MARKET SUMMARY 07-05-2022

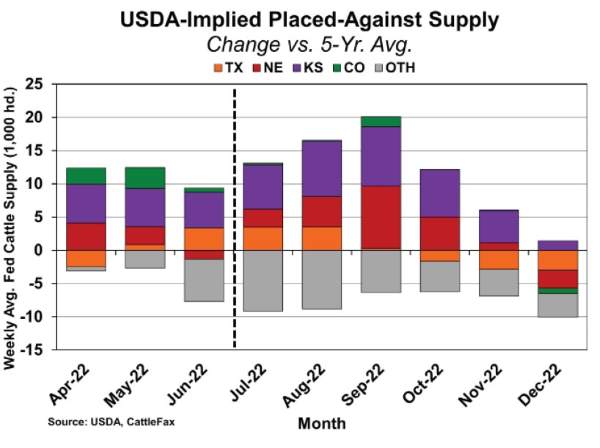

The cash price spread between the North and the South for cash-fed cattle has exploded in recent weeks. Last week, the Nebraska steer price averaged nearly $9/cwt above its neighbor to the South, while the Iowa/Minnesota price was more than $9/cwt higher than Kansas. There is no easy explanation for this price difference. The biggest factors are dealing with the overall lack of supply in northern cattle as placements of cattle supplies in “other states”, mainly those in the Corn Belt region are running well below last year and 5-year averages. Northern states like Iowa, Minnesota, and South Dakota are reporting smaller cattle on feed inventories for the first half of 2022 compared to last year. On the opposite side, Kansas posted annual increases in four of the first six months, and Texas was up every month. In addition, the currentness of northern cattle is causing packers to bid up for quality and chasing those higher-quality cattle. Carcass weights in the North are significantly lower than southern cattle. From early April to the end of June, Nebraska weights dropped 53 pounds compared to the five-year average of 39 pounds. Corn Belt weights declined 86 pounds, well below the 5-year average. Through the second quarter, Kansas and Texas weights trended relatively flat, similar to the five-year average. The split in northern and southern prices is a unique market dynamic, but given the forces at work, will likely stay in place in the relative future.

Like what you’re reading?

Sign up for our free daily TFM Market Updates and stay in the know!

CORN HIGHLIGHTS: Corn futures ended with sharp losses as the price collapse continued into its third week. Jul futures lost 18-1/2 cents closing at 7.36, while Sep gave up 27-1/2 to end the session at 5.92-1/4. Dec lost 29 to close at 5.78-1/2. Pressure came from a sell-off in energy as prices plunged more than 10.00 in crude oil. Additionally, a sharp rally in the U.S. dollar was also seen as negative. The U.S. dollar has now reached its highest level since 2002. After reaching a nearby high price of 7.49-1/2 on June 17, Dec futures have now lost 1.78-1/2 from high to low in 11 sessions.

The technical picture continues to look weak, as managed money is moving out of long row crop positions as they are not likely seeing a significant weather threat. Additionally, traders who are short are likely adding to positions creating additional downward momentum. Margin call liquidation likely added to price pressure. Oversold conditions according to stochastic indicators exist, yet a buy signal is not in place, at least not yet. A chart gap was filled on Dec futures at 5.74-1/4 from February 4. Export inspections at just under 27 mb were termed less than supportive. The most recent 6-10 day weather model indicates above-average temperatures, but also mostly normal precipitation. Bottom line, between downward technical weakness, rain on the radar, a higher U.S. dollar, and weaker energy, not to mention weakness in competing grains, the sharp downturn in price may not yet be over. Stay with a defensive posture.

SOYBEAN HIGHLIGHTS: Soybean futures closed sharply lower today as funds continued to dump their long positions as crude oil fell, and forecasts show increased moisture. Aug soybeans lost 70-1/2 cents, closing at 14.39-1/4 and Nov ended the session 79-1/4 lower at 13.16.

The bleeding continued today as non-commercials kicked selling into overdrive with a large drop in crude oil, improved weather forecast, and last week’s cancellation of a soybean shipment to China. With the funds having held such a large net long position, it has felt like any small thing could cause the market to tip over and fall apart. With last week’s Export Sales report showing 4.4 mb of canceled soybeans to China, it is becoming apparent that major importers are looking to Brazil’s cheaper soybeans to import rather than more expensive U.S. beans. In addition, Indonesia is cranking up their export quotas of palm oil, and crude oil took a sharp dive today giving soybean oil a nasty smack lower. The Crop Progress report is expected to show steady to slightly lower good-to-excellent ratings, and weekly export inspections were disappointing at 345,987 mt. When the funds decide that it’s time to sell, markets typically move downward hard and fast which is exactly what has happened here. The question now is how much further down they will bring the soy complex. Recession fears have dominated the trade with equity markets, and nearly all commodities, lower today. Nov beans gapped lower on the open and are well below their 200-day moving average.

WHEAT HIGHLIGHTS: Wheat futures settled with significant losses. Fund liquidation on economic concerns again appears to be the main culprit. Sep Chi lost 39 cents, closing at 8.07 and Dec down 38-1/2 at 8.24. Sep KC lost 51-1/2 cents, closing at 8.62 and Dec down 51 at 8.70-1/2.

The wheat market has been dropping like a rock, with Sep Chi now down roughly 4.75 from the May 17 high. Fundamentally, other than some changes to the weather forecast, not much is different today vs a couple weeks ago. The Ukraine war is still going on (and some would say it’s worse than ever) yet wheat prices are now basically back to pre-war levels. Additionally, winter wheat harvest is still expected to be down 7% from last year. So why have markets declined so quickly? We are struggling to come up with a great answer, but it is likely a combination of factors. The first would be concerns of recession and inflation. As consumers are faced with rising food and fuel prices they may cut back on their purchases, decreasing demand. These same concerns may also be triggering fund selling, and algorithmic trading based on seasonal patterns may also be playing a part. Other bearish influences include the rising U.S. dollar, recent beneficial rains in the western Canadian prairies, and the fact that the USDA is still estimating Russian wheat production to be record large at 81.0 mmt.

CATTLE HIGHLIGHTS: Cattle futures, both in the live and feeder contracts, followed many other commodities lower suffering losses of 1.65 to 1.72. Aug live cattle closed 1.67 weaker at 132.92 while Apr gave up 1.65 to end the session at 152.25. Feeders lost similar amounts with Aug leading today’s declines closing at 152.25.

As expected, the cash market was relatively undeveloped. Expectations are for a good 4th of July disappearance, however, we did not get the sense that retailers were caught short-bought. The big picture continues to suggest the live cattle market could have problematic demand due to continued inflation and higher interest rates. Additionally, the U.S. dollar today reached its highest level since 2002. The combination of potential slowing domestic demand and lackluster exports in the months ahead is keeping the market mostly rangebound. From a supply-side perspective, we stay with the bias that limited supplies and higher feed prices suggest little to no herd expansion. In fact, it is likely the herd will have contracted over this past year. Cow slaughter at 6.2% above a year ago is a confirmation.

LEAN HOG HIGHLIGHTS: Hogs managed to be the only commodity to close higher today after the nasty sell-off thanks to a big jump in the cutout. Jul hogs gained 2.550 to 112.150 and Aug added 2.975 to 105.950.

Hogs were higher today thanks to an increasing cutout which boosted the front months significantly higher while deferred months lagged but were still positive. The cutout ended the day up 5.73 at 114.48, and cash rose by 6.24 to 120.46 on the Direct Afternoon Report. Slaughter pace continues to lag, but trade is realizing that while hogs are available, supply is relatively tight. The packer has clearly needed to be aggressive to obtain inventory. Weights are heavy for this time of year, but the smaller herd should even that out. As Chinese Covid restrictions ease, export demand for pork should continue to rise. Another bullish factor comes from African Swine Fever in Germany that is spreading to the country’s most important pig rearing region. China is expected to ban German pork imports for years to come and the outbreak will have long-lasting consequences. Aug hogs closed above their 40-day moving average and will look to the 50-day which has acted as resistance. Hogs are still rangebound and will need more significant news to establish a clear trend in either direction.

DAIRY HIGHLIGHTS: The start of the shortened holiday week brought the commodity world plenty of red as most markets broke severely in Tuesday’s trade. Class III futures saw a near limit down close for the August contract, while September did finish on the limit of 75 cents lower, dropping the Q3 average more than 60 cents. Class IV futures held on in the front and second month futures comparatively, but every other contract out into next spring closed with double-digit losses. The grain and energy markets also faced heavy losses as favorable weather, disappointing demand, and a higher dollar have led to long liquidation and renewed selling.

Total Farm Marketing and TFM refer to Stewart-Peterson Group Inc., Stewart-Peterson Inc., and SP Risk Services LLC. Stewart-Peterson Group Inc. is registered with the Commodity Futures Trading Commission (CFTC) as an introducing broker and is a member of the National Futures Association. Stewart-Peterson Inc. is a publishing company. SP Risk Services LLC is an insurance agency. A customer may have relationships with all three companies. TFM Market Updates is a service of Stewart-Peterson Inc. Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition.