The CME and Total Farm Marketing offices will be closed

Monday, September 6, 2021, in observance of Labor Day.

MARKET SUMMARY 09-02-2021

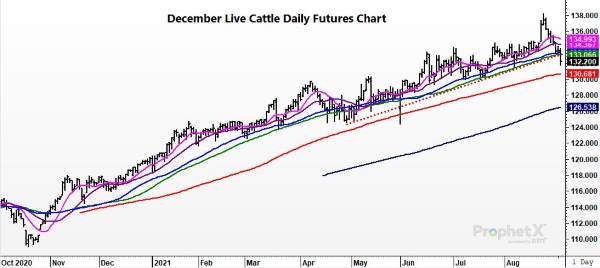

Despite strong demand, and packer margins, cattle futures broke technically on Thursday’s trading session. The cattle market has been well supported since last fall as cattle prices have seen a steady climb. The Dec contract posted a low on 10/20/2020, at 109.350, and has been without a major correction, peaking out last week at $138.225 before the chart started to roll over. The demand for beef both domestically and on the export front has helped support beef prices. In addition, ongoing labor issues have kept packing plants kill totals low, tightening the beef supply picture in the face of good demand. Recently, the choice beef carcass value touched $350.00, a strong value for boxed beef, and helped push packer margins. The cash market has struggled to reflect the strength, gaining very slowly, as the lower kill capacity kept cattle supplies in check. The beef market is hitting a seasonal window where prices soften as retailers have bought necessary supplies for the Labor Day holiday. In addition, cattle weights are starting the move slightly higher, adding more production of beef supplies. The carcass values have begun to soften, and this has triggered a pull back in futures prices. Since the high, Dec cattle have lost over $6.00 in value. The concern is the technical picture, as the weak close on Thursday opens the door for additional technical pressure, and the Dec live cattle contracts are poised to test lower support levels.

Like what you’re reading?

Sign up for daily TFM Market Updates and stay in the know:

https://info.totalfarmmarketing.com/market-updates

CORN HIGHLIGHTS: Corn futures finished mixed with small gains on all crop and losses on next year. Sep futures closed at 5.16-1/4 up 0-3/4 and Dec gained 2-3/4 to end the session at 5.25-3/4. Sep of 2022 lost 5-1/2 cents to close at 5.07-1/2. Corn futures are at an interesting crossroads. In four of the last five years, the harvest low has occurred in August. The exception was 2017 when prices bottomed in November. The problem we see using that analysis to anticipate a low this year is that prices were significantly below the cost of production. That is, there wasn’t much of an incentive to sell at harvest. This year prices are still high and with Dec futures trading at 5.25 the value per acre is still high and significant. Yet, the confusion factor for this year is that Dec corn futures have traded at 5.50 in each of the last five months. Therefore, farmers have had multiple opportunities to sell. The only aggressive selling we likely see in the near term will be those who get into early harvest and may have extra bushels they need to move. Otherwise, our bias, after multiple conversations with producers, is they are prepared to store. Export sales for old crop were a negative 11.8 mb. This puts total old crop sales at 2.757 bb or 99.4 of the projected total sales of 2.775 bb. Sales for the new marketing year came in at 45.6 mb, bringing the year-to-date total to 804 mb or about one-third of expected total sales of 2.4 bb.

SOYBEAN HIGHLIGHTS: Soybean futures ended the session with a small hook reversal on charts as futures pushed below yesterday’s low, yet managed to bounce back to finish with small gains of 1-1/2 in Sep and 5-1/2 in Nov. Sep finished the session at 12.79-1/4 and Nov at 12.83-1/4. Export sales for old crop were 2.5 mb, bringing the year-to-date total to 2.286 bb or 101.2% of the forecasted 2.260 bb. New crop (2021/2022 marketing year) was 78.4 mb – a robust figure representing strong daily sales as reported last week on daily sales. Soybean meal lost between 3.5 and 5.8 dollars while soybean oil finished with moderate to strong gains of 70 to 85 points. A softer dollar provided support, as did ideas the recent downturn in prices is overdone. Factors pressuring prices this week were; beneficial rainfall last week and again the last 24 hours in addition to weak chart activity, and most important concerns with shipping being disrupted due to Hurricane Ida. When supplies are tight, as they are with soybeans, that doesn’t imply that prices must move higher unless end users are aggressively securing inventory or there is reason for prices to rally, perceived or otherwise. On the eve of harvest neither end user buying nor perception of tightening supply beyond current levels is creating incentive for end users to cover.

WHEAT HIGHLIGHTS: Sep futures, on thinning volume, gained 3 cents closing at 7.04 and De gained 2-3/4 cents closing at 7.17. KC Sep gained 6 cents closing at 7.01-1/4 with a volume of only 81 contracts today, and Dec contracts gained 5 cents at 7.09. Obviously, Dec contracts have virtually taken over as front-month futures, even though technically Sep futures don’t expire until Tuesday, 9/14. From a technical standpoint, although cutting it very close, futures are still holding support levels for now. Paris milling futures were ahead today as well. Several wheat tenders globally, although once again the U.S. continues to get bypassed due to our internal price just not being competitive right now in the global marketplace. Once again, there was talk today about global production shrinking as rumors swirl that Russian production numbers could be closer to the 70 mmt – that is well below the 75.4 mmt Russia is currently projecting and below the 72.5 mmt the USDA is projecting. In the U.S. much appreciated rains are falling today in Kansas and Nebraska, helping replenish moisture to the soil ahead of planting.

Total Farm Marketing and TFM refer to Stewart-Peterson Group Inc., Stewart-Peterson Inc., and SP Risk Services LLC. Stewart-Peterson Group Inc. is registered with the Commodity Futures Trading Commission (CFTC) as an introducing broker and is a member of National Futures Association. Stewart-Peterson Inc. is a publishing company. SP Risk Services LLC is an insurance agency. A customer may have relationships with all three companies. TFM Market Updates is a service of Stewart-Peterson Inc. Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition.