MARKET SUMMARY 10-04-2021

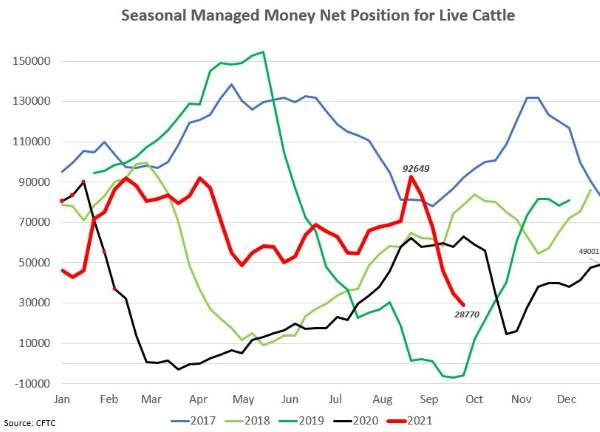

The strong selloff in the cattle market can easily be seen by the money flow as fund-exit long positions. Besides fundamental factors that can move price, the technical indicators and the flow of investor money can be very telling in a market’s direction. Since posting its most recent high, the December cattle futures have lost over 12.00 of value in price. A large portion of this move has been the influence of the money flow in the market. At the contract high, managed funds held a long position of 92,649 net long positions, and as money has moved to the sidelines, the funds have now shed 63,800 net long positions. That total is likely great, as additional selling pressure was evident in the cattle market to end the week. Historically, managed funds don’t move to a short position in live cattle markets. That could bring some optimism that the end of the pressure may be near. Unfortunately, the cattle market is also struggling on the fundamental front, and the market still looks weak overall.

Like what you’re reading?

Sign up for our free daily TFM Market Updates and stay in the know!

CORN HIGHLIGHTS: Corn futures ended the session on a quiet note after December reached a daily high of 5.47-1/2, (plus 6 cents) closing at 5.40-3/4, down 0-3/4. Resistance at this level was in the form of the 100-day moving average and 50% retracement of the August 12 high of 5.94-1/4 and the September 10 low of 4.97. This recent rally of 50 cents likely increased farmer selling as well as speculators taking gains.

Corn export inspections were solid at 31.8 million bushels, but if dividing the total sales year to date by a weekly average, still came in below the 47.5 mb need per week. Some rain delays and farmers concentrating on soybean harvests will keep today’s harvest total expectation on the progress report lower for completed acres. Last week was 18% with expectations at 30% this week. A warm but wet forecast suggests it may be difficult to reach 50% harvested by the end of next week. The key for price direction will be yield results which continue to suggest mixed. Where corn is very good, we’re hearing very positive results. Where corn struggled with weather, we’re hearing mixed results. This week will be key for farmer feedback regarding yields on a wider total Midwestern scale.

SOYBEAN HIGHLIGHTS: Soybean futures continued to lose value on harvest results and a lack of positive news with November closing 10-3/4 cents lower at 12.35-3/4, its lowest close since March 31. Meal prices sank another 2.00 to 3.00 today sinking to their lowest level in a year. Soybean oil was mostly unchanged.

Generally good weather for harvest the next four to six days will keep pressure on prices. After that, the 6-to-10 outlook indicates warmer than usual but also above-normal precipitation for the entire Midwest. Farmers will make a big push to get as many beans harvested in the next several days as they can. Yield results to date suggest that August rains were beneficial. Expectations of yield prior to harvest are on the lower side for many, as yield is better for many. This keeps alive the theory that if the plant can make it to August, it’s a matter of moisture and weather. This year may prove that theory very correct. Export inspections at 31 mb were, like the corn, solid yet below the 40 mb needed on a weekly average. Inspections are also running behind a year ago for this same time, yet it is too early in the marketing year to draw any credible conclusions.

WHEAT HIGHLIGHTS: Wheat futures had a mixed close today, with a lack of fresh news. Dec Chicago gained 1-1/4 cents, closing at 7.56-1/2 and March gained 2-1/4 cents, closing at 7.68-1/4. Dec KC wheat lost 5-1/4 cents, closing at 7.54-1/4 and March lost 4-1/2 cents closing at 7.62.

Wheat was able to hold near recent gains, however, without much fresh news to start the week, the market seemed to run out of steam. Bear spreading was noted in all three wheat contracts, but most apparent in KC. Anecdotal reports are that a lot of farmers are planting wheat, and with current prices it is easy to see why. With expectations for more bullish news on the October 12 WASDE report, traders are likely anticipating higher prices to persist into next year. Today the USDA reported 22.5 mb of wheat inspections – a pace higher than needed to meet their export target. Russian wheat exports are expected to be down 3.5 mmt from last year. Additionally, there are rumors that Russia may implement new wheat export restrictions to offset the rise in food inflation. Here in the U.S., the southern Plains received rains over the weekend with more forecasted this week. It was also noted that wheat stocks as of September 1 in North Dakota, South Dakota, Minnesota, and Montana were at 438.2 mb – the lowest number since 1961.

Total Farm Marketing and TFM refer to Stewart-Peterson Group Inc., Stewart-Peterson Inc., and SP Risk Services LLC. Stewart-Peterson Group Inc. is registered with the Commodity Futures Trading Commission (CFTC) as an introducing broker and is a member of National Futures Association. Stewart-Peterson Inc. is a publishing company. SP Risk Services LLC is an insurance agency. A customer may have relationships with all three companies. TFM Market Updates is a service of Stewart-Peterson Inc. Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition.