MARKET SUMMARY 07-15-2021

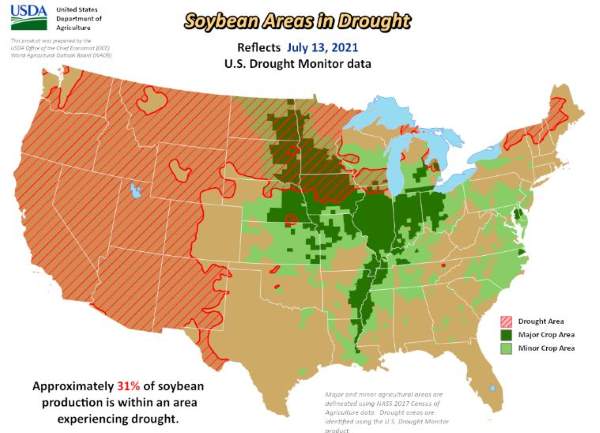

After the July USDA Supply and Demand report, the weather comes back into focus, with the biggest emphasis on the soybean crop and the northern Plains. As of July 13th, 31% of U.S. soybean acreage was experiencing some form of drought, but in North Dakota, South Dakota, and Minnesota, 99-100% of planted soybean acres are experiencing some form of drought. Two of those states, North Dakota and Minnesota, are in the top five for total soybean acres, with Minnesota ranking 3rd and North Dakota ranking 4th, and combined with South Dakota, this totals 19.9 million acres or 22.7% of the 87.55 million acres projected for U.S. soybeans this year. While recent rains have been beneficial in some areas to stabilize the crop temporarily, long-range forecasts are not friendly, projecting potential triple-digit heat into this region going into the end of the month. If realized, the soybean market is likely poised to add additional weather premium moving into the key August weather window.

CORN HIGHLIGHTS: Corn futures traded both sides of steady ending the session quietly with small losses. Sep lost 4 cents to close at 5.64-1/4 and Dec down 2-1/2 to 5.56-1/4. Technically, the corn market may be trying to fill a gap left last week after the weekend of the fourth when futures started on Tuesday, July 6 substantially lower. The topside of the gap is 5.73-1/2. Today’s high was 5.61-1/2 and yesterday’s high 5.62-3/4. Considering the amount of rainfall over regions of the Midwest, it is hard to believe corn prices have rallied the previous three sessions as well as held today. Heavy liquidation of longs after the July 4 weekend likely pushed prices too low too quickly. The 6 to 10 and 8 to 14-day forecasts continue to suggest limit rain for the northwestern regions of the Midwest. Wheat, oats, and soybean oil continue to move higher providing underlying support as do thoughts that export business could increase as Brazil may not have enough supply. Basis remains firm, yet with Sep, the front month, not gaining against deferred months could be a sign that the trade is expecting enough old crop supplies as well as new crop corn, wheat, and milo to be an early-season substitute for old crop corn. Exports at 5.5 mb old crop were uneventful. This brings the year-to-date total sales to 2.750 bb or 96.5% of the most recent forecast of 2.850 bb.

SOYBEAN HIGHLIGHTS: Soybean futures closed 5-1/2 lower in Aug at 14.47-1/2 and 3-1/4 weaker in Nov at 13.80. Meal lost over 5.00 while soybean oil gained over 100 points as vegetable oil supplies remain tight. Nov soybean futures closed above the 50-day moving average yesterday and held this level again today. Overnight rains were again viewed as beneficial, yet forecasts for the next 10 to 14 days suggest much of the northern and northwestern regions of the Midwest will be below normal in precipitation and above normal in temperature. Today’s trade was rather subdued with a small trading range compared to recent sessions. It looked as though the market was marking time waiting for more news or weather forecast to provide direction. We have argued the most critical weather for soybeans is the pot filling stage and if dry weather persists in the West and North it will be likely that yield will not reach 50.8 bushels an acre. Export sales at 0.8 mb brings the year-to-date sales total to 2.275 bb or 100.2% of the most recent USDA forecast of 2.270 for the current marketing year.

WHEAT HIGHLIGHTS: Sep Chi up 17-3/4 cents at 6.72 & Dec up 16-1/2 cents at 6.78-3/4. Sep KC wheat up 12-1/2 cents at 6.40-1/4 & Dec up 12 cents closing at 6.50-3/4. Wheat prices were bolstered today by better than expected export numbers with weekly sales totaling 427,000 mt. Tack on the bullish overflow from Monday’s bullish USDA report numbers and the worrisome weather in the Plains, and there’s little reason to see wheat trend lower today. Looking at Monday’s report numbers for HRS production, the current estimate is 305 mb – which is the lowest HRS ending stock number in 8 years. Given the hot and dry forecast, that number could easily shrink even further by the end of the growing season. MNPLS wheat is still leading the rally, closing at 8.94 today, the highest close since 2013. Unfortunately, the SRW wheat harvest has been delayed by rains that have fallen this week in areas like Kansas, however, nothing is changing in the weather models for the northern Plains. With only 16% of the spring wheat crop there rated good/excellent it won’t be shocking to see that number decrease even from here, as the next 2 weeks are expected to stay too hot with zero precipitation on the horizon.