MARKET SUMMARY 6-22-2021

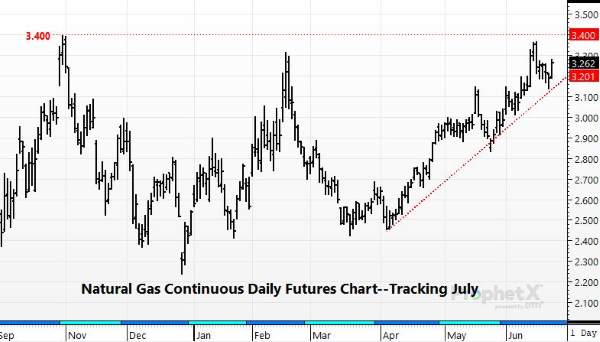

Natural gas futures have been on a steady rally since the first of April as prices have climbed off of the lows for spring. Tightening supplies, strong demand tone due to hot weather and the need for energy, and overall strength in the energy sector have helped fuel the price climb in natural gas futures. Prices recently tested the $3.40 level and the high established in October 2020. A cooler forecast has brought some profit-taking, testing price support where the market has shown some resiliency. As the calendar turns into the heat of summer, the possibility of a top-side breakout is possible, sending natural gas prices to test the $4.00 window. If prices break support levels, a test of $2.80 will be likely. The weather forecast as the market moves into July is forecasted to stay above average in temperature, which should support the natural gas market.

CORN HIGHLIGHTS: Corn futures started the overnight firmer gaining near double digits but as has been the case of late, was unable to hold onto gains and by the pause session at 7:45 was trading 10 cents lower on new crop Dec. That trend continued throughout the session with losses of 18 cents in both the Dec and Mar futures. Dec closed at 5.39 while Jul closed 0-1/2 higher at 6.59-3/4. The forecast continues to suggest improving moisture for the central and eastern Midwest while the western regions remain mostly dry. Temperatures will again be above normal today and tomorrow with the 6-10 day forecast indicating below normal precipitation for the western Midwest and temperatures cool in the central-eastern, but above normal in the west. Though crop ratings dropped last night to 65% good to excellent from 68% the week prior, recent rains and more in the forecast could reverse that trend. The drought monitor map will likely look much different on Thursday which is scheduled for release. The Drought Monitor is produced jointly by the National Drought Mitigation Center (NDMC) at the University of Nebraska-Lincoln, the National Oceanic and Atmospheric Administration (NOAA), and the U.S. Department of Agriculture (USDA). For now, it looks like the market is focusing on improved crop conditions and ignoring dry to very dry areas.

SOYBEAN HIGHLIGHTS: Soybean futures closed weaker selling off into the close giving up positive gains from early in the session. By day’s end, Jul futures lost 20-1/2 cents to close at 13.94-1/2 and Nov down 17 at 13.02-1/2. Increased calls for rainfall throughout much of the Midwest and weaker corn and wheat prices all aided in today’s losses. Part of the recent slide is also likely related to the time of year. When row crop prices rally into June, prices often begin to work lower and the market is aware of this pattern. Therefore, traders are quick to exit longs positions when the prices slow their upswing or begin to turn lower. Closer attention is likely paid to technical signals and sell stops more aggressively used. Row crops are water-intensive and when the market has a good forecast for moisture it is tough to sustain rallies and easy for prices to drop. Yet, we cannot get away from concerns regarding drier regions in the Corn Belt that will likely remain moisture deficit along with battling high temperatures. Therefore, expect high volatility to continue. For now, we remain defensive as the market is telling us to do so but also recognizing that this early in the growing season there’s plenty of time for significant change in crop production potential and price trend.

WHEAT HIGHLIGHTS: Wheat prices traded mixed today, with selling pressure in the Chicago and KC wheat classes, and strength in the spring wheat markets. Jul Chi down 10-1/2 cents at 6.51 and Dec down 9-1/4 cents at 6.61. Jul KC wheat was down 3-1/4 cents at 5.96-1/2 and Dec was down 3-3/4 cents at 6.16 1/4. Spring wheat was the strength of the market with the Jul contract up 18-1/2 to 7.83. The spring wheat strength came from the reaction to yesterday afternoon crop ratings. The USDA estimated the spring wheat crop at 27% good/excellent, down another 10% from last week and below the market’s expectations. The poor conditions and forecast staying unfavorable in the longer term, concerns regarding abandonment of acres are in the market’s mind. These ratings are one of the lowest in history, since the time the data has been kept. Values did drift off session highs later in the day today as other grains were pressured by weather forecasts and potential rain going into the end of the week, but spring wheat futures look to have more upside potential, especially if the long-range forecasts are correct. Other wheat classes were still followers of other grains and struggled to find traction on Tuesday. With double-digit losses in the corn and soybean markets, wheat saw sellers take control. Winter wheat harvest is picking up, but the market will be watching forecasted rains that could affect progress and quality. Globally, wheat supplies are adequate and world production will limit strong price rallies.