MARKET SUMMARY 07-07-2022

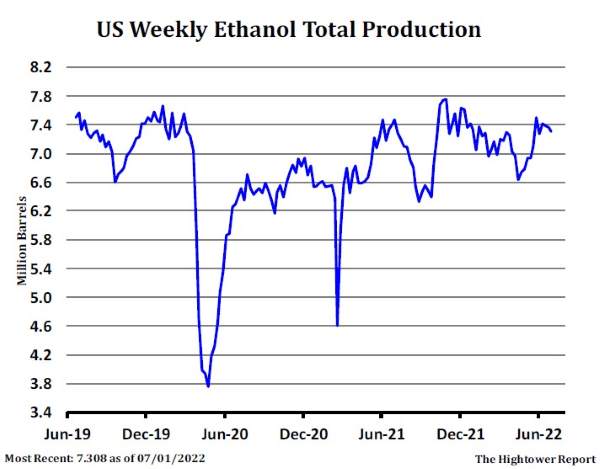

Weekly ethanol production helps the corn market keep an eye on domestic demand. With gas prices soaring, concerns about gasoline and the ripple effect on ethanol demand has been a concern. Weekly ethanol production for last week was 1.044 million barrels/day, down slightly from last week and 2.16% from last year. Total ethanol stocks were at 23.49 million barrels, up 3.3% from last week and 11% over last year. The heavy stockpiles are concerning, but current corn usage continues to run ahead of pace. Last week, an estimated 105.99 million bushels of corn were used for the ethanol grind. Total usage for ethanol this year is at 4.52 billion bushels of the USDA target of 5.35 billion bushels. The use of 105 million bushels still keeps the consumption pace ahead of schedule for the market to reach the USDA target. At this point, corn used for ethanol demand is still supportive of the corn market.

Like what you’re reading?

Sign up for our free daily TFM Market Updates and stay in the know!

CORN HIGHLIGHTS: Corn futures closed firmer for the second session in a row with Jul gaining 2-3/4 closing at 7.47. Sep added 9-1/4 to end the day at 6.09 and Dec gained 11-1/4 closing at 5.96-12. Futures finished well off their daily high. Sep peaked at 6.23-1/2 and Dec at 6.08-3/4. A lack of farmer selling, recovery in crude oil prices, and over-sold technical indicators supported prices today. Short covering was likely a feature this morning once prices rallied. China will be instituting a stimulus package, and this too was supportive to prices.

It is getting to be that time of year where actual weather is dominant and this last week many saw rain which vastly improved crop conditions. Yet, others did not. Also, for this time of year, consistent timely rains are needed. These patterns are difficult to come by as of late. Whether price improvements today and yesterday were nothing more than a bounce in an over-sold condition or the start of a more meaningful price recovery remains unknown. However, the same fundamental issues remain in place, which are tight world inventories and the need for a big U.S. crop. From many angles, the market is undervalued, and if managed money is done liquidating a meaningful recovery for price may be getting underway. Export sales will be released tomorrow.

SOYBEAN HIGHLIGHTS: Soybean futures had their second positive day as the extreme fund selling appears to have eased. All three soy products had higher closes, and gains in crude oil and the stock market were a supporting factor. Aug soybeans gained 38-3/4, closing at 14.85-1/4 and Nov gained 42-3/4 at 13.65-1/2.

The soy complex finally got a rally across the board following the massive sell-off thanks to fund liquidation. Commercials may be stepping in to take advantage of these lower prices as the fundamental picture is still relatively bullish. The rising U.S. dollar is the main bearish factor now with U.S. soybeans becoming more expensive than Brazilian beans, and support from the export market is what traders need to see right now to continue this upward momentum. Soybean prices in Brazilian reals are still historically high and should incentivize expanded production next year. Indonesian palm oil rose nearly 2% today as the country is considering lowering its export business in order to improve sales, and crude oil was significantly higher, providing support to soybean oil. Domestic demand for cash soybeans is very strong with cash crush margins up to nearly 3 dollars a bushel. Weather forecasts are bearish in the short term with rain moving into the eastern Midwest and northern Plains, but the extended forecast projects well-below normal rains into August with soil moisture already low and drought moving into the East. Technically, Nov beans are trying to climb back above the 200-day moving average, with a target of filling the gap at 13.91. Once that gap has been filled it is possible that prices stabilize short term until a new catalyst emerges.

WHEAT HIGHLIGHTS: Wheat futures had a firmly higher close today as the market corrects from oversold territory. Sep Chi gained 32 cents, closing at 8.36-1/2 and Dec up 30-1/4 at 8.51-3/4. Sep KC gained 37-3/4 cents, closing at 8.89-1/4 and Dec up 37-1/2 at 8.97-1/2.

Double-digit gains in all three U.S. futures classes may signal the beginning of a recovery and a correction from a very oversold situation. Support is coming from gains in corn and soybeans, as well as Chinese stimulus news in which $220 billion of bonds will be sold. On a bearish note about China, however, Covid cases are reportedly on the rise again in Shanghai, which is causing some concern about new lockdowns and what that would mean for the global economy. In other global news, India said they will restrict wheat flour export sales as of July 12 – a bullish item of note. Additionally, U.S. exports are becoming more competitive, but Egypt was reported to have purchased 63,000 mt of German wheat Thursday. Here at home the U.S. dollar, while still historically high, faded back earlier in the session and may have also provided some relief to the wheat market. This could be tied to news surrounding Boris Johnson, the UK Prime Minister, and the reports that he is resigning (and what it will do to the British pound and European currencies). This situation is still unfolding at the time of writing with news outlets commenting that a new successor still needs to be appointed. As far as a direct impact to the wheat market, next week Tuesday will feature the monthly WASDE report – Russia’s crop may be increased but Europe’s is expected to remain largely unchanged.

CATTLE HIGHLIGHTS: Cattle futures saw mixed trade as the market is waiting for a true cash market to develop. Early cash trade is still not a true indicator, but southern trade has been softer, while northern cattle are still seeing some buying support. A recovery in grain markets pressured feeders on Thursday. Aug live cattle closed 0.050 higher to 134.550, and Oct cattle slipped 0.100 to 139.850. Aug feeders were pressured, losing 0.825 to 172.475.

Cattle markets keep being held in check technically by key moving averages running over-top current price levels. Either the 100-day or the 200-day moving averages are going to be a key swing point in the live and feeder cattle markets. The cash cattle market is finally starting to see some interest after feedlots put up a good fight in deferring the week’s business in hopes of driving prices higher. The Southern Plains is seeing cattle sell for mostly $137, steady to $1.00 lower than last week, and Northern cattle are selling anywhere from $147 to $151, which is steady to $1.00 higher than last week. The post-July 4th window usually brings some demand concerns with the heat of summer. Retail values had a strong day yesterday, and at midday were firm with Choice gaining 0.26 to 268.31 and Select also 0.26 higher to 243.19. The load count was light at 79 midday loads. The USDA will release weekly export sales and will continue to show solid export demand for U.S. beef. The forecast looks to turn temperatures hotter in the second half of July, and that could help support cash markets as weight gains may become more difficult. The recovery in grain markets on Thursday pressured feeder cattle prices. The Feeder Cash Index was 2.18 softer to 162.90 and could be a limiting factor to the Aug feeder contract. Overall, the cattle market is continuing to consolidate, looking for a reason to move, but resistance over-top keeps prices in check. The economic concerns and demand concerns will be limiting, but the overall light production may keep the market supported.

LEAN HOG HIGHLIGHTS: Hog futures stayed supportive as prices saw moderate to strong gains, supported by a strong overall cash market tone and the prospects of demand. Jul hogs gained 0.100 to 113.250, and Aug added 0.300 to 109.500.

Buying support followed through from the strong day on Wednesday, but resistance at the 100-day moving average kept the upside limited on the day. The front end of the hog market is optimistic for some demand boost as Germany has discovered African Swine Fever in parts of its hog production region. Chinese hog prices have firmed, adding buying support. The hog market is looking for more prospective demand. Weekly export sales announced tomorrow will help be the gauge for global demand. Pork carcass values were firmer at midday supporting the market. Carcasses gained 1.61 to 113.11, on a load count that was moderate at 174 loads. Cash markets jumped higher on morning direct trade on Wednesday but softened on Thursday. The weighted average price move lost 1.85 to 119.31 in the morning. The 5-day rolling average is currently 118.46. The Lean Hog Index was 0.65 softer to 109.93. The premium of the Jul futures to the index is a limiting factor with the Jul expiration looming on the 15th. The hog market is at a point to break out higher or correct back to the bottom of the range. The hog market is watching what may develop overseas and more potential U.S. demand. Some news there or continued strength in cash may be the key.

DAIRY HIGHLIGHTS: Class III futures held moderate to strong gains today with the August contract at $21.84, up 40 cents on the day and 64 cents above yesterday’s low. The recent beating had gotten the markets oversold and due for a retracement like many commodity markets, and time will tell what is possible for further upside potential. Spot cheese is hanging in there with a penny gain today, while spot whey was unchanged at $0.49/lb again. Class IV trade spiked as well with the second month contract still not far beneath $25.00, keeping the August contract nearly $3.00 above its Class III counterpart.

Total Farm Marketing and TFM refer to Stewart-Peterson Group Inc., Stewart-Peterson Inc., and SP Risk Services LLC. Stewart-Peterson Group Inc. is registered with the Commodity Futures Trading Commission (CFTC) as an introducing broker and is a member of the National Futures Association. Stewart-Peterson Inc. is a publishing company. SP Risk Services LLC is an insurance agency. A customer may have relationships with all three companies. TFM Market Updates is a service of Stewart-Peterson Inc. Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition.