MARKET SUMMARY 1-5-2022

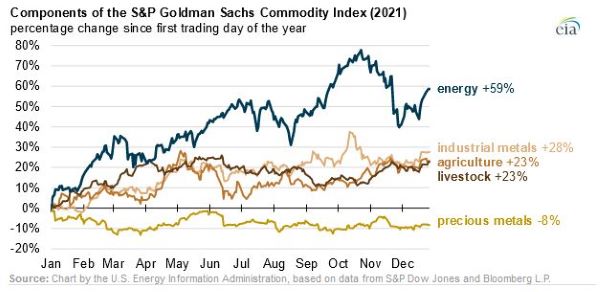

Commodity markets had a banner year in 2021. Multiple sectors posted strong gains as buyers stepped into the commodity markets. The components that make up the Goldman Sacs commodity index reflected those gains, with only the precious metals sector pulling a lower trade during the year. The index is heavily weighted on energy markets, and the energy markets tallied a 59% gain over the year as strong demand returned into those markets. Agricultural markets (grains/cotton) posted a 23% gain, supported by strong demand and weather concerns. Livestock markets added 23% as well, reflecting good product demand and overall product supplies. In addition to individual stories, commodity markets were the backside of the inflation play, reflecting the inflation growth in the U.S. and globally. A lot of the same components are still in place for commodity markets going into 2022, so the potential for additional gains is a possibility.

Like what you’re reading?

Sign up for our free daily TFM Market Updates and stay in the know!

CORN HIGHLIGHTS: Corn futures gave back some of yesterday’s gains closing 7-1/4 cents weaker in March at 6.01-1/4 and 1 cent lower in December at 5.54-3/4. Lackluster trade was noted in corn and wheat, while beans finished with modest gains. Managed money has recently added to long positions on heightened weather concerns in Brazil and Argentina. Somewhat negative to price was a weaker ethanol grind at 106.392 mb, solid but below last week by about 1 mb. Stocks rose by near 1 million barrels, concerning some that demand may have peaked. Crude oil prices are rallying but thoughts driving may be on the decline due to covid is a factor the market is trying to weigh.

Weather is the southern Hemisphere is critical in the weeks ahead. Talk continues to circulate that China may be in the market for as much as 7 mmt (about 280 mb) of corn for the 2021/2022 marketing year, yet not confirmation. Yesterday it was estimated funds were buyers of over 22000 contracts, no small amount. The market is sending mixed signals with a very negative looking reversal last week and strong positive bounce yesterday but lacking follow through buying today. Stay balanced in the next few weeks.

SOYBEAN HIGHLIGHTS: Soybean futures rallied early in the session, running into overhead resistance at today’s high of 13.99. March futures closed at 13.94-3/4, up 5 cents on the day and November added 4-1/2, closing at 13.04, a new high on this rally and its highest close since May. Weather concerns are the primary drivers as southern Brazil and northern Argentina remain mostly dry. An export sale announcement of 132,000 mt to unknown destination was viewed as supportive.

Focus will be on weather with the latest models indicating a high-pressure ridge forming over southern Brazil, which could keep moisture to the north but keep drier conditions in the south as well as northern Argentina. New crop has resistance on charts at 13.13-3/4, the contract high established on June 8, 2022. Firmer energy prices helped soy oil close at its highest level in over 5 weeks. Focus could again turn toward tighter world veg oils. Declining crop ratings in the Brazilian state of Parana where the crop is now rated only 30% good, down from 90% at the end of November indicates the struggles that some of South America is experiencing.

WHEAT HIGHLIGHTS: Wheat futures fell today, as selling pressure over-encumbered the market. Limited bullish factors were not enough to lead to a rally. March Chi lost 9-1/4 cents, closing at 7.60-3/4 and July down 5-1/4 at 7.61. March KC lost 17 cents, closing at 7.87 and July down 14-1/2 at 7.87.

While the significant reduction in winter wheat crop ratings should help support the market, it appears not to have been enough today to push prices higher. Rumors that Iraq may have bought up to 200,000 mt of HRW wheat are also supportive, but again, the market did not seem to care. To be fair, this is only a rumor, with results from the tender expected next week. Also supportive is the forecast for the US southern Plains, which remains dry for at least two weeks. Despite these factors, wheat futures tumbled again today with Minneapolis taking the heaviest losses – March was down 22-1/4 cents to 9.48-1/4. The March MPLS contract also closed below the 100-day moving average for the first time in more than a year. The US Dollar Index is adding to the pressure, remaining above the 96 mark. Poor exports are also likely preventing wheat from rallying further. In regard to exports, Russia has likely shipped less wheat than what the USDA is estimating. Paris milling wheat futures were also lower today, taking out much of yesterday’s gain. From a technical perspective, momentum continues to point toward the downside in both stochastics and the RSI.

Total Farm Marketing and TFM refer to Stewart-Peterson Group Inc., Stewart-Peterson Inc., and SP Risk Services LLC. Stewart-Peterson Group Inc. is registered with the Commodity Futures Trading Commission (CFTC) as an introducing broker and is a member of the National Futures Association. Stewart-Peterson Inc. is a publishing company. SP Risk Services LLC is an insurance agency. A customer may have relationships with all three companies. TFM Market Updates is a service of Stewart-Peterson Inc. Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition.