MARKET SUMMARY 09-13-2022

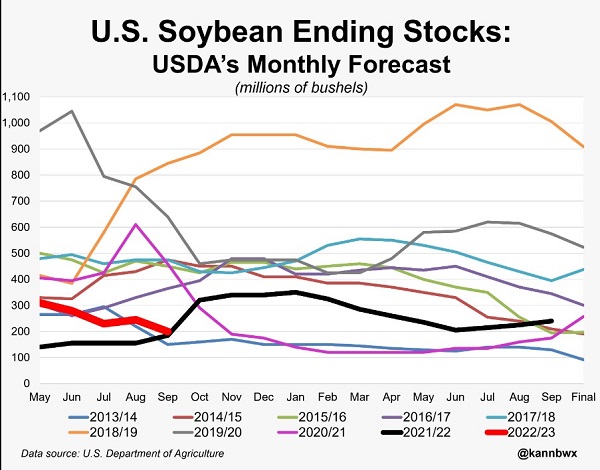

The largest surprise on Monday’s USDA crop production numbers was the drop of soybean yield to 50.5 bushels/acre and taking 600,000 acres off the total harvested acres. Those adjustments lowered expected production in the next marketing year to 4.378 billion bushels, down 152 million bushels for the August estimates, and 57 million bushels below last September’s report. Even with the USDA making demand adjustments of 93 million bushels to that side of the balance sheet, projected carryout for the 2022-23 marketing year is forecasted at 200 million bushels, an extremely tight number. The stocks-to-use ratio, which is a measure of available supply was dropped to a 9-year low of 4.5%. This the equivalent of 16 days of available soybean supplies. Regardless, the soybean market is extremely tight, and price may need to lift in order to ration the U.S. projected stockpile.

Like what you’re reading?

Sign up for our free daily TFM Market Updates and stay in the know!

CORN HIGHLIGHTS: Corn futures edged lower following a reversal in soybean prices, closing 3-1/4 lower in September at 7.09. December also gave up 3-1/4 to end the session at 6.92-3/4. A lack of new bullish news and a likely increase in farmer selling kept prices in check today. There was no technical damage to charts today, however, stochastic indicators are in the over-bought territory, suggesting technical selling could develop soon.

Heightened concern supplies will be limited for the northern hemisphere and will underpin prices for now. Yet, new bullish news could be lacking. The key may lie in money flow and whether funds will hold strong net long positions, or if the end is near for the rally as an increase of farmer selling is likely to occur, which could ignite a long liquidation. The mentality that world supplies, as well as U.S., remain precariously low should underpin prices. If the old saying, “small crops get smaller” has merit, then 172.4 bpa isn’t small enough. Projected soybeans carry out for 2022/2023 crop is 200 mb, a very small figure. The idea of declining corn yield in future USDA reports, coupled with tight soybeans supplies, could lead to a fight for acres after harvest. With December 2023 trading at 6.33 and 2022 December near 6.93 implies there is plenty of room for the December 2023 contract to work higher. Ukraine is said to be discounting it’s corn at a rate that makes it very attractive to end users.

SOYBEAN HIGHLIGHTS: Soybean futures closed lower today after yesterday’s massive gains following the WASDE report. Today, a higher dollar, major pressure on equity markets following bearish CPI data, and lower crude put pressure on soybeans. Sep soybeans lost 15-1/2 cents to end the session at 15.34-3/4, and Nov lost 8-1/2 cents to 14.78-3/4.

This morning, the labor department released the CPI data, which was greater than expected at 8.3%, and now it seems more likely that the Federal Reserve will increase rates again by 75 points. This information, along with a higher dollar and lower crude oil, sent the stock market spiraling downward and put pressure on most commodities. All things considered from these bearish outside influences, soybeans stayed relatively strong with minimal losses. Yesterday, the USDA shocked the market with a reduction in yields of 1.4 bpa to 50.5 bpa and reducing ending stocks by 45 mb to just 200 mb, the lowest in 7 years. Global soy stocks also fell by 2.4 mmt to 98.9 mmt. Despite the rains that fell in August, it clearly was not enough to keep the bean crop in good shape and many farmers are reporting serious variability in their fields. South America is estimated to have a record crop, but any issue with weather that may impact yields would leave a large upside potential for soy prices. Export business should remain solid with Chinese soybeans on the Dalian exchange at the equivalent of $20.74 per bushel, a strong incentive to import from the US. With such tight supplies in soybeans, producers should look to re-own cash sales off the combine as any additional cut to global production could send prices significantly higher. Nov beans closed at the top of their Bollinger Band and have broken out of their trading range higher, with a gap to fill higher on the chart at 15.57.

WHEAT HIGHLIGHTS: Wheat futures made small increases in price, but were well off of daily highs. Bullish underlying fundamentals are providing support, but are facing resistance from inflation and a surging US dollar. Dec Chi gained 1-3/4 cents, closing at 8.60-1/2 and Mar up 3-1/2 at 8.76-3/4. Dec KC gained 6-3/4 cents, closing at 9.33-3/4 and Mar up 6-1/4 at 9.34.

CPI data showing inflation for August at 8.3% acted as an anchor today. The US Dollar Index also once again nearing the 110.00 level is providing a bearish headwind. The stock market is also sharply lower with the DOW down about 1,300 points at the time of writing. Despite all of these influences, wheat managed to squeeze out a positive close. This could be due to the generally bullish underlying fundamentals and the fact that Putting is expected to close the Ukraine export corridor. There is also talk that India is banning wheat and flour exports (despite the USDA still showing them exporting wheat on yesterday’s report). India also announced they are going to ban future rice exports. Here in the US, dryness in the southern Plains adds a bullish tone, but those areas could see some showers next week. In other news, the USDA said US spring wheat is 85% harvested (vs 89% average) and 10% of winter wheat is planted (vs 7% average). As a final point of note, possible railway strikes here in the United States have the potential to disrupt supply chains and the economy.

CATTLE HIGHLIGHTS: Difficult day in cattle markets as long liquidation pressured the market, triggered by a “risk off” trade across the markets in general, with additional selling pressure fueled by weaker morning retail values. Oct cattle dropped .950 to 144.800 and Dec cattle lost .900 to 150.450. October feeders dropped triple digits again, losing 2.600 to 180.525.

The technical breakdown started on Monday with limited gains and selling pressure in the feeder market after the USDA report, but a higher-than-expected inflation total for August released today triggered strong selling across multiple markets. The higher inflation print tightens the consumer dollar, triggered a price surge in the U.S. Dollar Index, which triggered profit taking in multiple markets. The weak overall market tone and concerns regarding the consumer spending may keep pressure on the cattle market in the near-term. Cash trade was still undeveloped on Tuesday, but early bids were trending $140-141, steady with last week. With the overall market weakness, cash trade will likely hold off until the end of the week. Expectations are for cash prices to be steady to higher this week and packers are still looking for higher quality grades of beef. This is reflected in the retail prices. Retail values were lower on Tuesday. At midday, choice carcasses dropped 2.07 to 256.87 and select was 0.85 lower to 234.91. The load count was light at 113 midday loads. The feeder market broke apart technically as prices are challenging key support levels below the market. The potential strong grain market tone and the overall market weakness drove feeder prices lower. The Feeder Cash Index slipped .85 to 180.06. Sept feeders were trading at a small discount to the index and may keep Sept tied to the index value expiration is around the corner. The technical selling could continue given the overall marketplace weakness, so trade in the outside market may weigh above the impact of fundamentals.

LEAN HOG HIGHLIGHTS: Lean hog futures saw strong buying on short covering, as prices are trying to breakout to the topside off a near-term low. Oct hogs gained 3.875to 95.750 and Dec hogs added 85.700

Front end hogs turned higher on Friday last week with a positive hook reversal and found some money flow to push prices sharply higher on Tuesday. October hogs clears multiple moving average and closed at its highest price since mid-August. The hog market still needs to find some stability in the cash market before that turn higher can truly occur, but the strong price action on Tuesday will likely lead to additional buying on the market open on Wednesday. The cash trade is still trending lower, but midday direct cash trade was not reported today due to confidentiality but the 5-day rolling average was lower to 93.30. The Lean Hog Cash Index continued to slide, reflecting the recent cash weakness, losing 1.28 to 98.29.. Oct futures are still trading at a 2.54 discount to the index and the gap has closed quickly in recent sessions. In direct cash trade, October is at a premium, and the weak cash tone is still a concern to the market but could possibly be starting to turn. Retail values were the bright spot but were softer at midday, slipping .94 to 104.77. Today’s midday load count was moderate at 199 loads. The USDA will release updated export sales numbers for the first time in a month on Thursday, and that could help direct the market into the end of the week. The estimated hog slaughter for today was 476,000 head, down 7,000 from last week, but 5,000 lower than last year. The front-end supplies have stayed heavy, which has made it difficult for the cash market to find footing. The hog market looks to have made the turn higher starting last week, and the strong price action today helped build that potential low is in place. Hog supplies will be looking to tighten, but concerns regarding food inflation and consumer demand may be a limiting factor.

DAIRY HIGHLIGHTS: Spot cheese closed above $2.00/lb for the first time since July 20 today with a 6.1250 cent jump, while spot whey managed to gain 4 cents for a solid Class III spot trade. Class III futures, however, gave back early gains to close red, but the October contract held above the $21.51 mark. Class IV futures held gains into the close, helped by a substantial 7.00 cent jump in spot butter to another all-time high at $3.14/lb. Like Class III futures, the grain and energy markets came under selling pressure as the day progressed, thanks to traders’ growing fears on the equity sell-off, inflation, and rallying dollar.

Total Farm Marketing and TFM refer to Stewart-Peterson Group Inc., Stewart-Peterson Inc., and SP Risk Services LLC. Stewart-Peterson Group Inc. is registered with the Commodity Futures Trading Commission (CFTC) as an introducing broker and is a member of the National Futures Association. Stewart-Peterson Inc. is a publishing company. SP Risk Services LLC is an insurance agency. A customer may have relationships with all three companies. TFM Market Updates is a service of Stewart-Peterson Inc. Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition.