAT HIGHLIGHTS: Jul Chi up 11-1/2 cents at 6.87-3/4 & Dec up 11-1/4 cents at 6.99-3/4. Jul KC wheat up 12-1/4 cents at 6.36-1/2 & Dec up 11-1/4 cents at 6.55-1/4. The market returned to trading the hot and dry weekend that is ahead for most of us that will extend well into the beginning of next week. Key wheat-growing areas are expected to experience triple-digit temps and in some areas potentially even record-breaking. Wheat lives in a full-fledged with weather for the bulls and record production estimates looming for the bears. Newer weather models did build in some rains for the later part of next week, but it is still believed that most of that rain will not land where it is needed most, in the spring wheat growing areas. We’ll see how the USDA updates the crop rating, spring wheat was rated 43% good/excellent this past Monday. Without weather concerns, there’s not much to bolster wheat. Global conditions are pretty optimal and EU & other key wheat-producing countries are actually increasing their projections for production not lowering them. Demand continues to be weak as U.S. wheat just isn’t competitive on a global scale. Russia will likely continue to garnish most of the export business at least through Tuesday, June 8th, when they return their export taxes to higher levels.