MARKET SUMMARY 08-23-2021

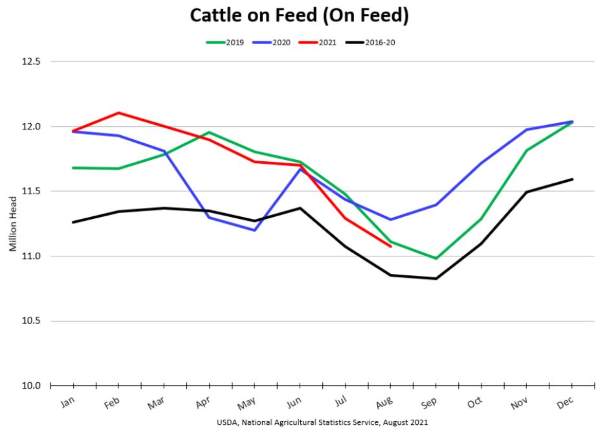

The USDA Cattle on Feed report forecasts a tighter cattle supply going into 2022. The report last Friday projected total cattle on feed as of August 1 to be at 98% of last year or just over 11 million head. The report confirmed what the market was expecting, a tighter overall supply picture. The only drawback was the placement of heavy-weight steer in the 900-999 lbs. category, as high grain prices have tightened margins, and producers are closing the feeding window using heavier feeders. This may still keep the upfront numbers slightly heavy, especially given the tighter slaughter capacity. The beef market responded with a strong rally to the upside to start the week, as the front-end contract broke out to new contract highs. The demand for retail beef has been extremely strong as beef retail prices have pushed to new highs for the year and show no signs of slowing down. The cattle market is moving into overbought territory and should be taken with caution, but at this time the fundamentals and technicals are supporting the cattle price.

Like what you’re reading?

Sign up for daily TFM Market Updates and stay in the know:

https://info.totalfarmmarketing.com/market-updates

CORN HIGHLIGHTS: Corn futures closed at 5.38 in Sep, down 3/4, and 5.35-1/2 in Dec, finishing the session at 1-1/2 cents lower. Last week, Dec corn lost 36 cents, and that negative close kept pressure on the corn market to start the week, as price action stays soft as corn prices slipped off overnight highs. The rumors last Friday that the EPA will lower renewable fuel blending mandates, unconfirmed at this time, were actually met with a friendly story stating that the 2022 mandate will be above both 2020 and 2021 standards. This may have helped with the early session strength on Monday. The Pro Farmer Tour found a U.S. corn yield of 177 last week vs the USDA’s 174.6, which will keep the market cautious regarding the corn supply picture, and maybe keep the market slightly comfortable. The soften in price did finally bring some demand to the corn market this morning, as the USDA announced a sale of 458,600 metric tons of corn for delivery to Mexico during the 21/22 marketing year. Corn sales have been few and far between lately, so any additional demand news was welcome. Weekly crop ratings saw some additional stress on corn this past week, as ratings fell 1% to 60% G/E. This may be due to maturity moving along quickly, but the overall dry crop conditions in regions of the Corn Belt will be speeding up maturity. Technically, the corn chart took on some damage at the end of last week but held on to support today. Prices are still vulnerable to a further break lower technically if support fails to hold.

SOYBEAN HIGHLIGHTS: Soybeans had a much better start to the day, however, fizzled throughout the trade today. Sep soybeans approaching first notice day this Friday only captured a 1/4-cent gain closing at 12.94. Nov at one point had a high of 13.09 today, however, only closed up 2 cents with a close at 12.92-3/4 cents. Last week, Nov soybeans lost 74-1/4 cents. The Pro Farmer Tour found a U.S. soybean yield of 51.2 bushels per acre. There is concern over the spread of the Delta variant in Asia and how it will affect demand, especially from China. It may also complicate the transportation and logistics of moving grain in that region, as China’s ports are already congested. As with corn, the rumors surrounding EPA biofuel blending mandates affected the market last week, but these remain unconfirmed and were based on unnamed sources. U.S. FOB soybean prices are 48 cents per bushel cheaper than Brazil in October. India has cut their import tax for both soybean and sunflower oil in half, at 7.5%. Fundamentally, soybean prices should remain supported due to supplies expecting to remain tight in 21/22. DTN’s National Soybean Index closed at 12.78.

WHEAT HIGHLIGHTS: Wheat had a strong start to the day but refused to hold the gains that were visible midday today. Sep contracts are approaching first notice day this Friday, Chi Sep wheat gaining 5-1/2 cents closing at 7.19-3/4 and Dec wheat up 5-1/4 cents closing at 7.33-1/2. Sep KC wheat only garnished a gain of 2-1/4 cents closing at 7.04-1/4 while Dec up 1-3/4 cent at 7.17-1/2. Despite last week’s selloff, the market is still fundamentally bullish for wheat, still trending from USDA’s August report numbers, which projected the lowest ending stocks among the top 8 exporters in 14 years. Spring wheat harvest is underway and right on the trade’s expectation of 77% completed. Minimal rain in the forecast leaves room for progress to continue nicely. U.S. wheat prices continue to be supported by leaner world wheat supplies and higher prices. Parts of Russia continue to remain very dry, eastern Australia needs rain, and Argentina has chances for frost this week.

Total Farm Marketing and TFM refer to Stewart-Peterson Group Inc., Stewart-Peterson Inc., and SP Risk Services LLC. Stewart-Peterson Group Inc. is registered with the Commodity Futures Trading Commission (CFTC) as an introducing broker and is a member of National Futures Association. Stewart-Peterson Inc. is a publishing company. SP Risk Services LLC is an insurance agency. A customer may have relationships with all three companies. TFM Market Updates is a service of Stewart-Peterson Inc. Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition.