MARKET SUMMARY 10-10-2022

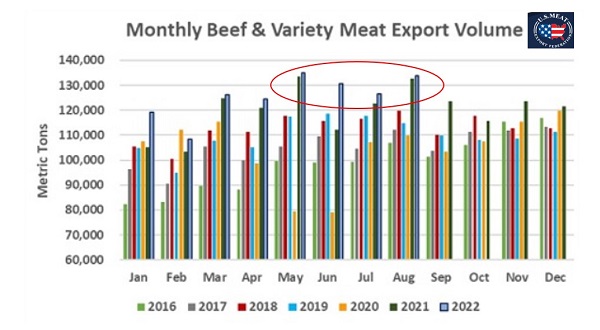

U.S. beef exports for 2022 continue to run at a strong pace as August export data shows. The U.S. exported 323.6 million lbs of beef in August, which was an all-time high, edging above the previous top from August of last year by 1.2 million lbs. This was also the second largest volume of beef products shipped ever, only eclipsed by May 2022. Total export value was just under $1.04 billion of value, making August the fourth consecutive month of pushing the $1.0 billion level. Since the first of the year, total beef exports are running 5% above last year in volume, which 2021 was a record. The impact of the Chinese consumer in the export market has been a big factor for the strength in exports. China has posted record purchases trending nearly 20% over last year’s levels. The total was despite ongoing COIVD restriction in China, which have limited some demand. The outlook into the end of the year stays optimistic as the beef export market is projected to stay supportive.

Like what you’re reading?

Sign up for our free daily TFM Market Updates and stay in the know!

CORN HIGHLIGHTS: Corn futures surged higher breaking the 7.00 mark for the first time since late June reaching a daily high of 7.06-1/2 before ending the session at 6.98-1/4, up 15 cents for the session. This is the highest level for December corn since June 21. December 2023 gained 9 to close at 6.33-1/2. Sharp gains in wheat and technical short covering were features in today’s market. Supporting wheat, and corn prices, is a serious escalation of the Ukraine war. Mostly conducive weather is allowing harvest to run wide open.

Export inspections were not available today due to the Columbus Day observation by the Federal government. Crop Progress and Ratings are also delayed one day. Expectations for Wednesday’s WASDE report suggest a slight reduction in yield, but also in demand. The central Midwest continues to suffer from declining basis levels, not only due to harvest, but also slowed and/or stopped barge traffic on the Mississippi River. The problem is that there is no timetable for this issue. A year ago, the lower Mississippi suffered elevator terminal damage due to a hurricane. There were at least some estimates for how long repairs would take. How do you estimate a return of rain to alleviate dry issues? There are a lot of moving parts for the corn market to digest. In no particular order, tight world inventories, harvest, low water in the Mississippi, a rebound in crude oil prices this past week, and a war in a region where corn is important to the world and talk Europe may have to shop for corn to find it.

SOYBEAN HIGHLIGHTS: Soybean futures closed higher today led by a massive rally in the wheat complex and the end of China’s holiday week, which may have prompted the beginning of their resumed buying. Nov soybeans gained 7 cents to end the session at 13.74, and Jan gained 6-1/2 to 13.85-3/4.

While the majority of today’s gains in the soy complex can be attributed to the hostility between Russia and Ukraine that sent wheat prices soaring, China’s return from their week-long holiday was supportive as well, and may have seen them resume purchases from the US. Today on the Dalian exchange, soybeans closed up 2.6% at the equivalent of $21.21 a bushel, a contract high for the November contract. While China has been purchasing most of their beans from South America, it’s clear that they will need to look to the US for imports as well. Despite waiting on sluggish export business to ramp back up, domestic demand has been supportive of soybean prices as demand for soymeal remains firm due to the high price and small supply of corn. The value of soybean crush is currently 3.12 above the cost of soybeans based off the January futures and remains a good incentive for processors to continue buying cash. The October WASDE report will be released this Wednesday and while trade is expecting a modest increase in ending soybean stocks for 22/23, it could still be at the lowest levels of supply in seven years. Regarding movement of grains, barge traffic on the Mississippi River remains a problem due to low water levels, although two choke points were opened in order to improve traffic. In addition, it was just announced that railway workers have rejected an agreement, which again raises the possibility of a strike with a new deadline possibly set for November 19. Friday’s CFTC data showed non-commercials as sellers of soybeans reducing their net long position by 17,343 contracts to 77,488 contracts. Nov beans remain in a downward trend and are still oversold with a gap on the chart at 13.49.

WHEAT HIGHLIGHTS: Wheat futures finished the session with very strong gains as developments in the Black Sea area are leading to increased tensions and war concerns. Dec Chi gained 57-3/4 cents, closing at 9.38 and Mar up 56-1/2 at 9.51-1/2. Dec KC gained 55-1/2 cents, closing at 10.24-1/4 and Mar up 54-1/4 at 10.24-1/2.

It was a banner day in the wheat market as the Ukraine war escalates. News broke over the weekend that a key bridge connecting Crimea and Ukraine was bombed. This led to several new missile attacks in Ukraine cities (including Kyiv) and the war now seems worse than ever. As a consequence of the increasing hostilities, most likely the export corridor deal will not be renewed in November (and could potentially be ended early). This news is probably what also resulted in Paris milling wheat futures gapping higher with a gain of 16.25 euros in the December contract. Here in the United States, another bullish factor is also helping futures – continued dry weather in the southern Plains. There is the potential for some rain from Missouri to central Texas this week, but even these moderate showers will not be enough to fix the problem and difficulty planting the HRW crop. Another item of note this week will be Wednesday’s USDA Supply and Demand report. General expectations are for a friendly report for wheat, with carryout expected to be the lowest in 15 years. It is also worth noting that the Export Inspections and Crop Progress reports, which are usually released on Monday, are delayed until tomorrow in observance of Columbus Day today.

CATTLE HIGHLIGHTS: Cattle market started the week under selling pressure as the feeder market broke to the downside, weighing on the entire cattle complex as money flow and technical selling triggered by higher grain prices pushed prices lower. October live cattle lost .625 to 144.700 and December cattle fell 1.050 to 147.000. Feeders posted strong losses as November feeders dropped 2.750 to 172.875.

A strong jump higher in grain prices tied to increased tensions in the Ukraine over the weekend provided the energy for cattle futures to push lower. Front-end feeder cattle closed the day challenging the contract lows from six months ago. Funds liquidating long positions and growing shorts positions has been a big factor in the selloff as managed money positions have quickly liquidated livestock positions overall. Beef cutouts were mixed at midday with choice .41 lower to 245.66 but select added .34 to 216.47 on light to moderate demand of 66 loads. Choice beef carcasses trended higher last week, gaining $1.28 on the week. Export demand stays supportive as overall beef demand is running at record levels in volume and value for 2022, and that is expected to continue. Feeder cattle broke out of the recent consolidation trade with strong selling pressure as the strong grain markets triggered short selling. Prices are poised to challenge contract lows from May, closing today at 6-month lows. The Feeder Cash Index traded .31 lower to 174.61 and at a small premium to the October futures. First notice day for October live cattle futures was on Monday, which could have been a factor in the market pressure. October futures are trying to build a trend higher led by the stronger cash, and December is trying to build a base above the recent low, but today’s weak price action is concerning for prices to try and break lower like the feeder market saw on Monday.

LEAN HOG HIGHLIGHTS: Lean hog futures saw strong buying in the front end of the market fueled by a surge higher in Chinese pork prices and value buying stepping into the hog market on an improved technical picture. October hogs gained .800 to 93.750, and Dec hogs led the market higher, gaining 2.450 to 79.600. October futures and options expire this week, closing trade on 10/14.

Chinese pork prices surged to multi-month highs after the completion of their Golden Week holiday last week, and with U.S. pork prices extremely oversold, anticipation of good export demand potential helped fuel the front end of the market. December hogs look undervalued compared to the rest of the complex, with October expiration this week. December is trading at a 13.05 discount to the Lean Hog Index. The cash index did trade .12 lower on Monday to 92.65. Managed money has aggressively sold the hog market, eliminating over 41,000 contracts over the past two weeks as of last week Tuesday, the market has improved technically since, signaling a potential bottom. The cash hog market is still struggling with Direct Morning Trade 4.52 lower to 83.12 and a 5-day average of 87.79. Slaughter pace has been running strong with estimated slaughter at 2.558 million head last week, running 2.85% from last week, but down 1.5% from last year, reflecting the tighter overall hog numbers. Hog slaughter is running nearly 3% under last year, and weights are slightly under last year’s, but demand has been a concern, building supplies. Pork retail values were higher, gaining .94 at midday to 102.48 on good demand of 205 loads. Hog supplies stay ample, and there are still plenty of animals for the packers to pursue. The technical picture did improve last week with the higher weekly closes and got the follow-through it needed to start the week. Demand may still be the key to maintain a seasonal rally.

DAIRY HIGHLIGHTS: The commodity markets were jumpy today with further escalation over the weekend in the Russia/Ukraine war. Class IV action was pretty quiet with the November contract closing up a nickel at $24.15, whereas the Class III markets were higher this morning but came into selling before this afternoon’s close. November futures, which took over as the second month contract last week, traded to a daily high of $22.15 before closing down 45 cents at $21.40. That $22.00 mark has served as resistance on that second month chart for about a month and remains a tough hurdle to surpass. The Class III 2023 contracts were unchanged or slightly higher as with the average at $20.61.

Total Farm Marketing and TFM refer to Stewart-Peterson Group Inc., Stewart-Peterson Inc., and SP Risk Services LLC. Stewart-Peterson Group Inc. is registered with the Commodity Futures Trading Commission (CFTC) as an introducing broker and is a member of the National Futures Association. Stewart-Peterson Inc. is a publishing company. SP Risk Services LLC is an insurance agency. A customer may have relationships with all three companies. TFM Market Updates is a service of Stewart-Peterson Inc. Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition.