Market Summary 6-15-2021

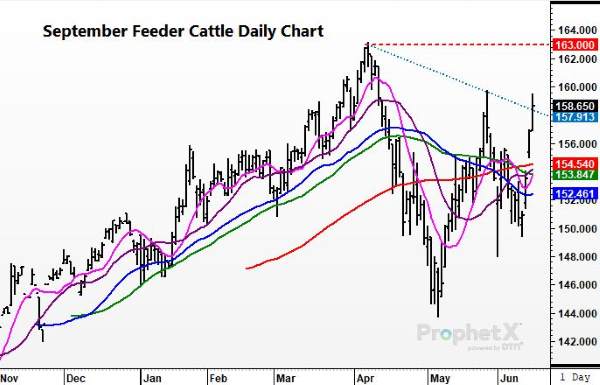

Strong buying has moved into the feeder cattle market, and the cattle market in general this week. Since placing a low on June 10, the August feeder contract has quickly added $10.00 and is trading at its highest levels in nearly a month. The strength in the cattle market has started after the recent sell off in grain markets. Feeder cattle has typically been the inverse of the corn market, as corn loses values, feeders are typically bought. In addition, recent improved money flow into the live cattle market, and the strength in the 3rd and 4th quarter. The feeder cattle market is challenging the key $160 level, but if the strength continues a test of the contract high established in April.

CORN HIGHLIGHTS: Corn futures finished lower, except for July, for the third consecutive session, as December led today’s drop losing 7-1/4 cents to close at 5.73-3/4. July futures closed 8-1/4 higher at 6.67-1/2, well of its low of 6.46-3/4. December struggled most of the session with double digit losses and it too finished well of the low of 5.61. Rain and cooler temperatures for next week remain in the forecast, however some private analysts have backed away from some of the totals. The most recent 6-to-10-day forecast indicates the western corn belt will remain below normal for precipitation. The entire corn belt remains below normal for temperature. Crop ratings declined 4% in the good and excellent category with Iowa a notable reduction of 14%. Yet prices continued to move lower today as what we believe, was another round of heavy speculative liquidation. Stay with a bias that volatility will remain high but also that much needed moisture if it occurs will likely keep pressure on prices. The difference this year from other years, however, is that the current dry weather pattern is just not a near term event. It has existed from last summer and consequently, subsoil conditions, are well depleted. Therefore, it will take more than just one rain event. Timely rains will be required throughout the season.

SOYBEAN HIGHLIGHTS: Soybean futures were weaker again today with front month July losing 6-1/2 and November losing 21-3/4. July closed at 14.65-3.4 and November at 13.73-1/2. Weakness in soybean oil and continued long liquidation has sellers in charge, pressuring prices and likely keeping liquidation in process. November soybeans experienced a 45-cent trading range. Cooler and wetter in extended forecasts suggest the crop will show improvement by end of next week. This week the heat and dry continues to stress the crop. The USDA crop ratings report indicated 62% of the crop rated good or excellent. This was down from 67% last week. This is the second consecutive week of decreasing crop ratings, something you might think would be supportive. Yet, it appears that the row crops are in a liquidation phase as manage money may be heading to the sideline. Weaker world vegetable oils have weighed on soybean oil as has wording from the administration that it is considering a change in its biofuels policy that may allow for oil companies to waive mandates. Expect volatility to remain high. If weather does take a turn for the better for crop production the market has already factored some if not much of this into the current price drop. On the other hand, if the dry and warm conditions persist, in particular the western corn belt, then prices may be poised to move significantly higher. For now, we stay with a balanced approach. View rallies as opportunities to sell.

WHEAT HIGHLIGHTS: Jul Chi down 13 cents at 6.61 1/2 and Dec down 14 cents at 6.72 1/4. Jul KC wheat down 15 1/4 cents at 6.12 3/4 and Dec down 15 cents at 6.29 3/4. Another down day in the wheat sector with no bullish news to lend a helping hand to a corn market that also fell – wheat stood little chance today. Yesterday, the USDA reported that winter wheat harvest is off to a slow start at only 4% compared to the 15% average. Harvest progress should pick up, however, with virtually no weather to stand in, its way in the south west Plains. White wheat is not ready for harvest yet and prognosis on condition is not good – winter wheat in Washington was rated 19% good/excellent yesterday and only 14% in Oregon due to drought effects. Spring wheat crop is virtually fully emerged at 96% but still only rated 37% good to excellent – lowest since 1988. The rains of last week appear to have floated a life line to the crop in the Dakotas, however, the outlook remains hot and dry for the next 7-10 days. Montana is projected to see temps as high as 106 this week. Globally, we still don’t see a major problem developing yet. Southern Russia has some areas that are in need of rain soon, but so far, nothing disastrous.