MARKET SUMMARY 6-24-2021

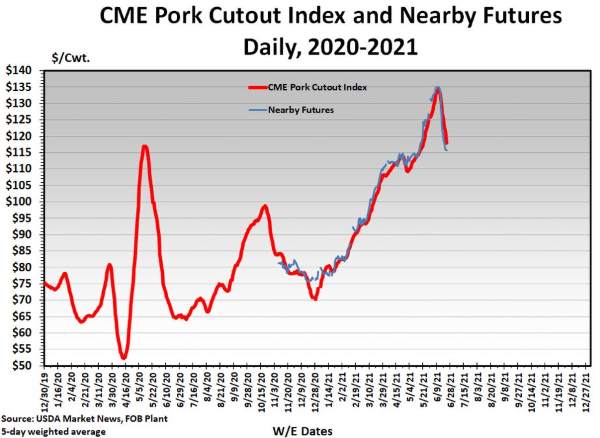

The lean hogs market followed through on its strong selloff on Thursday, as prices in the Jul contract traded the 4.500 expanded limit lower. One of the biggest factors causing the selloff in hogs has been the sharp drop in retail values. As of yesterday’s close, pork carcass values were trading nearly $17 lower than the prior week’s values. The drop in value of pork carcasses has worked step in step with the drop in futures. Midday today did bring some relief, as carcass values jumped $7.00 higher, but key for the day will be the afternoon close. The demand for pork has been extremely strong domestically and internationally. The break in pork values may be finding a bottom, and are back to trading as a value for the end user.

CORN HIGHLIGHTS: Corn futures ended the session quietly in all but the Jul contract with Dec closing 0-1/4 higher at 5.36. Jul futures lost 11 cents to close at 6.53-1/4. It was another wild day as prices plunged early in the session as December lost more than 21 cents reaching a low of 5.14-1/4, its lowest price since May 26. Rumors that China may have purchased old crop corn and a private firm lowering their acreage estimate from last month were viewed as supportive. Rain on the radar and more expected for many parts of the Midwest was viewed as negative as much-needed rainfall will help alleviate general dry conditions. Some rainfall totals could vary from between four and six inches, perhaps more than some are looking for. Nonetheless, the market still views the overall moisture developments this week as significantly positive for most production. The far west and north will continue to remain on the warm and dry side with only scattered variety type rain. This is becoming a more serious problem daily which leads many to believe the market has moved too low this week considering long-term projections require a trendline crop or larger to meet a growing demand base. Export sales at 8.5 million bushels were again slow yet this brings the total sales to 2.737 billion bushels. This equates to 96% of projected sales of 2.850 billion.

SOYBEAN HIGHLIGHTS: Soybean futures finished weaker despite a strong comeback in corn prices and another announced export sale to China for over 14 million bushels of new crop. Jul futures lost 13-3/4 cents closing at 13.71-1/4 and Nov down 8-1/2 at 12.91-3/4. Export sales at 5.2 million were termed neutral to supportive but failed to provide a reason for buyers to jump in. Year to date sold soybeans are now 99.5% of the projected sales of 2.280 billion bushels with today’s yearly figure at 2.269. A conducive forecast for crop growth in much of the Midwest has been a negative influence on soybean prices this week as futures have broken many support areas and continue to experience long liquidation. High volatility has also created an environment where the exchange has raised margin requirements, and this too may be a somewhat limiting factor to participants. With Nov soybeans currently trading under 13.00 and it being only the 24th of June with much of the Northwest parched, one must wonder if weather premium is pretty much out of the market. While it is true the USDA did make a small revision upward to project carry out to 150 million bushels this is still critically tight which leaves no room for error in this year’s production for the Northern Hemisphere.

WHEAT HIGHLIGHTS: Chi and KC wheat settled lower today, though Minneapolis wheat ended the day marginally higher. The Jul Chi contract lost 10 cents at 6.51-1/4 and Dec lost 11-3/4 cents at 6.58-1/2. Jul KC wheat lost 6 cents at 6.06 and Dec was down 6-3/4 cents at 6.24. Minneapolis wheat’s Jul contract closed up 4-1/2 cents at 8.09-1/4. Over the next 7 days, there will be limited moisture in the northern Plains from isolated thunderstorms, with most areas remaining dry. Some think this is reminiscent of 1988 in North Dakota when farmers only harvested 75% of their spring wheat acres, and the final yield was only 15 bushels per acre. Weather will be an important factor going forward. Spring wheat areas in Canada look to be in better shape with recent rains but have a dry forecast over the next 7 days. Russian wheat conditions ahead of harvest are mostly favorable. Central and eastern parts of the Midwest have received heavy rains today which could delay harvest. Missouri and Arkansas may experience areas of local flooding over the next 7 days, delaying the SRW harvest there as well.