MARKET SUMMARY 08-04-2021

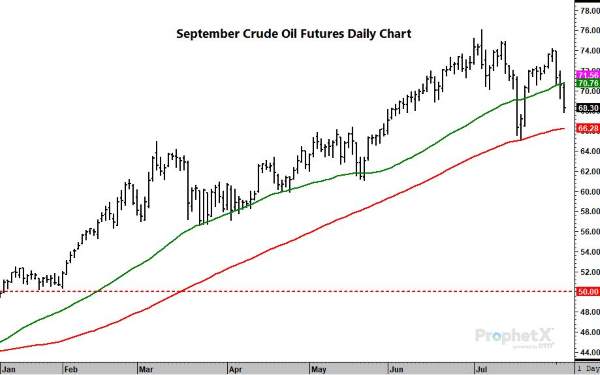

Crude oil futures traded strongly lower on Wednesday, and prices broke support levels and are poised to challenge recent lows. The oil market has been under pressure from the spread of the Delta variant of COVID internationally, and the prospects of a tightening demand picture, building supplies. The weekly Energy Information Association (EIA) report released on Wednesday only helped add to the fears of building supplies. On Wednesday, oil prices fell for the third day in a row to a two-week low on a surprise build in U.S. crude stockpiles, negative U.S. economic reports, and worries the spread of the coronavirus Delta variant will weigh on global energy demand. The EIA report stated crude stockpiles rose by an unexpected 3.6 million barrels last week, above analyst expectations. Technically, charts are set up for additional long liquidation, as prices will likely target the 100-day moving average on the September contract, near the $66.00 a barrel level.

CORN HIGHLIGHTS: Corn futures saw two-sided trade before finishing mixed with selling pressure on the front end of the markets. Sep corn dropped 4-3/4 cents to 5.45-3/4 and the most actively traded Dec futures slid 5 cents lower to 5.46-3/4 on the close. Dec corn had a 15-1/2 cent trading range as consolidation towards the 5.50 area continues today. In typical summer trade, the lack of news has been giving the market little direction to go on. Late yesterday, private analyst, StoneX, released their producer survey yield estimates. Those projections came in at 176.9 bushels per acre, which is 2.6 below the current USDA projections. As the market looks toward the August 12 USDA Supply/Demand report, additional crop production projections will be in front of the market. The USDA will be using producer surveys on this report to determine yield. The weather will likely be the dominant factor going forward. Near-term forecasts are looking more favorable for crop production, but models are changing rapidly. As harvest approaches the big remaining question mark is whether or not the areas that have gotten timely rains (and potentially record yields) will outweigh the areas that are still struggling with heat and dryness. As it stands today, the European and GFS weather models are somewhat in conflict as to what areas will get rains over the next 10 days. Technically, stochastics show nearby corn losing momentum and we will be watching this closely. We will also be watching the spread of the Delta variant of COVID-19 and what it will mean for food and fuel demand.

SOYBEAN HIGHLIGHTS: Soybean futures rebounded after yesterday’s sell-off, with Aug futures gaining 11-1/4 cents at 14.03 and new crop Nov posting a 6 cent gain and closing at 13.25-3/4. Today was nice to see, as yesterday’s close below 50 & 100-day moving averages was concerning. As we move closer to next week’s USDA report, more and more private analysts throw their projections into the ring. Stone X yield estimate came in at 50 bps, down 0.8 from USDA’s previous estimate. Barchart released their estimate of 51.1 which is even bigger than USDA’s previous estimate. Veg oil markets were back up today with palm oil futures rising 3.6 after plunging 6% yesterday. Bean oil was up today, with support from canola futures, which both helped support the soybean complex today. Funds sold yesterday, now expected to hold only 22,000 at the beginning of today. Export demand has been down, with poor crush margins and adequate supply in China keeping them out of the market for now. Stochastics in nearby beans shows downward momentum with Nov actually approaching oversold territory, Nov beans need to hold 13.00 or risk breaking into the next support of 12.60 to 12.80.

WHEAT HIGHLIGHTS: Sep Chi down 7-1/4 cents at 7.17-1/4 & Dec down 6 cents at 7.28-3/4. Sep KC wheat down 13-1/4 cents at 6.94-1/4 & Dec down 16-3/4 cents closing at 7.05-1/2. Wheat traded in the red today, most following corn’s lead and on the news of rains across the Canadian Prairies and northwest Plains today. With these scattered showers comes some relief from the high temps as well, however, the stress easement may be too late for much of the wheat and canola crops as harvest starts up. Global weather is still of concern. Scattered showers continue through Ukraine and northwest Russia over the next week, but it is drier in the Southwest while temperatures are above normal with no relief in sight yet. The U.S. dollar has settled into a range of around 92 points. The U.S. has pushed above world values, which should limit exports and upside short term unless global values can catch up. Although the outlook for tomorrow’s export report regarding U.S. wheat is expected to stay minimal, global demand for wheat is still strong. Turkey and Algeria have both purchased 300,000+ mt of wheat, along with Pakistan purchasing 400,000 mt of milling wheat.