MARKET SUMMARY 08-17-2022

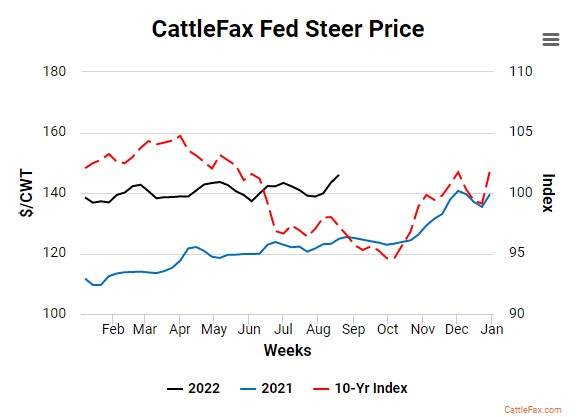

Fed cattle prices have been firming the past couple weeks, and early indications show higher trade again this week. The recent strength in the live cattle market has been driven by a strong cash market. Cash prices have been trending nearly $20 over last year, and last week had a national average of $143. Prices have been in a recent uptrend, as packers are actively looking for cattle; retail values and packer margins have stayed supportive. Cash trade has still been developing this week, but southern bids are challenging the $150 level, keeping the trend higher. This cash strength has pushed futures markets to new highs in the front-end, and the prospective tight cattle supplies have had long-term price support as those contracts are also reaching new contract highs.

Like what you’re reading?

Sign up for our free daily TFM Market Updates and stay in the know!

CORN HIGHLIGHTS: Corn futures traded both sides of steady but finished the session with small gains. The market is likely in a bit of a “wait and see” mode and that has kept the corn trade in a mostly sideways pattern. Sep closed 4 cents higher at 6.15, and Dec was up 1-3/4 to end the session at 6.12.

A lack of fresh news is keeping the market relatively range bound. Dec corn’s daily trading range between 6.06-3/4 and 6.17 was pretty narrow and stayed within the 21 and 10-day moving averages of 6.06-1/4 and 6.17-5/8 respectively. These moving averages are key price levels and a breakout, especially below support at the 21-day moving average, could look very negative technically. The chance for more rains over the next seven days in the U.S. is a bearish item of note, as are the scattered showers across parts of Europe. Rains may help to stabilize the crop there but are unlikely to replenish river or water levels. The Rhine River in Germany is critically low and is causing logistic issues. In Ukraine, grain still appears to be flowing without interference from Russia. Reportedly, five new ships have arrived to be loaded. So far most of what Ukraine has been able to export has been corn, with lesser amounts of wheat and sunflower products. To some traders, the greater concern surrounds China and its ultimate import demand. A recent drop in their interest rates was a bit surprising and may signal that their economy is not doing as well as some thought. The U.S. economy is also still a big question mark at this point, with recession and inflation still on the minds of many.

SOYBEAN HIGHLIGHTS: Soybean futures closed higher today with Sep showing the most gains as short-term dry weather returns, and crush margins are good. Sep soybeans gained 21 cents to end the session at 14.75-1/4, and Nov gained 9 cents to 13.90.

Soybeans had a break from the selling over the past two days and closed higher with Sep leading the way, as demand for cash beans is strong with good crush margins. Spot soybean crush margins have risen to 2.55 per bushel, which is up significantly from last week, and crush margins in Illinois as high as 3.00 a bushel. Soybean oil traded lower today despite higher crude and higher palm oil but remains near the monthly high. Weather forecasts have also changed to the drier side over much of the Corn Belt in the short-term providing support today, but recent rains should give a boost to crop ratings come Monday’s report. South America is wrapping up harvest, but Argentinian farmers reportedly have as much as 845 mb of soybeans in storage as they wait for better prices with Argentine inflation nearing 90%. Argentina is the world’s number one exporter of soymeal, so their refusal to sell soybeans is bullish for U.S. meal. China’s sluggish economic situation is still something to be watched along with exports to the country. Further bearish Chinese-related news could send soybeans lower so producers should be defensive in the short term. Nov beans didn’t make it back above the 200-day and there is a gap lower on the chart at 13.49-1/4.

WHEAT HIGHLIGHTS: Wheat futures closed sharply lower, as a combination of weather and a canceled purchase of U.S. wheat weighed on the market. Sep Chi lost 22-3/4 cents, closing at 7.63-1/4, and Dec down 22-1/4 at 7.80-1/2. Sep KC lost 20-3/4 cents, closing at 8.51, and Dec down 20-1/4 at 8.53.

The wheat market was under pressure today, in part due to a canceled tender by Iraq for 50,000 mt of US wheat. Heavy rains expected across the southern U.S. HRW Wheat Belt over the next seven days also added to the bearish tone. With amounts expected between 2-4 inches, that moisture will be a big help for the soils going into next year’s planting season. Scattered showers in Europe also pressured not only U.S. futures, but Paris milling wheat futures were down roughly 5 Euros per mt. Some are calling theirs a “100-year” drought and while these rains may help to stabilize crops, it is unlikely that there will be much improvement. Ukraine grain shipments are also on traders’ minds, and though most of what has left so far has been corn, some wheat has been exported and reports suggest five new vessels have arrived to load. In regards to Ukraine, the U.S. is said to be purchasing 150,000 mt of Ukrainian wheat for the UN world food program. In general, there is not much fresh market-moving news and this has wheat remaining in a sideways trading pattern. The overarching theme of economic concern for China, Europe, and the U.S. is also likely suppressing strong wheat rallies and keeping prices in check.

CATTLE HIGHLIGHTS: Cattle markets had a strong day again anticipating a strong cash tone, as bids firmed on Wednesday. Aug live cattle closed at a new contract high, gaining 0.450 to 141.750, and Oct traded 0.175 higher to 145.850. Feeders followed suit with Aug gaining 1.725 to 183.250 and Sep added 1.650 to 187.125.

Aug futures used the strength of the day to post a new contract high and high close on the day. With prices holding at the top of the range for the day, will likely keep buyers active on Thursday’s open. Oct futures filled the Jun price gap, and like Aug, seemed poised to challenge the contract high. Cash trade is still undeveloped, but packer bids firmed on Wednesday with $150 bids in Nebraska, and Southern $141 bids were passed on by the feedlots. The feedlots are gaining some leverage and are willing to see where the bids will go while packer margins and retail values stay firm. Today’s slaughter totaled 126,000 head, even with last week, but 6,000 greater than a year ago. Carcass weights have been on the climb, typical of this time of year, but the rate of climb is starting to slow as weights are slipping back to 5-year averages due to high input costs. This trend could be very key in the weeks ahead. Retail values at midday were mixed, as choice carcasses gained 0.06 to 265.50 but select was 0.56 lower to 238.56. The load count was moderate/good at 88 midday loads. The choice/select spread moved back to $26.94. Feeder cattle posted triple-digit gains with spillover strength from the live cattle market, and grain futures were relatively quiet. With the strength, prices are back to challenging their recent highs, with Sep just short of those contract highs. Cash feeder prices remain strong as producers struggle to secure cattle. The Feeder Cattle Index added 0.54 to 179.89. The overall market is still trending higher, and fundamentals stay supportive. The strong cash market tone and support in retail markets gave cattle markets a boost again on Wednesday. Feeders are back to the recent highs and looking to push through, as the cash market supports feeder prices. The cattle market is looking toward Friday’s cattle on feed numbers and pricing in a friendly report.

LEAN HOG HIGHLIGHTS: Lean hogs futures saw some early selling pressure only to have buyers return and prices recovered with moderate to strong gains. Oct added 1.475 to 98.050 and Dec hogs added back 0.725 to 88.425.

The strong risk-off trade posted a reversal on the charts on Tuesday, only to have a more friendly chart picture with the hook reversals on Wednesday’s trade. It is likely the hog market may be moving into a sideways trading range. The cash trade saw price strength yesterday and this morning, bringing the buyers back into the market. Midday direct cash trade, which gained 5.73 on the close Tuesday, was 8.32 higher at midday today to 128.87 and a 5-day rolling average of 123.48. The Lean Hog Cash Index was slightly lower on the day, slipping 0.65 to 121.06. The index is still trading at a strong premium to the Oct futures, closing at 23.010 premium over the futures on the close. The retail market saw midday pork carcasses trading firmer, gaining 2.38 to 123.53, as prices are trending slightly higher this week. The load count was moderate at 160 loads. USDA will release weekly export sales on Thursday morning, and those numbers could help influence the price action on Thursday’s open. The carcass weights are a key in this window, and current weights are trending under last year’s levels, and are looking to trend under 5-year averages. Those lower weights should stay supportive of the market, especially since the trend in hog numbers is lower. The hog market is still well supported by the cash market, as today’s price action triggered buyers to come back into the market on the lows of the day. One day doesn’t make a turn back higher, but the fundamentals are still there to support the market.

DAIRY HIGHLIGHTS: Class III prices took a step back today with second month September finishing at $20.67, which was briefly limit up yesterday and touched $21 again during today’s trade. Spot cheese followed suit with lower values; block/barrel average off slightly to finish the day at $1.9125/lb. Block and barrel failed to find any trades for the second consecutive spot session. Cheese reports, however, painted a prettier picture with higher supplies being offset by good export and retail demand. Butter continues to be a strong asset to the dairy complex, as the spot trade was up over two cents to finish at $2.99/lb. Supplies continue to be tight and have kept Class IV prices moving up. Second month Class IV September was up a quarter to finish at $23.50.

Total Farm Marketing and TFM refer to Stewart-Peterson Group Inc., Stewart-Peterson Inc., and SP Risk Services LLC. Stewart-Peterson Group Inc. is registered with the Commodity Futures Trading Commission (CFTC) as an introducing broker and is a member of the National Futures Association. Stewart-Peterson Inc. is a publishing company. SP Risk Services LLC is an insurance agency. A customer may have relationships with all three companies. TFM Market Updates is a service of Stewart-Peterson Inc. Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition.