MARKET SUMMARY 08-09-2022

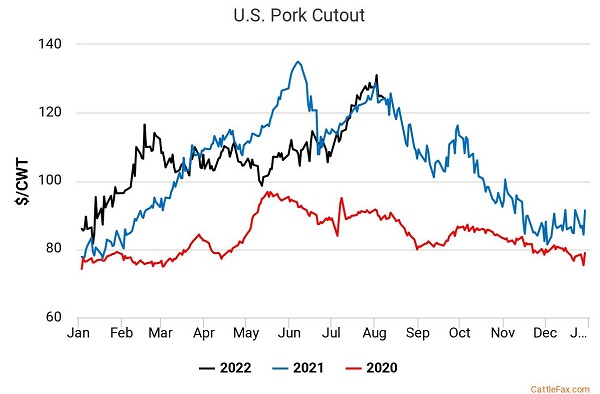

Strong cash and pork retail values have been supporting the hog market, but that may be coming to an end. Pork carcass cutout value was trading near the highs for 2022, with midday value on Monday challenging the $129.00/pound level. This was challenging the highs for the year, but the retail market may be poised to peak. Historically, pork retail values turn lower in the post Labor Day demand window as the consumer emphasis moves away from grilling demand to more indoor preparation. In addition, hog slaughter numbers and hog weight tend to trend higher into the end of the year, adding more pork production into the market. This year could pose a different trend, at least in terms of hog numbers. High input costs have caused the hog herd to contract, an animal available for slaughter into the end of the year will be trending under last year’s levels. Weights will still likely increase, so the demand will be the key piece to the hog price puzzle. Demand has held up well this summer despite economic concerns, and a strong demand tone into the end of the year with tighter production can keep some value in the hog market this fall.

Like what you’re reading?

Sign up for our free daily TFM Market Updates and stay in the know!

CORN HIGHLIGHTS: Corn futures started the day higher on spillover news of yesterday’s announced sale of 120 mt to China, as well as a somewhat surprising drop in crop rating. Additionally, a drop in the yield estimate by DTN was also viewed as supportive. September corn finished 7-0 cents higher closing at 6.15-1/2 and off the high for today of 6.26. December corn ended the session adding 6-3/4 to close at 6.14, 10-1/2 cents off its daily high. Firmer soybean and energy prices spilled over into the corn market. Futures jumped higher on the overnight, leaving a second chart price gap. The first price gap was on 7/25. Gap theory would suggest this could be a measuring gap pointing to a potential high near 6.40 December futures.

Weekly crop ratings indicated 58% of the crop as rated good to excellent, down from 61% last week. The poor and very poor categories are now 16%, an increase of 2% from the previous week. Bottom line, the crop, at least according to crop ratings, is not likely getting bigger. Expectations for the USDA estimate of 177 yield is in doubt. Ships are moving out (more this week) of Ukraine, with one moving in. However, it is naive to believe that things in that region of the world are normal. The question many have asked is if the market has factored too much into the idea of grain moving out of Ukraine/Russia? Our vote is yes. Higher crude oil prices today and no perceived downside for grain/oilseed complexes from the Climate Bill, which moves to congress was also considered positive for price. DTN Digital Tour is currently pegging yield at 167.2. This is substantially below the current USDA estimate of 177. The USDA report is due Friday with the average pre-report yield at near 176 bpa. There could be acreage adjustments to SD, ND, and MN due to late planting conditions.

SOYBEAN HIGHLIGHTS: Soybean futures closed higher with front month August leading the way, with significant gains after crop conditions dropped and yields are expected to fall with Friday’s USDA report. Aug soybeans gained 73-3/4 cents to end the session at 16.93-1/4, and Nov gained 28-3/4 cents to 14.28-3/4.

August soybeans scored new contract highs today as crush margins have jumped with soybean products now 5.43 above the cost of soybeans in Illinois according to the USDA’s report last Friday. Processors should continue to be aggressive in obtaining cash soybeans. August soybean meal posted new contract highs, as well as the USDA’s spot price of meal in Illinois shows a high premium, over $100 a short ton higher than the September futures price. Yesterday, the USDA lowered crop conditions by 1% to 59% good-to-excellent with Kansas and Kentucky falling the most to only 41-42% good-to-excellent. The USDA also reported that 89% of the crop is blooming with 61% setting pods, which is down from the 5-year average of 66% for this time of year. This Friday’s USDA report will be crucial for getting updated yield estimates. DTN’s Digital Yield Tour estimated national soybean yields at 48.9 bpa, while the USDA’s estimate last month was 51.5 bpa, and the average trade estimate at 51.1 bpa. A significant drop in yields could put ending stocks for 22/23 into a dangerously tight spot. Nov beans are working their way to attempt to get back above their 50-day moving average, which is 9 cents away, while Sep meal is near contract highs and Sep soybean oil has been on a steady uptrend.

WHEAT HIGHLIGHTS: Wheat futures had a mixed close again today. There simply hasn’t been much fresh news for the market to rally on, and pressure is still coming from Ukraine’s increasing exports. Sep Chi gained 1-3/4 cents, closing at 7.81-1/2 and Dec was unchanged at 7.99-1/4. Sep KC gained 4 cents, closing at 8.51-3/4 and Dec up 3-1/4 at 8.58-1/4.

It was another mixed close for wheat today. Spring wheat did gain around 12 cents, likely due to the USDA dropping crop conditions 6% to 64% good to excellent. This was more than expected; 9% of that crop has also been harvested. Additionally, 86% of winter wheat is harvested, lagging a bit from the 91% average. The US forecast is showing mostly dry conditions ahead for the Spring Wheat Belt, so crop conditions could deteriorate further. In the southern hemisphere, Argentina’s wheat crop is still struggling, though the central part of the country has had scattered showers over the past day or so. The USDA may end up cutting back their production on Friday’s report. In other news, a total of 12 ships have left Ukraine, though they are carrying corn and sunflower products. This is pressuring the market though, as wheat is likely to make its way out soon as well. Ultimately, the market seems to be in a wait and see mode, but if there are major changes to Friday’s USDA report, it could cause a price breakout.

CATTLE HIGHLIGHTS: Live cattle saw some profit taking on Tuesday, led by a drop in feeder cattle prices as grain markets traded higher to start the day. Aug live cattle closed 0.375 lower to 137.975, and Oct lost 1.050 to 143.175. Feeders posted strong triple digit loses, with August dropping 2.475 to 178.800 and September led the market lower, dropping 3.150 to 182.500.

October cattle saw selling from the start of the session as the cattle complex traded lower, Oct is testing the 10-day moving average under the price at $143.150, but still trading in an uptrend. Cash trade is still undeveloped for the week, but expectations are for cash to trade steady to firmer with asking prices in the $138-140 range. At these levels, Aug live cattle are fairly priced to the cash estimates. The tighter cattle supply and the search for quality has packers staying active in the cash market. Retail values at midday were mixed as choice carcasses slipped .60 to 265.64 and select was .88 higher to 239.74. The load count was light, but improved at 78 midday loads. The choice/select spread is still trading at a wide $25.90 at midday. This reflects the tightness of the beef lots and packers bidding up to find choice beef product to meet the demand. Feeder cattle pushed sharply lower on profit taking as a drop in crop ratings caused grain prices to surge higher overnight. With prices pushing near contract highs, the market was susceptible to some profit taking. The Feeder Cattle Index jumped 1.09 to 176.40 and is still at a discount to the August futures. With the cash undeveloped, and a softer retail tone, the cattle market was set for some profit taking. The overall market is still trending higher, and fundamentals stay supportive. Open interest is growing and there is still room for money to flow into the cattle market.

LEAN HOG HIGHLIGHTS: Hog futures saw mixed trade on Tuesday with some profit taking in the front end of the market. Front month August hogs stayed tied to the cash index with expiration around the corner on the 12th. Aug hogs gained 0.400 to 122.200, and Oct slipped .700 to 99.600.

The October futures saw some technical selling pressure hitting the psychological $100 barrier on Monday, but prices still used the strong fundamental tone to pull of the session lows for that day as prices consolidated. With August expiration on Friday, the front-end market will likely stay choppy. The large spread between the August and October contracts is still wide at 22.275 on the close, and still look to be supportive of the October futures. The Lean Hog Cash Index was slightly lower, losing .17 to 121.92. With August expiration on Friday, the August futures are tied to the index and moved to a small premium to the index. October is at a strong discount, trading 22.300 under the index. The strong cash market tone is the fuel for the front of the market, but prices are trending lower. Midday direct hogs on Tuesday were softer, losing 4.29 to 118.59 and the 5-day rolling average at 126.38. The retail market saw midday pork carcasses were firmer gaining 1.36 to 125.42. The load count was moderate at 182 loads. Retail values established a new high for the year recently, but have begun to roll over, typical of the post-Labor Day retail market. The hog market is strong and money flow supports the market, but the season window could move here to slow the upside potential. The demand will be key as hog numbers are still less than anticipated, and packer are still looking for product.

DAIRY HIGHLIGHTS: The US spot cheese block/barrel cheese average has closed higher in three straight sessions, adding an impressive 6c in Tuesday’s session alone. This brings the cheese price back to $1.85/lb after bottoming last week at $1.75625/lb. Buyers have returned after the price had fallen nearly 70c from the high of year. Class III futures responded positively to the bidding, taking the front month August contract up 14c to $20.09 and taking September up 47c to $19.87. Even Class IV futures rallied despite weakness in the powder and butter spot trade. Spot powder has closed lower six sessions in a row and has fallen a total of 18c to $1.46/lb. This is its lowest price since October 2021. Spot butter is down four sessions in a row to $2.96/lb.

Total Farm Marketing and TFM refer to Stewart-Peterson Group Inc., Stewart-Peterson Inc., and SP Risk Services LLC. Stewart-Peterson Group Inc. is registered with the Commodity Futures Trading Commission (CFTC) as an introducing broker and is a member of the National Futures Association. Stewart-Peterson Inc. is a publishing company. SP Risk Services LLC is an insurance agency. A customer may have relationships with all three companies. TFM Market Updates is a service of Stewart-Peterson Inc. Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition.