MARKET SUMMARY 10-08-2021

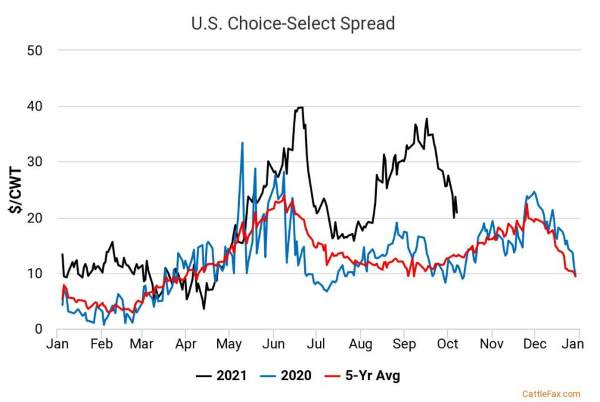

The choice/select retail spread still reflects good demand for high-quality beef. The choice/select spread is a good measure of demand and the condition of the feedlots in the countryside. A wider spread usually indicates a stronger demand tone for the higher quality, choice beef. At the same time, a wider spread can present how current the feedlots are (if choice product is lacking in the marketplace). This fall, the choice/select spread was trading well over the $30 levels between the value of each cut, reflecting good overall demand. The spread has lost approximately $10 of value, trading just over $20 yesterday. The value of the choice carcass has slipped in relation to select carcass values, tightening the spread. Historically, the 5-year average for the spread in this window is $13.00. Cattle prices have taken a tumble off recent highs, but a historically wide choice/select spread, and retail values starting to slow their descent have brought some buying optimism into the cattle market this week, as demand for high-quality beef stays strong overall for export trade and domestic usage.

Like what you’re reading?

Sign up for our free daily TFM Market Updates and stay in the know!

CORN HIGHLIGHTS: Corn futures closed lower losing 2 to 3-1/2 cents lower on a lack of positive news and big supply increases expected for South America. Dec futures lost 3-1/2 cents for the day and 11 cents for the week closing at 5.30-1/2. Harvest pressure is mounting as producers will soon be pushing near 50% complete. This week, we would argue feedback from producers suggests many are experiencing yield better than anticipated from just prior to starting harvest.

Conab, a reporting agency under the Ministry of Agriculture in Brazil, is estimating Brazilian corn production at 116 mmt as compared to the September estimate of 87 mmt. More soybean acres double-cropped to corn is where the big acre push will come from. Yet, much attention will focus on availability of inputs, namely fertilizer and herbicides. Potential support may come from China where recent heavy rainfall totals in northern provinces are delaying the start of harvest as well as increasing quality concerns. Add to that a severe energy crisis which could impact drying the crop in a timely manner. China is expecting a record crop, yet it’s not in the bin yet. Tuesday, the USDA will release the next WASDE report. Export inspections normally released on Monday will be delayed one day due to the government closure for Columbus Day.

SOYBEAN HIGHLIGHTS: Soybean futures firmed throughout the session, yet finished lower with Nov dropping 4-1/4 cents closing at 12.43, well off the daily high of 12.62-1/2. Near the noon hour, it looked like futures just ran out of gas led by weaker soybean oil, wheat, and corn futures. For the week, Nov soybeans lost 3-1/2 cents.

Conab, a reporting agency under the Ministry of Agriculture in Brazil, is estimating the Brazilian soybean crop at 140.75 mt versus the September estimate of 137.33. This would be record-large. This past year’s crop is estimated at 135.9 mmt. Paramount in the weeks and months ahead, is if there is enough fertilizer and other inputs for the Southern Hemisphere to produce much-needed large crops. We are hearing more concerns regarding supply logistics. U.S. prices, while closing on a disappointing note today, managed to hold together well this week, a key window for harvest. Rain delays were noted, and it looks like it will be hit or miss for harvest the next several days due to rain. Nonetheless, a bullish key reversal on charts established Tuesday held, bolstering the bullish argument that a low price may be at hand. We are not quite sold that a low is in, therefore will stay defensive. Strong world vegetable prices were also noted this week and with energy prices firming (crude oil hitting $80 today) the big picture perspective is supportive. Rapeseed and canola prices continue to reach new highs. Lastly, if fertilizer supply is limited, a switch to more bean acres in the U.S. is likely. We’ll keep a stop under Nov 2022 futures as a strategy to move more defensive if the market indicates us to do so.

WHEAT HIGHLIGHTS: Along with corn and soybeans, wheat had a lower close on a lack of volume ahead of next week’s WASDE report. Traders, near the noon hour, seemed to take a defensive posture in all three commodities. The dollar held strong this week holding near its high for the year. Dec Chicago wheat lost 7-1/4 cents, closing at 7.34 and Mar lost 7-1/2 to end the session at 7.47-1/4. Dec KC wheat lost 3-3/4 cents, closing at 7.37-1/2 and Mar down 3-3/4 closing at 7.45-3/4.

Chi and KC wheat futures again could not hold their gains into the end of the trading session. Paris milling wheat futures made new contract highs but also struggled to keep those gains. Despite lower prices to end the week, there has not been much bearish news. MPLS spring wheat, still trying to buy acres, did eke out a positive close in the front-month contracts. Argentina’s wheat crop is reported to be 37% headed but their good to excellent rating dropped to 44% from 51% last week. In Saskatchewan, Canada, wheat yields are estimated at 30 bushels per acre vs 36 on average. Ukraine’s wheat crop is estimated at 32.3 mmt. Russia’s wheat export tax continues to rise and is near $60 per metric ton. Looking at the big picture, and despite a lower close to end the week, the outlook for wheat is still bullish. With a WASDE report released Tuesday, it will be interesting to see if U.S. wheat ending stocks are estimated below 590 mb – if so it would be the lowest in 14 years. From a weather standpoint, rains are expected west of the Mississippi which could interrupt winter wheat seedings, though the moisture is welcomed.

Total Farm Marketing and TFM refer to Stewart-Peterson Group Inc., Stewart-Peterson Inc., and SP Risk Services LLC. Stewart-Peterson Group Inc. is registered with the Commodity Futures Trading Commission (CFTC) as an introducing broker and is a member of National Futures Association. Stewart-Peterson Inc. is a publishing company. SP Risk Services LLC is an insurance agency. A customer may have relationships with all three companies. TFM Market Updates is a service of Stewart-Peterson Inc. Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition.