MARKET SUMMARY 06-29-2022

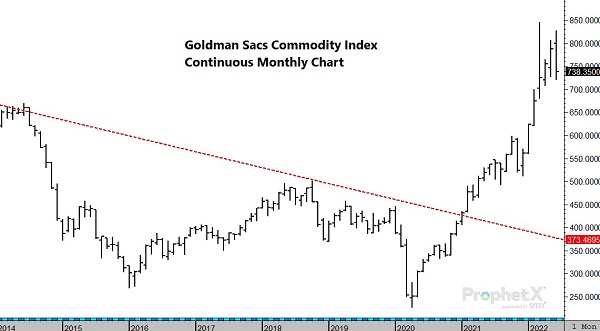

As the month of June comes to a close, the overall commodity markets have struggled this past month. The commodity sector has been supported by global demand, tight supply pictures, and supporting inflation concerns, but the month of June has seen those commodity values soften. The Goldman Sacs Commodity Index is a basket of commodity contracts that are weights by price, with energy market being a large portion of the price. During the past month, crude oil, natural gas, grain markets, cotton, and even the livestock sector has seen prices retreat off the highs earlier in the spring. The monthly chart for the index is posting a reversal pattern, which could signal further weakness across the commodity sector going forward. As the end of June is here, the money flow and technical indicators are pointing to additional weakness in commodity markets going forward.

Like what you’re reading?

Sign up for our free daily TFM Market Updates and stay in the know!

CORN HIGHLIGHTS: Corn futures softened into the close, finishing 8-1/4 cents off the daily high with September giving up 5-3/4 cents, ending the session at 6.64. Tomorrow is first notice day for July futures, which gained 10-3/4 cents to end the session at 770-1/4, while new crop December lost 5-1/2 to close at 6.53-3/4. A good forecast for the Midwest with the most recent 6-to10-day outlook forecasting above normal temperatures, but also above normal precipitation likely had traders on the defensive, as did the likelihood traders who have been recent buyers have been crushed after holiday weekends. With major reports out tomorrow and the markets closed on Monday, many may have moved to the sidelines waiting until after the long weekend.

Basis levels continue to hold firm or strengthen, an indication of light farmer selling, strong demand, or both. In this case, likely both. Yet, at this time of year, the markets main driver is weather. On the bullish side, some chart formations are indicating over-sold, yet for this time of year, we would not read too much into these signals as the trade will likely focus on crop production. Crude oil prices reversed lower by afternoon, probably adding pressure to corn prices into the close. The average pre-report estimates for corn acres on tomorrow’s report is 89.69 according to DTN. On the last report (March 31), the USDA estimate was 89.4 million. Last year was 93.36. The wild card is likely the Stocks report. Strong basis continues to suggest tight supplies on hand. The pre-report estimate is 4.33 bb with a range of 4.474 bb to 4.095. Last year’s stocks figure was 4.111.

SOYBEAN HIGHLIGHTS: Soybean futures managed another solid day of gains. Higher meal and oil helped, but traders are likely focused on, and positioned themselves in front of tomorrow’s reports. July soybeans gained 10-1/2 cents, closing at 16.74-1/4 and Nov ended the session 15-3/4 higher at 14.78-1/4.

Despite little fresh news ahead of tomorrow’s reports and weakness early on, soybeans again showed strength by the close. Higher meal and oil were again supportive to beans with meal gaining 9.60 in the August contract. So far, the news of China relaxing quarantine restrictions has not been met with new demand, but that is still the expectation. There are rumors of China purchasing Brazil soybeans for August this week. Tomorrow’s reports are still the main item on trader’s minds, however, and could still possibly show near record soybean seedings (so the strength seen the past few days is impressive). Pre report estimates show an average guess of soybean stocks at 959 mb, compared to 1,931 mb in March and 769 mb at this time last year. As far as acreage, the average estimate is pegged at 90.43 million acres, compared with 90.96 million in March and 87.20 million last year. Due to the poor conditions in North Dakota and Minnesota this year, traders will also be keeping a close eye on prevent plant acres in that region. Once the report is over, the market will likely go back to trading weather, and the extended forecast still calls for heat and dryness throughout most of the Midwest.

WHEAT HIGHLIGHTS: Wheat futures were mixed today with losses mainly in MPLS as trade was relatively quiet ahead of tomorrow’s USDA report. Jul Chi lost 5-3/4 cents, closing at 9.15-1/2, and Dec lost 6 at 9.44. Jul KC gained 1-1/2 cents, closing at 9.85-1/4, and Dec gained 3/4 cents at 10.00-1/4. Jul MPLS lost 15-1/4 at 10.19-1/2.

Chicago and MPLS wheat gave up early gains to close lower, while KC showing modest gains. Egypt’s General Administration for Supply Commodities reportedly received offers from 15 different exporters with the cheapest being Romania on a delivered basis. Although the US soft wheat is at a large discount, the Egypt protein requirements are too high for soft red wheat to meet those standards. Taiwan bought 40,000 mt of US wheat and Pakistan, Bangladesh, and Jordan were buyers as well. Spain, Italy, and Argentina are all experiencing extreme drought, which is stressing their wheat crops, while forecasts in the US remain hot, but with improved moisture. Sov Econ has increased their estimate of Russia’s wheat exports to 42.6 mmt, compared to the USDA’s forecast of 40 mmt, but Russia may still have trouble exporting as the ruble soars, high export taxes, and consequences from sanctions make things difficult. Tomorrow is the anticipated Stocks and Acreage report and should point the wheat market in some clear direction, and if the USDA estimates less than 11.02 million acres of spring wheat, it will be the smallest area since 1972. Tomorrow, July will go off the board and September will become the new front month. Support for all contracts is at the 200-day moving average.

CATTLE HIGHLIGHTS: Live cattle futures finished mostly lower again on Wednesday, as prices are looking for some support. Live cattle futures are watching the development of cash markets and weigh the concerns regarding still heavy front-end supplies of cattle. June cattle expire on Thursday and have stayed tied to the cash trade. Jun cattle gained 0.500 to 136.800, but Aug cattle were 0.550 lower to 132.175. In feeders, Aug feeders were 1.100 lower to 171.725.

Cash trade has been starting to be established on Wednesday, and light trade is being reported in all three major feeding states. Southern live deals have been marked at $138, compared to last week’s weighted averages, that is steady in Texas, but roughly $1 lower in Kansas. In Nebraska dressed deals are marked at $234, not quite $1 lower than last week’s weighted average. The front-end supply of heavy weight cattle will stay plentiful, limiting potential overall cash. With cash trade at $138 or better, August is looking undervalued as the June contract is coming off the board tomorrow. Beef carcass cutout values were lower at midday, with choice values losing 1.59 to 266.55 and select was 1.98 lower to 241.33. The load count was light at 56 loads. As the retail demand window moves past the 4th of July holiday, demand may be more of a concern going into the heart of summer. The weakness in retail values is a limiting factor in prices. Feeder cattle posted triple digit losses with the weakness in live cattle and technical selling pushing the market. Feeder Cash Index values were .12 lower to 164.08. The cattle market tide is drifting lower overall and may be poised to test the bottom of trading ranges. The heavy supply of front-end cattle will be a limiting factor. The cash market will still be the key for price direction in the near-term. Mid-summer demand and large front-end cattle supplies are limiting factors in the market.

LEAN HOG HIGHLIGHTS: Hog futures finished mixed as choppy range-bound trade continues with the market looking forward to the Quarterly Hogs and Pigs report release on Wednesday. Jul hogs slipped 0.525 to 109.400, and Aug hogs lost .250 to 103.575.

The hog market stays in a consolidative pattern, trading between the 100-day and 200-day moving averages on both the July and August charts. This pattern has held since early May, as the market may be looking for a longer-term direction. The USDA released the Quarterly Hogs and Pigs report after the market close, and the report was neutral according to expectations, but did confirm an overall tighter hog supply. Total hogs and pigs as of June 1 at 99% of last year. At 72.5 million head, this is the lowest pig herd in 4 years. Animals kept for breeding at 99% of last year at 6.17 million head is a 5-year low. Lastly, animal kept for marketing at 99% of last year. With no big surprises, the hog market will shift the focus back to the major fundamentals. Cash trade has stayed firm as packers bid up for hog supplies. Direct morning trade was firmer on Wednesday, adding 5.32 to 119.86, the 5-day average trade to a rolling average price of 118.13. The Lean Hog Cash Index traded 0.29 higher to 111.64, reflecting the overall support in the cash market. Demand has been more of a concern, but midday carcass values were higher, gaining 4.91 to 110.38, rebounding from a difficult afternoon close on Tuesday. Load count was moderate at 148 loads. The hog market will likely stay choppy, but the confirmation of an overall tighter hog supply will keep the market supported. The cash market is still surging higher, and that should help the futures market overall going forward into the summer. Just keep an eye on demand and the impact of the consumer.

DAIRY HIGHLIGHTS: Buyers have returned to support the class III and IV milk futures higher the past couple sessions as demand for dairy spot products is once again present. Over the past two days, spot cheese has added 7.875c, powder is up 2c, and spot butter is up 9.25c. Buyers may have found value with the market at discounted levels off of the highs of the year, and are looking to fill orders at this time. The jump over the past two days has put the spot butter trade within striking distance of the $3.00/lb level once again. This has been a level that has acted as resistance to butter in the past. The cheese trade is back up to $2.1950/lb despite recent reports of record cold storage inventories. There have also been reports of slowing demand for cheese across the country, but for now the cheese trade still holds prices at elevated levels.

Total Farm Marketing and TFM refer to Stewart-Peterson Group Inc., Stewart-Peterson Inc., and SP Risk Services LLC. Stewart-Peterson Group Inc. is registered with the Commodity Futures Trading Commission (CFTC) as an introducing broker and is a member of the National Futures Association. Stewart-Peterson Inc. is a publishing company. SP Risk Services LLC is an insurance agency. A customer may have relationships with all three companies. TFM Market Updates is a service of Stewart-Peterson Inc. Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition.