MARKET SUMMARY 07-08-2022

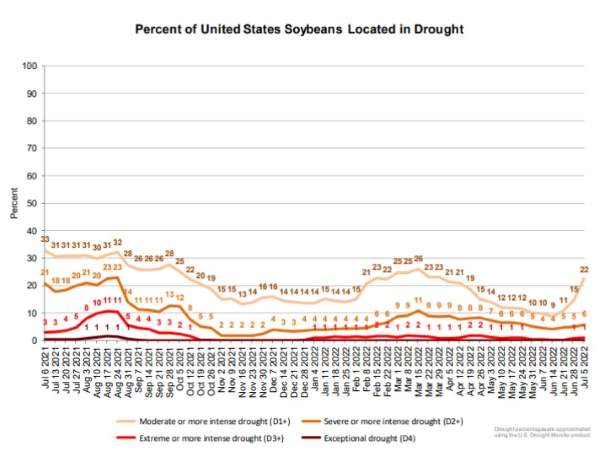

As the calendar moves into the heart of summer, the weather will become a focus of the grain markets. Recently release USDA data showed a trend that more soybean acres are being impacted by drought conditions. As of July 5, 22% of U.S. soybean acres are impacted by drought, this is up from 9% just a few weeks ago. Recent rains may have helped ease some of those problem areas, but a potential base is being built. At this point, long-range forecasts are bringing a trend to a drier and hotter weather forecast for the second half of July into early August. With soybean acres being reduced from March planting intentions, the U.S. soybean supply picture could become extremely tight for the 2022-23 marketing year. This will likely bring some support back into the soybean market, as prices add some weather premium back to prices after the recent sell-off. Weather models can change quickly and will bring even more volatility to the soybean futures market.

Like what you’re reading?

Sign up for our free daily TFM Market Updates and stay in the know!

CORN HIGHLIGHTS: Corn futures rallied sharply today in line with strong gains in the soybean and wheat markets. Jul gained 31-1/4 to close at 7.78-1/4 and Sep added 24-1/4 to close at 6.33-1/4. Dec closed at 6.23-1/2, up 27-1/4 on the session. Weekly gains were noted. Export sales were weak, yet the market ignored this information and reflected concern that both the 6-10 day and 8-14 day forecasts are calling for below-normal precipitation. Much needed rain fell in parts of the Midwest this week and while helpful, most farmers’ soils were so dry they will need additional rain soon. Areas that missed rain will be more adversely affected soon unless actual rain develops. Crude oil gained near 6.00 in the last two sessions and is viewed as supportive.

Export sales were dismal with a -2.6 mb old crop. While on the surface this is negative, the glass half full theory suggests end users saw the market falling and backed away. Now that prices have softened from recent highs and showing a turnaround, coupled with weather uncertainty and Ukraine issues creeping back into the picture, we would not be surprised to see importers more aggressively purchase U.S. corn. China was rumored to be a buyer today. For the week, Dec new crop gained 16 cents, posting a friendly hook reversal. Crop ratings will likely improve in some areas this week and not in others suggesting little net change. The over-sold technical indicators this week and stochastics buy signal may have spurred new buying and short covering.

SOYBEAN HIGHLIGHTS: Soybean futures closed significantly higher today and appear to be in recovery mode after the brutal sell-off that saw Nov beans drop as low as 13.02. Aug soybeans gained 28 cents, closing at 15.13-1/4 and Nov gained 31 cents at 13.96-1/2.

Soybeans continued the rally off their lows today and closed higher for the third day in a row. Funds have laid off on their liquidations, and commercials have stepped into the market to take advantage of the lower prices. Today’s big supporting factor was tied to China’s Ministry of Finance announcing a potential 220-billion-dollar stimulus meant to kickstart the economy. The additional bullish factor comes from August’s weather forecast in the U.S. which is expected to be hotter and drier than normal. Export demand is still sluggish with net sales at 160,000 mt for 21/22, up 33% from last week but down noticeably from the prior 4-week average. Exports of 504,900 mt were down 3% from the previous week and 5% from the prior 4-week average, with top buyers being Mexico, China, and the Netherlands. While export demand has been soft, domestic demand is strong with board crush rising to 1.52 per bushel for new crop. Brazil’s CONAB lowered Brazilian soy production by 300,000 mt to 124 mmt. All soybean contracts closed back above their 200-day moving averages and both Sep and Nov beans closed their very important chart gaps. Trade could be expected to trend slightly higher to range-bound with the 200-day acting as new support.

WHEAT HIGHLIGHTS: Wheat futures firmed again today as the market recovers from the recent selloff, the Ukraine situation worsens, and weather looks to turn warm and dry. Sep Chi gained 55 cents, closing at 8.91-1/2 and Dec up 54-3/4 at 9.06-1/2. Sep KC gained 56-1/2 cents, closing at 9.45-3/4 and Dec up 56 at 9.53-1/2.

Wheat led the way higher with prices jumping 50-55 cents in all three U.S. futures classes. Paris milling wheat futures also gapped higher, gaining about 15-18 euros per metric ton. Part of what is helping the rally is dryness in Europe; Argentina’s wheat crop is also struggling with dry conditions. Another factor is that futures are still oversold. Upward momentum is increasing though and as long as prices continue this trend next week they may break out of this technical region. Additionally, the fact that the Ukraine war is still raging on provides a bullish backdrop. Apparently, Ukrainian farmers are getting two dollars per bushel for their wheat (and one dollar for corn). This raises concern about why they would even harvest or plant crops at these levels. With a significant amount of their farmland now under Russian control, some suggest that they may not have much of a choice. In other news, today’s export sales data had the USDA reporting 10.5 mb of wheat export sales for 22/23 – not a stellar number but with the recent drop, U.S. exports are becoming more competitive. There was talk that China may be making a purchase of wheat (and corn) from the PNW. In terms of weather, this weekend there may be rains but the next two weeks look warm and dry across most of the Midwest. Weather will play an important role in market direction next week, in addition to the WASDE report. No major changes are expected, but there is always the potential for surprises.

CATTLE HIGHLIGHTS: Cattle futures saw mixed to mostly lower trade as pressure in the feeder market and steady to lower cash trade brought a pause to the cattle market. A strong move in grain prices pressured the feeder market to end the week. Aug live cattle closed 0.600 lower to 133.950, and Oct cattle slipped 0.900 to 138.950. Aug feeders were pressured, losing 0.750 to 171.725. For the week, Aug live cattle were 0.650 lower, and Oct dropped 1.025. In feeders, Aug feeders dropped 2.775.

Cattle markets stayed in consolidation trade, as the Oct contracts have traded both sides of 139.00 for the past 5 sessions. The market is looking for news to break in either direction. The cash market tone should support the market, but the concerns regarding consumer demand and the U.S. economy limit the near-term upside. Front-end cattle supplies keep the market cautious. Estimated slaughter for Friday was 125,000 head, up 4,000 from last week and year. Those supplies, especially in southern cattle, keep a lid on the cash market. The cash cattle were mostly complete for the week, except for some light clean-up trade. The Southern Plains saw cattle sell for mostly $137, steady to $1.00 lower than last week, and Northern cattle are selling anywhere from $147 to $151, which is steady to $1.00 higher than last week. Overall, business was light this week, influenced by the holiday. Retail values were mixed at midday with Choice gaining 0.07 to 268.14 and Select 1.23 lower to 241.35 The load count was light at 61 midday loads. Carcass values saw some light gains, trending higher on the week from last Friday’s closes. The USDA released weekly export sales on Friday morning and posted new sales of 1,000 MT for 2022, down 35% from the previous week and 30% from the prior 4-week average. Top buyers of U.S. beef last week were Japan, South Korea, and Canada. The follow-through strength in grain markets on Friday pressured feeder cattle prices. The Feeder Cash Index was 2.18 softer to 162.90 and could be a limiting factor to the Aug feeder contract. For the week, the Cash Feeder Index traded 2.77 lower. Overall, the cattle market is continuing to consolidate, looking for a reason to move, but resistance over-top keeps prices in check, and value in the cash market provided support. It will still come down to the cash trade on a week-to-week basis to find price direction.

LEAN HOG HIGHLIGHTS: Hog futures were mixed with bear spreading action, as the price support was seen in the deferred contracts. Tighter overall hog supplies support the back end of the hog market, but potentially softening cash and demand concerns limited the front-end gains. Jul hogs slipped 0.400 to 112.850, and Aug lost 0.325 to 109.175. For the week, Jul hogs were 3.250 higher, and Aug hogs gained 6.200.

Strong week overall in the hog markets saw some Friday afternoon profit-taking. Oct and Dec hogs are poised for a potentially strong move higher but will need to see follow-through of Friday’s trade. The front-month contract stayed tied to the cash index, with the expiration of the Jul contract on July 15. Weekly export sales were strong for the week with new net sales of 31,200 MT for 2022 were down 3% from the previous week, but up 23% from the prior 4-week average. Mexico, China, and Japan were the top buyers of U.S. pork last week. Pork carcass values were firmer at midday supporting the market. Carcasses gained 2.02 to 114.21, on a load count that was moderate at 167 loads. Cash markets were softer on morning direct trade on Friday. The weighted average price move lost 0.73 to 118.58 in the morning. The 5-day rolling average is currently 119.18. The Lean Hog Index was 0.23 higher to 110.16. For the week, the Lean Hog Index traded 0.68 lower as the cash market may be finding a top. The premium of the Jul futures to the index is a limiting factor with the Jul expiration looming on the 15th. The hog market is at a point to break out higher or correct back to the bottom of the range. The market started pricing in a possible peak to the cash market last week, as prices have moved into range-bound trade. The deferred contract may be ready to surge higher next week on a possible breakout over resistance.

DAIRY HIGHLIGHTS: Class III and IV milk futures have pushed lower for about four weeks in a row now. This week’s trade was yet another volatile one, but the market did stabilize late in the week. The August second month Class III contract was down 74c on Tuesday and fell another 24c on Wednesday. Buyers then supported and helped August recover 40c on Thursday. It then fell 9c on Friday, which put the contract down 67c in total for the week. The heavy selling pressure to start the week came from a lower Global Dairy Trade, a commodity-wide selloff, dairy spot market pressure, and technical weakness. The market broke below the May low, which may have also fueled additional selling pressure. The market trend has now turned from an uptrend to a downtrend.

Total Farm Marketing and TFM refer to Stewart-Peterson Group Inc., Stewart-Peterson Inc., and SP Risk Services LLC. Stewart-Peterson Group Inc. is registered with the Commodity Futures Trading Commission (CFTC) as an introducing broker and is a member of the National Futures Association. Stewart-Peterson Inc. is a publishing company. SP Risk Services LLC is an insurance agency. A customer may have relationships with all three companies. TFM Market Updates is a service of Stewart-Peterson Inc. Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition.