MARKET SUMMARY 07-28-2022

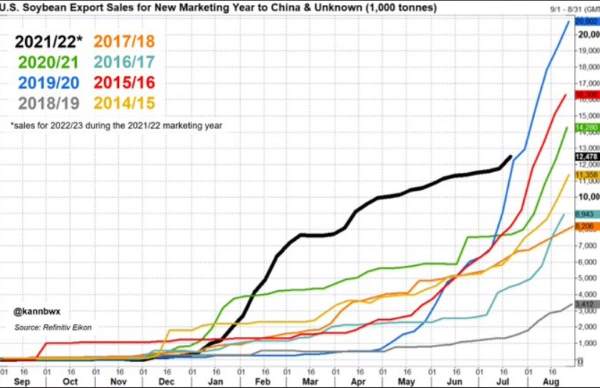

Weekly Export sales numbers for soybeans saw business pick up for new crop soybeans this week. New crop soybean sales totaled 748,800 MT last week, of which China and Unknown destination added 737,000 MT of those sales or approximately 27 mb of booked new crop soybean. The last week was the most active week of new sales since mid-April. As of July 21, the combined total of 12.5 MMT of sales for China + Unknown is an 8-year high and accounts for 84% of all new crop sales on the books. Typically, business should pick up in this time window as end users are switching their focus to the cheaper U.S. bean and the soon arriving fresh supplies with this fall harvest. With the strong sales totals on the books, this fall and early winter will likely see a strong demand tone in the soybean market, supporting prices overall.

Like what you’re reading?

Sign up for our free daily TFM Market Updates and stay in the know!

CORN HIGHLIGHTS: Corn futures rose for the fourth consecutive session on continued calls for above-normal temperatures and below-normal precipitation for the next two weeks. Short covering was noted as well. Strength in soybeans is spilling over to the corn pit as well. Nov soybeans have now rallied over 1.50 in five sessions. Sep corn finished 14-3/4 higher closing at 6.15. Dec futures added 16 cents to close at 6.19, its highest close since July 11. Equity markets continued to climb as well, trading to their highest level since the first week of June, adding a favorable tone.

Export sales continue to be slow with today’s figures at 5.9 mb old crop and 7.6 mb new crop. Concerns the USDA may have to lower exports on their balance sheets could keep rally potential in check. On the other hand, reported sales are based on a time delay. In essence, what’s reported today were sales last week and likely decisions made by importers two or three weeks ago when prices were in a heavy sell-off. The point is if end users are getting nervous about supply due to adverse weather in the U.S. export sales, as well as end-user short covering, could rapidly come into the marketplace. Strong closes and strength in competing markets are supportive to corn prices but most importantly is the perceptive view that yield could be challenged if the longer-range forecasts into August continue to hold for above-normal temperatures and below-normal precipitation.

SOYBEAN HIGHLIGHTS: Soybean futures closed higher again today as weather dominates the trade with hot and dry forecasts worsening. Aug soybeans gained 30-1/2 cents to end the session at 16.09-1/4 and Nov was up 30-1/2 to 14.40-1/2.

Weather is driving this soybean market right now, as forecasts continue to show extreme heat and dry conditions broadening over the Corn Belt and Dakotas. Net export sales were bad with another week of net reductions, but the market clearly shrugged that off as weather may take a real toll on the soybean yields if conditions don’t improve at some point through August. The net sales reductions were 2.2 million bushels for 21/22, and 27.5 mb for 22/23, down 21% from the previous week and 14% from the previous 4-week average. Soybean export shipments now total 1.961 bb for 21/22 and are down 10% from a year ago. Soybean oil surged today and closed above its 200-day moving average for the first time since the end of last month, as palm oil gained 3.5%, and crush premium is incentivizing at 2.91 a bushel. Despite a pullback in meal, the front month closed higher as there has been a surge in demand for cash meal, which is trading 59 dollars above Aug futures in Illinois. With The USDA estimating only a 230 mb surplus for 22/23, a drop in yield due to weather could cause serious supply problems. Nov soybeans closed above their 40-day moving average for the first time in over a month and are nearing resistance at the top of their Bollinger Band at 14.48.

WHEAT HIGHLIGHTS: Wheat futures eliminated yesterday’s losses as the market deals with the unknowns surrounding Ukraine and how much grain they will export. Sep Chi gained 26-3/4 cents, closing at 8.17, and Dec up 26-3/4 at 8.35-1/4. Sep KC gained 28 cents, closing at 8.89-3/4, and Dec up 27-1/2 at 8.96-1/2.

The market as a whole is still trying to figure out just how much wheat Ukraine will actually ship over the next 3 months. As we mentioned yesterday, there were incorrect reports that 80 vessels were ready to ship 20 mmt. As it came to light that this was false, it likely gave traders confidence to buy back into the market. So far, for the month of July, Ukraine has shipped about 260,000 tons of wheat. Current realistic expectations are for Ukraine to ship about 2 mmt of grain per month over the next three months (for a total of 6 mmt). This is far less than the 20-some million tons that some had anticipated. Here in the United States, day two of the spring wheat tour found a yield of 47.7 bushels per acre (the day previous it was 48.9 bpa). The USDA also reported an increase of 15.1 mb of wheat export sales for 22/23 – the Philippines were the top buyer. As a bullish item of note for wheat price – the Buenos Aires Grain Exchange reported that Argentina’s wheat crop is rated only 16% good to excellent as they struggle with drought. Last year at this time the rating was 55%. Global wheat supplies are already tight and there is concern with Europe and Ukraine also dry that global supply may continue to drop.

CATTLE HIGHLIGHTS: Live cattle futures were mixed to lower with a weaker cash market tone pressuring the front of the market, while feeders saw triple-digit losses as strong grain markets brought the sellers back into the feeder market. Aug live cattle closed 0.625 lower to 136.175, and Oct lost 0.500 to 141.825. Aug feeders dropped 1.675 to 177.425.

Cattle futures are falling off most recent highs, and the weak price action is a concern that front-end futures are looking to test support back to the 200-day moving average, near $140 in the Oct live cattle futures. Cash trade has stayed disappointing overall this week, with light trade at $135 in the south, steady to $1 lower, and northern trade at $225, down $2 from last week. Trade was very quiet today, and most trade is likely wrapped up for the week. Today’s slaughter totaled 121,000 head, 2,000 below last week, but 1,000 more than a year ago, as overall numbers have stayed firm, but carcass weights are lower, tightening production. Midday carcass values were soft, adding to the selling pressure as choice carcasses lost 0.42 to 267.57 and select was 1.34 lower to 240.47. The load count was light at 48 midday loads. Weekly export sales released this morning added new sales of 25,300 mt of beef, which is up 6% from last week. South Korea, Japan, and China stayed as the top buyers of U.S. beef last week. Feeder cattle stay under pressure from the strong grain markets. Like live cattle, a pullback to the 200-day moving average looks like a downside target on the front month futures. The Feeder Cash Index jumped 1.91 higher to 172.55 but is still trading at a discount to the futures market. The cattle market is moving into a more range-bound trade and is now challenging support levels. The weaker cash tone and the concerns about the consumer and consumer demand limit the market’s potential.

LEAN HOG HIGHLIGHTS: Hog futures were mixed as the strong cash market supported the Aug futures, but economic concerns and consumer demand limited gains in the deferred contracts. Aug hogs gained 0.525 to 119.125, but Oct slipped 0.125 to 96.325

Hog futures saw weak price action, which could lead to additional selling pressure on Friday’s open. Volatile cash markets pressured the hog market overall. Midday direct hogs were sharply higher yesterday, but gave back most of those gains on Thursday’s trade, dropping 11.20 to a weighted average price of 117.86 and a 5-day rolling average of 123.60. The Lean Hog Cash Index still trends higher gaining 0.25 to 119.73 and is trading at a small premium to the Aug futures, supporting that contract. The market will be watching the actions of the cash market as the forecast for extreme heat will be impacting the Midwest and will likely limit hog movement and weight gains. The retail market is trading at its highest levels in a year and gained value at midday today. Pork carcasses were 2.16 higher to 128.95. The load count was light at 89 loads. Weekly export sales showed decent pork movement international with new sales of 21,600 MT last week, up 5% from the previous week. Mexico, Japan, and Canada were the top buyers of U.S. pork last week. The cash market has been volatile, but still overall supportive. The soft close on Thursday may set the market up for some price pullback going into the end of the week.

DAIRY HIGHLIGHTS: Class III second month milk futures gave up all gains from earlier in the week, while Class IV second month remains above where we started the week. Heavy volume was present in today’s dairy trade with over 600 contracts traded in August Class III futures and nearly 800 contracts traded in September Class III. Sellers unloaded inventory on the market and were aggressive in doing so. All spot market products were lower, even butter, which recently had been the best performing spot product. The market got support from grains being higher and the dollar was a bit softer, but the spot session was very bearish.

Total Farm Marketing and TFM refer to Stewart-Peterson Group Inc., Stewart-Peterson Inc., and SP Risk Services LLC. Stewart-Peterson Group Inc. is registered with the Commodity Futures Trading Commission (CFTC) as an introducing broker and is a member of the National Futures Association. Stewart-Peterson Inc. is a publishing company. SP Risk Services LLC is an insurance agency. A customer may have relationships with all three companies. TFM Market Updates is a service of Stewart-Peterson Inc. Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition.