MARKET SUMMARY 9-27-2021

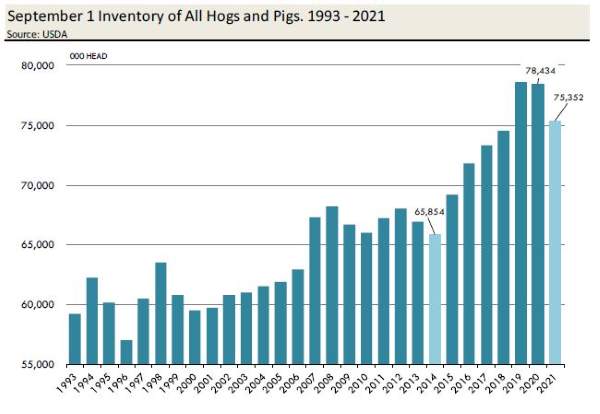

Friday’s USDA Quarterly Hogs and Pigs report brought a few surprises. The USDA reported that hog inventory was projected at 75.352 million head, down 3.082 million head or 3.9% lower than last year. This was well below expectations of 1.7%, and the new numbers sent the market off to the upside, trading limit higher on the Dec futures, and strong gains throughout the complex. This miss suggests a 1.75 million head difference with analyst expectations, which implies a significant tightness of hog availability during the fall and winter months. Following suit was market hog inventory, down 2.9 million head from last year, with the majority of that reduction occurring in the 120 pounds and under class. This suggests that weekly hog slaughter could be down as much as 6% during that time frame. The report also brought significant revision to previous inventory estimates, in all painting a very bullish look in the near-term hog market.

Like what you’re reading?

Sign up for daily TFM Market Updates and stay in the know:

https://info.totalfarmmarketing.com/market-updates

CORN HIGHLIGHTS: Corn futures saw good buying strength as prices were 11-13 cents higher across the board. For Monday, Dec corn finished 12-3/4 cents higher to close at 5.39-1/2 and Mar futures gained 12-1/2 to 5.47. This was the highest close on Dec corn since September 1st, and prices rallied to the top of the trading range. With the close today, Dec corn challenged the 40-day moving average, with the 50-day moving average just above. This may be difficult to push through. In addition, prices are at the top of the range built here in the near term. Short covering and some technical buying helped push the market higher, even against likely hedge pressure as harvest ramps up. Talk of the Chinese looking for bids for U.S. corn may have supported the market, and the market will need to see some results. In addition, the crude oil market worked higher as analysts have raised price targets higher given the strength in the energy market. This had an indirect impact on the corn market, and overall commodity strength. Weekly crop progress put harvest pace at 18% complete, up 8% on the week. Warm and dry weather pushed maturity, moving to 74% mature, up from 57% a week ago. The forecast looks friendly for a strong harvest pace, as the majority of the Corn Belt will see above-average temperatures and below-average precipitation. The cash market is attempting to pull corn in off the field, as end users are looking for freshly harvest bushels. When the pipeline becomes full, a quick harvest could limit price gains.

SOYBEAN HIGHLIGHTS: Nov futures gained 2-1/2 cents today, closing at 12.87-1/2 and Jan gained 2-3/4 cents, closing at 12.97-1/2. While there are rains expected in the southern Plains, the forecast for the Midwest is mostly dry, which should allow harvest to progress quickly. Early anecdotal harvest reports are that yield numbers are lower than expected, but this should be taken with a grain of salt. There is still concern surrounding the closure of Chinese soybean crushing plants – at this time it is unknown how long they will be closed. It does appear that China needs soybeans – today private exporters reported to the U.S. Department of Agriculture export sales of 334,000 metric tons (13 mb) of soybeans for delivery to China during the 21/22 marketing year. China is also experiencing rolling electricity blackouts due to a shortage of coal and natural gas, which could slow their economy. This has crude prices up today, which in turn are added support to the grain markets. Domestically, all eyes will be on Washington DC this week, as the federal government will vote on Thursday whether or not to increase the debt ceiling. If this increase is not passed, the government will shut down, and many of the USDA reports we rely upon for price direction will be delayed until after they reopen. The USDA is estimating 21/22 exports at 2.090 bb – soybean inspections totaled 16.2 mb and the YTD total is at 34.6 mb (though early in the season, this is below the average needed to meet the USDA’s goal). Concerns around export capabilities at the Gulf still remain a challenge, but once things are up and running again, we could see better export numbers.

WHEAT HIGHLIGHTS: Dec Chicago wheat lost 1-1/2 cents today, closing at 7.22-1/4 and Mar lost 1 cent, closing at 7.33-3/4. December KC wheat gained 1 cent, closing at 7.20-3/4 and March gained 3/4 cent, closing at 7.28-1/2. With another mixed close in wheat, it seems the market is looking for direction. This may come in the form of Thursday’s Small Grains Summary report which will contain updated wheat production numbers. On Thursday, we also get the Quarterly Grain Stocks report. In terms of weather, the southwest Plains have rains forecasted for this week which should help early winter wheat conditions. Looking to the eastern part of the Midwest, there is good soil moisture, but this week’s drier forecast should aid in SRW wheat planting progress. Total YTD wheat inspections are at 294 mb with inspections totaling 10.5 mb on today’s report. The USDA is estimating wheat exports at 875 mb in 21/22. There are rumors that China bought Australian and French wheat within the past week. News that there could be a U.S. government shutdown this week, as well as congress trying to pass a $3.5 trillion spending bill, are items to keep an eye on, as they could add volatility to the trade. Additionally, a government shutdown could delay key USDA reports that help give the market price direction.

Total Farm Marketing and TFM refer to Stewart-Peterson Group Inc., Stewart-Peterson Inc., and SP Risk Services LLC. Stewart-Peterson Group Inc. is registered with the Commodity Futures Trading Commission (CFTC) as an introducing broker and is a member of National Futures Association. Stewart-Peterson Inc. is a publishing company. SP Risk Services LLC is an insurance agency. A customer may have relationships with all three companies. TFM Market Updates is a service of Stewart-Peterson Inc. Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition.