MARKET SUMMARY 08-26-2021

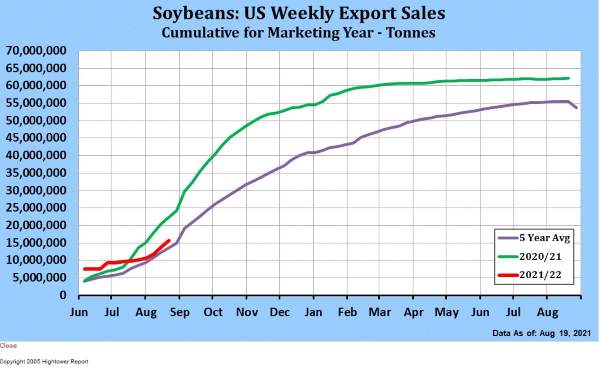

While recent export sales activity for soybeans has been encouraging, there is still a lot of room for potential. The demand for U.S. soybeans is still a concern, especially given the strength of U.S. sales last year in this window. On this week’s weekly export sales report, total sales for the 2021-22 marketing year were 15.6 MMT of U.S. beans, and last week added 1.750 MMT. This is still a solid number, but compared to last year, sales on the books were closer to 24 MMT as the strong Chinese buying program elevated the sales. Just recently, U.S. soybeans became more competitive in price compared to the rest of the globe, and export business has picked up accordingly. Expectations are for U.S. export business to not reach last year’s levels, limited by reduced Chinese demand and the recent large and forecast record South American production. U.S. soybean supplies are very tight and any demand will keep the market supported, but some of the optimism regarding massive export sales numbers may be a little more muted in 2021-22.

Like what you’re reading?

Sign up for daily TFM Market Updates and stay in the know:

https://info.totalfarmmarketing.com/market-updates

CORN HIGHLIGHTS: Corn futures traded quietly on the overnight and early morning session on either side of steady with yesterday’s close. By day’s end, futures closed mixed with Sep closing 1-1/2 higher at 5.52-3/4 and Dec 1-0 lower at 5.50-3/4. With the end of the marketing year upon us (Aug 31st), we will focus attention on new crop sales. Today’s figures for sales last week totaled 26.9 mb, which puts new crop sales year to date at 759 mb, a strong start. A lot of rain on the radar today is impressive, yet likely late for many to do much good. Rain on August 26th is still welcomed. As we indicated earlier in the week, the crop progress showed that corn was maturing quickly and with high temperatures that will likely continue. Bottom line, help from rain this week has likely been negated by crop maturing sooner and consequently, we’re quickly reaching a point where yield will likely be whatever it is. The September Supply and Demand report will provide a good perspective as boots on the ground and significant survey samples will help round out expectations prior to harvest. We’re keeping an eye on a tropical depression in the Gulf which could potentially strengthen into a tropical storm, Ida. If this does occur, harvest delays or field damage could occur in Texas, Oklahoma, Louisiana, and surrounding states.

SOYBEAN HIGHLIGHTS: Soybean futures were pressured by helpful rainfall in parts of the Midwest. While it has been hot, some producers have suggested rain this week will make a big difference in yield potential. As an example, some might argue they may have gained 2 bushels an acre this week instead of losing 2, or a swing of 4 bushels. Significant rain on the radar today likely kept soybean prices under pressure as it appears much of the rain is falling in areas that really could use additional moisture. Old crop export sales at 2.8 million were viewed as supportive bringing the year-to-date total to 2.284 bb, or 101.1% of the latest USDA estimate of 2.260 billion. Impressive were sales for the new year, 2021/2022 at 64.3 mb. This brings the total for the new marketing year to 574 mb. Expect volatile price activity to continue in the days and weeks ahead. Projected carry out at 155 million bushels is just too tight and with crop ratings at 56% good to excellent as compared to 69% a year ago, we are still doubting the 50 bu/acre projection despite beneficial rain this week. The poor to very poor category at 16% is double that of a year ago. Traders were selling soybean oil and buying meal today due to concern over world meal supplies creeping higher, as La Nina is a mounting concern for Argentina which remains dry.

WHEAT HIGHLIGHTS: After a weaker start to the week, wheat pulled ahead nicely today, while soybeans & corn kept their habit of being inverted to wheat prices for most of the week. Sep Chic wheat gained 14 cents closing at 7.25-1/4 and Dec gained 13-3/4 closing at 7.39-1/4. KC wheat Sep futures up 13-1/2 cents closing at 7.15-1/2 and Dec contracts gaining 13-1/4 cents at 7.28-1/4. Today’s rally was attributed to Paris Milling futures back up today (after a 30 cent loss yesterday) on fears that European crop estimates are being lowered due to quality concerns. Back in the U.S., it’s expected that spring wheat harvest is continuing nicely, with little to slow it down even through the rains that have occurred this week. Speaking of rain, there is still no rain in sight for the drought-stricken U.S. northern Plains, further hurting the winter wheat planting conditions. Exports today were lackluster as expected with only 116,000 mt exported for the week.

Total Farm Marketing and TFM refer to Stewart-Peterson Group Inc., Stewart-Peterson Inc., and SP Risk Services LLC. Stewart-Peterson Group Inc. is registered with the Commodity Futures Trading Commission (CFTC) as an introducing broker and is a member of National Futures Association. Stewart-Peterson Inc. is a publishing company. SP Risk Services LLC is an insurance agency. A customer may have relationships with all three companies. TFM Market Updates is a service of Stewart-Peterson Inc. Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition.