MARKET SUMMARY 1-20-2023

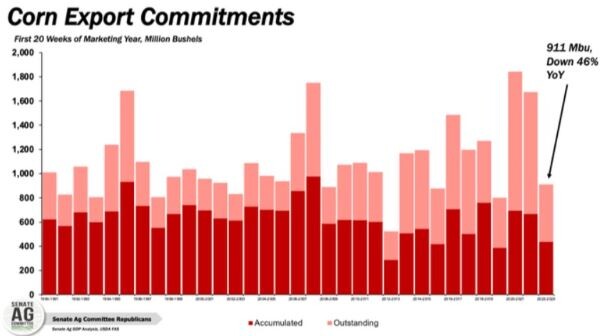

The U.S. corn export program is starting to gain some momentum as weekly export sales were at a 6-week high. Last week, U.S. exporters posted new sales of 1.132 MMT of corn for export. Unfortunately, the U.S. program still has a lot of work to do to reach the current USDA export targets. By comparison, current sales pace is running 46% behind last year at a total of 911 million bushels of sales on the books. The U.S. corn export program has been limited due to the higher price of U.S. corn versus the global marketplace and overall tight supplies of corn available after last year’s limit harvest due to weather. The corn export program should still be active in the weeks ahead as the U.S. has the majority of corn available on the world market for the next couple of months.

Like what you’re reading?

Sign up for our free daily TFM Market Updates and stay in the know!

CORN HIGHLIGHTS: Corn futures traded quietly but ultimately closed slightly lower on the day. This was the third consecutive day of losses in the corn market, which began when Argentina’s weather forecast was updated to show better rain chances. Last week’s exports were decent while shipments were behind. March lost 1 cent to end the session at 6.76-1/4, while December gave up 1/2 to close at 5.95-3/4. For the week, Mar gained 1-1/4 cents while Dec lost 2-3/4 cents.

Argentina’s drought had a bullish grip on the corn and soybean markets, but forecasts have changed and now show much needed moisture, but it is likely not enough to save the crop. Over the next two weeks, 2 to 4 inches is forecast to cover between 70% to 75% of the corn acres. 53% of the crop is tasseling already, so the benefits from this late rain may not be enough. The Buenos Aires Grain Exchange has reported that only 5% of the crop is rated good to excellent while 47 is rated poor to very poor. Last week, the exchange dropped their corn production estimate to 44.5 mmt, and the WASDE has not been updated to reflect that 7.5 mmt drop as their estimates remain at 52 mmt. It is possible that the damage in Argentina has already been priced into the market. Export sales have been lacking but are poised to pick up in the next few months as Brazil runs low on supplies. Last week’s export sales were good at 44.6 mb, but shipments were behind again. A significant increase in coming exports could be a bullish sign for corn prices, especially combined with low production in Argentina. March corn closed below the 200-day moving average and the stochastics show the beginning of a sell cross over.

SOYBEAN HIGHLIGHTS: Soybean futures closed lower for the third consecutive day along with corn, as Argentinian rain forecasts remain a bearish force. Both bean oil and meal closed down hard as well with meal threatened by Argentina’s exports and oil down despite another jump in crude oil today. Mar soybeans lost 8-1/4 cents to end the session at 15.06-1/2, and May lost 9-3/4 cents at 15.01-3/4. For the week, March soybeans lost 21-1/4 cents and May fell 25-1/2 cents.

The soy complex closed lower again with the deferred months posting the bigger losses. November beans lost over 12 cents, while March only lost 8 showing that the domestic crush demand is still somewhat supporting nearby prices. The bigger story has been Argentina’s weather and the slowing of demand in the face of Brazil’s harvest. The trend in both soybeans and corn reversed as soon as Argentina’s forecasts began showing between 2 to 4 inches of rain over the next two weeks, but it may not be enough to help the crop as much as is needed. Only 3% of Argentina’s crop is rated good-to-excellent and 60% was rated poor. 4% of the crop is setting pods, and this is the portion of the crop that could fare much better thanks to the incoming rain. Export sales were okay, but slipping, at 36.2 mb last week, and shipments were good at 75.9 mb, above the necessary average to meet USDA estimates. This morning a flash sale was reported of 220,000 mt of beans for delivery to unknown destinations for the 22/23 marketing year, but it is anticipated that exports will continue to decline. March beans remain in their upward trend but have lost 40 cents in the last 3 days. Stochastics showed a sell crossover and support is hovering around the 14.80 region.

WHEAT HIGHLIGHTS: Wheat futures posted decent gains in today’s session, which made the weekly closes look a lot better. Wheat is again oversold and may be showing signs of a correction. Mar Chi gained 7 cents, closing at 7.41-1/2 and Jul up 6 at 7.51-1/2. Mar KC gained 16 cents, closing at 8.48 and Jul up 12-1/2 at 8.35-1/2. For the week, Mar Chi lost only 2-1/4 and Mar KC was up 4-1/4.

US wheat stopped the bleeding today, though the same cannot be said for Paris milling futures, which had a neutral to lower close at the lowest levels since March 2022. It is actually somewhat of a surprise that US wheat fared as well as it did. Overall, corn and soybeans did not provide any support, and the southern Plains are finally getting some much needed moisture. Unfortunately, the southwest areas remain mostly dry with most of the precipitation in northern and eastern areas. But decent export sales may have helped wheat to rally today. The USDA reported an increase of 17.4 mb of wheat export sales for 22/23 and an increase of 1.3 mb for 23/24. There was not much other fresh news pertaining to the wheat market today, but Russia’s ag minister said they will not cut export quotas; Putin was talking about potentially reducing exports to keep more for domestic usage. As an aside, Asian feed buyers may be switching from corn to feed wheat due to price. With the US Dollar trending lower, and 15-year low supply levels, wheat might still have some life left in it, but the next couple weeks will be key. The economic and recession concerns have taken a toll on the grain markets already, but if the country (and world) is headed that way, prices may trend lower in the long run.

CATTLE HIGHLIGHTS: Live cattle and feeder futures finished mostly higher on position squaring and profit taking before Friday’s Cattle on Feed Report. Feb cattle were 0.675 higher to 156.625, and Apr cattle added 0.800 to 159.925. March feeders were 0.875 high to 180.975. For the week, Feb live cattle lost 1.100 and April was 0.975 lower. March feeders were 1.900 lower on the week.

Relatively quiet but firmer trade was noted on the day as the market was anticipating Friday’s USDA Cattle on Feed Report. With the selling pressure this week and possible tighter cattle supplies, money moved to square market positions. The January Cattle on Feed report reflected expectations and the prospects of tighter cattle supplies. As of Jan 1, total cattle on feed in feedlots was 11.68 million head, or 97% of last year, in line with expectations. Cattle placements were at 92% of last year or at 1.804 million head, and lastly, marketings were 94% of last year. All three numbers were close to expectations. The market may find some additional support next week off this report, given the weakness this week, but the report brought no major surprises. The low placement number continues the trend seen over the past few months as feeder cattle supplies are tight. In other factors, weekly export sales were supportive with new sales on 17,300 MT with China, South Korea, and Japan the top buyers of U.S. beef last week. total exports last week were 15,700MT. Beef retail values were firmer, gaining 19 on Choice to 271.70 and adding 1.47 on Select to 257.16 at midday. The load count was 77 midday loads. Cash trade saw more completion on Friday. Cash deals were completed at $155-157, steady to $1 lower that last week. Northern dress trade was still developing with bids at $248, still softer than last week’s averages. The softer cash tone was one of the larger selling pressures during the week. Feeder cattle saw gains off the live cattle strength and a overall softer tone in the grain markets. A weakening cash index pressures the Jan feeders with expiration on 1/26. The feeder index dropped 0.84 to 177.03 and is trading at a discount to the board. On the week, the Feeder index was 5.00 lower. Cattle price may have found support before the report today, but the Cattle on Feed number didn’t provide any surprises. Next week may be interesting for direction, cattle on feed showed tighter supply, but cash trade this week was disappointing. It may still come down to fundamentals to bring price support on this weakness.

LEAN HOG HIGHLIGHTS: Lean hog futures saw some value buying and price recovery to end the week, led by a firmer retail market tone and strong weekly export sales. Feb hogs were 1.175 higher to 77.825, and April added 1.325 to 85.725. For the week, Feb hogs were 0.825 lower, and April lost 1.550.

The buyers returned to the hog market as some short covering fueled by profit taking lifted the April contract higher. Prices opened above Thursday’s close and pushed back through the $86.00 level before softening into the close. The retail market helped triggered the short covering after a firm close for carcass values on Thursday. Friday saw additional retail strength, gaining 3.30 at midday to 82.87. The load count was good at 192 loads. Weekly export sales were strong again this week as pork values have softened. USDA report new sales of 34,100 MT last week as Mexico, Japan and China were the top buyers of U.S. pork. Exports were supportive at 31,100 MT last week as well. In the cash market, the lean hog index slipped 0.57 to 73.85 and was down 2.21 on the week. The index is still trading at a discount to the futures. Direct cash was improved, gaining 0.34 to 70.40 and a 5-day average of 70.61, also holding a large discount to the Feb and April contracts. The hog market is an oversold market, the fundamental picture is still concerning as the cash market has just not found support at this point. the retail market did find a bid on Thursday afternoon and midday today, which is an encouraging sign. Prices were higher to end the week, but until the market can find some fundamental support in terms of stronger pork values or improvement in cash prices on a consistent basis, the hog market may still be searching for its low. The price action on Monday may be key for direction next week.

DAIRY HIGHLIGHTS: Second month Class III and IV futures both closed lower on the week, losing 34 and 38 cents, respectively. Last week these contracts managed to move higher despite a struggle in the spot markets but this week’s selling pressure was too much to overcome. Quarterly milk prices for both Class III and Class IV were mostly lower for 2023, except for Class III Q4 contracts which were up nearly a dime per CWT from last week. Most other quarters were down over 20 cents on the week with Class IV Q3 leading the charge lower with a weekly loss of nearly 55 cents. The GDT event from the beginning of the trade week was down just a point from the previous event on 1/3. Prices from this last event were roughly $2.01/lb on butter and $2.20/lb on cheddar.

Total Farm Marketing and TFM refer to Stewart-Peterson Group Inc., Stewart-Peterson Inc., and SP Risk Services LLC. Stewart-Peterson Group Inc. is registered with the Commodity Futures Trading Commission (CFTC) as an introducing broker and is a member of the National Futures Association. Stewart-Peterson Inc. is a publishing company. SP Risk Services LLC is an insurance agency. A customer may have relationships with all three companies. TFM Market Updates is a service of Stewart-Peterson Inc. Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition.