MARKET SUMMARY 09-26-2022

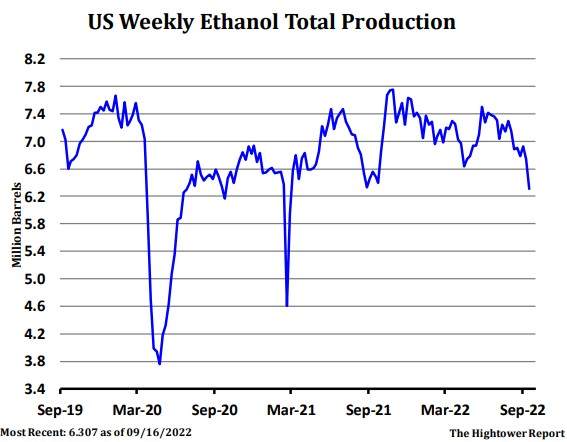

With demand as a concern in the corn market, last week’s ethanol grind was disappointing. With nearly 30% of U.S. corn production going into the production of ethanol, the consumption of corn bushels for the ethanol grind is an important piece to corn prices. Last week, total ethanol production dropped to 901,000 barrels per day, down 6.4% from last week and 2.7% from last year. This was the lowest production week going back to May. Ethanol producers used 90.56 million bushels of corn, well below the pace needed to reach the projected USDA target for the marketing year. The low grind may be due to poor margins, lack of demand, and the tightness of old crop supplies as end users are waiting for freshly harvested grain. The USDA has made adjustments lower on ethanol demand, and if the pace stays soft, they will have room to lower those targets even more.

Like what you’re reading?

Sign up for our free daily TFM Market Updates and stay in the know!

CORN HIGHLIGHTS: Corn futures struggled again today and ended toward the low of the trading range with Dec dropping 10-1/2 cents to 6.66-1/4, its lowest close since September 2. It also closed at channel support and at the 100-day moving average. Sharp gains again in the U.S. dollar and weakness in competing grains and energies weighed on futures. Export inspections, while good at 18.1 mb, were below the average trade estimate. Expectations for a big week of harvest may have also weighed on futures as did more economic concerns, especially in Europe.

In June, when equities sold off, it appeared the entire commodity complex sold off with it. In part, this may have been funds exiting commodities as they potentially were over-weighted to commodities in their portfolios. One must wonder if this is not happening again. Commodities, especially row crops, are at a high price historically and perhaps for good reason; supplies remain tight. Yet, if demand is hand to mouth and commodities (all else being equal) are more costly to importing countries on a practically daily basis, then we are not surprised futures are on the defensive. The dollar has gained over 6% since September 13. The Federal Reserve raised interest rates 0-3/4 point last week but analysts argue it is not enough. Inflation continues to remain strong. Early harvest results are mixed with some better and some worse than expected. As the week wears on, there will be more information from farmers the market can grab on to. For now, we will argue it is about as expected. A good crop, but not a great crop. Quarterly Grain Stocks are due for release on Friday.

SOYBEAN HIGHLIGHTS: Soybean futures closed lower today as the US Dollar Index continues to rise, and concerns of slow economic growth weigh on nearly all commodities, as well as the equity markets. Nov soybeans lost 14-1/2 cents to end the session at 14.11-1/4, and Jan lost 15-1/2 to 14.16-1/4.

The soy complex experienced losses today along with nearly every other commodity as the US dollar continues higher following the Federal Reserve’s rate hikes, and traders grapple with the possibility of slow economic growth. Crude oil prices have reached the lowest levels since January which should provide some optimism regarding inflation, but the war in Ukraine has caused tight energy supplies, and Europe may have insufficient supplies given a cold winter. This potential winter shortage may cause heating oil prices to spike come wintertime, which would create more demand for bean oil to extend the diesel supplies. Despite the recent sell-off caused by macro-economic outside influences, long-term demand for soy products is bullish, and current domestic demand is strong as well. According to today’s USDA report, the value of soybean crush products is 5.54 above the cost of soybeans in Illinois and 4.99 above in Iowa, large margins that will keep processors interested in buying beans even if non-commercials are selling out of fear. Also, from the USDA this morning were soybeans inspected for export last week of 9.5 mb, a small amount after Argentinian beans were dumped on the market. Friday’s CFTC data showed non-commercials as sellers of 7,436 contracts, reducing their net long position to 104,691 contracts. Despite the recent decline in prices, soybeans are still in their sideways trend, but did close below the 50-day moving average today.

WHEAT HIGHLIGHTS: Wheat futures closed sharply lower. A lack of new bullish news, compounded by new highs in the U.S. dollar caused markets to fade. Dec Chi lost 22-1/2 cents, closing at 8.58 and Mar down 22-1/2 at 8.71-1/4. Dec KC lost 21 cents, closing at 9.29-1/2 and Mar down 21-1/4 at 9.26.

It was a sour day but not just for wheat – corn, soybeans, livestock, crude oil, and stocks were all down today. This comes in the face of a two-sided trade wherein wheat traded positive earlier in the day. At the time of writing, the U.S. Dollar Index is above the 114 level and at a high not seen in 20 years. From a global perspective, the Russian shelling in Ukraine continued over the weekend in some of the areas where the referendums are being held. Currently, Russia’s wheat is the world’s cheapest but there is question as to just how much they will be able to export. The fact that they are calling up 300,000 reserve troops may signify that the war is not going in their favor (or at least maybe not to the degree anticipated). Here in the U.S., the southern plains continue to be warm and dry which should offer support to the market. In other news, there were unconfirmed rumors over the weekend of a military coup against Chinese President Xi Jinping. Again, this is unconfirmed, but it does look like the communist party will re-elect him. Today the market also received export inspections data. Wheat inspections were pegged at 19.1 mb with total 22/23 inspections now at 286 mb. As a reminder, Friday will feature both the Grain Stocks and Small Grains Summary reports.

CATTLE HIGHLIGHTS: The cattle market stayed under pressure from broad market selling, as the risk of a recession continues to move the money to the sideline as traders are exiting long positions. Oct cattle lost 0.775 to 143.475 and Dec cattle were 1.200 lower to 147.350. Selling pressured feeders as well with Oct losing 1.275 to 177.075.

Friday’s Cattle on Feed report was neutral to negative as the placement numbers were slightly above market expectations. Cattle on feed totaled 11.3 million head, just slightly above last year’s levels and the second largest September total on record going back to 1996. Placements were above expectations at 100% of last year. The analysts were looking toward placements of 98%, but the released numbers were within the expected range. Still, the final numbers were slightly heavy. The recent selling pressure seemed to price in those report numbers as prices were firm to start the session. As the overall markets saw selling pressure, led by weakness in crude and equity markets, the cattle markets reversed direction to the downside. Weekly charts turned extremely negative last week on the close, and the market saw follow-through selling into the end of the session to start the week. Cash cattle trade was quiet, typical on Monday as bids and offers were undefined. The market is hoping for a firmer cash tone as supplies are looking to tighten, but the declining market and softening retail market don’t support prices. Retail trade saw beef carcasses trading mixed at midday. Choice carcasses were slightly lower, losing 0.07 to 248.56 but select carcasses gained 3.09 to 223.21. The load count was light at 66 loads at midday. The softening retail trend is a concern and could keep a limit on cash prices. Feeder cattle were weak again reflecting the tone in the entire livestock sector overall, despite a weak price action in grain markets. The Feeder Cash Index traded 0.40 higher to 180.15 and is running at a strong premium to the futures market with Sep expiration on Thursday. This could limit downside pressure here, but money flow seems to be in charge. The livestock markets are looking past the fundamental supply picture as money continues to flow out of the cattle markets. This could provide a buying opportunity, but in the short term, the path of least resistance looks to be lower.

LEAN HOG HIGHLIGHTS: Lean hog futures saw strong selling pressure as longs keep being liquidated, driving prices to their lowest point since the start of the year. Oct hogs dropped 2.250 to 90.375 and Dec hogs led the market lower losing 3.400 to 79.400, breaking the $80.00 barrier.

The move in the hog market is more tied to money flow and technical selling versus the fundamentals. The market is experiencing long liquidation as money is moving to the sideline and price break key support levels. Oct hogs are testing the September lows, before finding some support. The USDA will release the Quarterly Hogs and Pigs report on Thursday the 29th, and negative news is more than priced in at this point. Overall, it is about outside markets being under selling pressure from global economic concerns, the concern for consumer demand is very real in the livestock markets going forward. Demand concerns and technical selling have outweighed the improving fundamental number recently. The cash hog market is trying to find some footing. The Lean Hog Index has leveled out recently but traded 0.50 lower on Monday to 97.59 on the day. Oct futures are trading at a 7.215 discount to the index, which should help support prices. Midday direct cash hog trade was higher, losing 4.24 to 90.45. The 5-day average of 93.03. Retail values were firmer at midday as pork carcasses traded were 0.60 higher to 101.57. Today’s midday load count was moderate at 198 loads. A technical washout seems to be happening in the hog market and the negative outside market influence only adds to the market’s concerns. The hog market is oversold and looks to be a value, especially if the Quarterly Hogs and Pigs report on Thursday confirms a potentially tighter supply.

DAIRY HIGHLIGHTS: The US dollar surged another 100 points higher on Monday to close up over 114.00, which is the first time its been able to do that since 2002. Commodities are starting to feel the pressure from the higher dollar as grains, fuel, cattle, and dairy futures were all lower to start the week. Heating oil futures dropped 12c, corn fell 11c, and soybean meal lost over $7 for the day. Most Class III and IV milk futures finished the session double digits lower despite a steady to higher dairy spot trade. In the spot trade, cheese blocks were bid 5c higher to $2.01/lb on 1 load traded. Barrels fell a penny to $2.1750/lb on no loads traded. This brings the block/barrel average back up to $2.0925/lb. US whey was bid 0.25c higher to $0.4525/lb, while both butter and powder held steady. Second month Class III fell 8c to $20.82, while the third month November contract lost 40c to $20.30.

Total Farm Marketing and TFM refer to Stewart-Peterson Group Inc., Stewart-Peterson Inc., and SP Risk Services LLC. Stewart-Peterson Group Inc. is registered with the Commodity Futures Trading Commission (CFTC) as an introducing broker and is a member of the National Futures Association. Stewart-Peterson Inc. is a publishing company. SP Risk Services LLC is an insurance agency. A customer may have relationships with all three companies. TFM Market Updates is a service of Stewart-Peterson Inc. Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition.