MARKET SUMMARY 10-05-2021

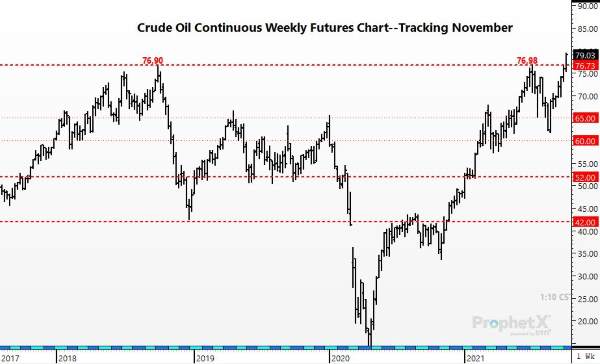

The energy sector stays aggressively bought as crude oil pushes to new 7-year highs. Strong trade has pushed crude oil through the 76.90 levels as the market has reached new multi-year highs, touching the $79.00/barrel price level on Tuesday. Energy demand and supply issues have moved to the forefront of the market with the strength in that sector. Natural gasses have pushed to new contract highs, gasoline and heating oil futures are following suit with strong upside trade. Crude oil saw buying strength as well, and news that OPEC and a Russian-led group of oil producers agreed that collective production will be expanded by 400,000 barrels a day each month. This was an already established level of production and was calculated into the world supply picture. Given the current supply/demand picture and the strength in the energy markets, the question now is, how high can oil prices climb? If prices maintain this week’s move higher, the test of $90.00 levels seems to be on the charts.

Like what you’re reading?

Sign up for our free daily TFM Market Updates and stay in the know!

CORN HIGHLIGHTS: Corn futures finished weaker losing 3-1/4 to 4-1/2 cents on spill-over losses from the wheat pit, harvest pressure, and traders reversing recent spreads of buy corn and sell soybeans.

December corn ended the session at 5.37-1/4 down 3-1/4 cents. December 2022 closed 3 softer at 5.31-1/4. Good weather should allow for farmers to make significant harvest progress over the next several days. Yet, the extended forecast calls for above-normal precipitation for the western two-thirds of the Corn Belt, suggesting a slow down next week. Also, keeping the brakes on some of the corn harvests will be farmers concentrating on soybeans. Yield results continue to be mixed with some farmers telling us they are surprised at how good their crop is and others disappointed. As we have pointed out before, when 15% of the crop is rated poor to very poor it’s hard to expect across the board above average yields from expectations. 29% of the crop was harvested as of Sunday night. 59% of the crop is rated as good to excellent with near 90% considered mature.

SOYBEAN HIGHLIGHTS: Soybean futures closed with double-digit gains, as traders were unraveling short soybean long corn and short soybean long wheat spreads. November futures led today’s gainers closing at 12.50-1/2 up 14-3/4 cents while November of 2022 closed 11-1/4 higher at 12.48.

The November 2022 contract has traded near 12.50 since May. Considering the high price of fertilizer, it might be easy to project an increase in soybean acres. So far new crop prices really haven’t reflected that expectation. Nonetheless, it doesn’t take long for a market to lose value. If behind on cash sales, get current with recommendations. We will make a new recommendation in hedging. As for old crop, we want to add a sale as well. Harvest pressure will likely continue in the week ahead as good weather is on tap for most of the Midwest over the next several sessions. Harvest is 34% complete as of Sunday. Farmers will make big progress this week with an expectation of potentially up to 60% harvested on next Tuesday’s Crop Progress report. Typically, this report is released on a Monday, however, the USDA reports will be delayed one day next week in observance of Columbus Day.

WHEAT HIGHLIGHTS: Wheat futures closed in the red, without positive news to support higher prices today after reaching new contract highs this week. Dec Chicago lost 11-3/4 cents, closing at 7.44-3/4 while Mar lost 11, closing at 7.57-1/4. Dec KC wheat lost 13-1/4, closing at 7.41 and Mar lost 13-1/4, closing at 7.48-3/4.

Winter wheat plantings are reported to be 47% done vs 24% last week and 46% average. Additionally, weekly export inspections were pegged at 22.5 mb, which is above the 14.8 mb needed each week to meet the USDA’s goal. From a global point of view, Matif wheat futures are making new highs, and Russian officials announced yesterday a wheat export quota system designed to combat a sharp rise in flour and bread prices there. The quota system is expected to be set at 31.5 mmt for the whole marketing year and could start mid-February; Russia may try to ship as much wheat as possible beforehand. Informal reports suggest that economics are proving more beneficial for wheat production so this likely means more wheat acres planted this fall in the United States. One analyst suggests that In October the USDA could show record low world exporter stocks to usage ratio, and carryout could be reduced by as much as 8 to 9 mmt from last year.

Total Farm Marketing and TFM refer to Stewart-Peterson Group Inc., Stewart-Peterson Inc., and SP Risk Services LLC. Stewart-Peterson Group Inc. is registered with the Commodity Futures Trading Commission (CFTC) as an introducing broker and is a member of National Futures Association. Stewart-Peterson Inc. is a publishing company. SP Risk Services LLC is an insurance agency. A customer may have relationships with all three companies. TFM Market Updates is a service of Stewart-Peterson Inc. Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition.