MARKET SUMMARY 10-12-2021

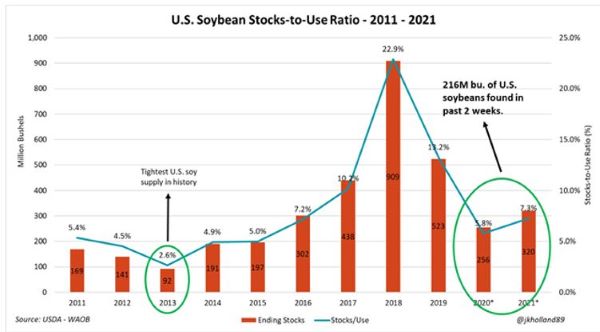

The U.S. soybean stockpiles have added 216 million bushels in a matter of two weeks to the balance sheet. This process started on the Sept 30 Grain Stock report, where the USDA adjusted the 2020 crop, adding 80 million bushels of production. On the USDA crop production report today, the USDA adjusted yield higher to 51.5 bushels/acres, bringing total production to an estimated 4.415 billion bushels this fall. With some demand adjustments, soybean estimated carry out has moved from 185 million bushels to 320 million bushels, or a stocks-to-use ratio of 7.3%. This heavier supply picture pushed soybean prices on the front-month November contract below $12.00/bushel and the lowest levels since March last spring. With a little more known about the supply picture, the focus of the market will shift back to the demand. With beans at their lowest prices in many months, the market will be watching to see if the demand business will pick up, or the supply side could face a growing supply picture into next year.

Like what you’re reading?

Sign up for our free daily TFM Market Updates and stay in the know!

CORN HIGHLIGHTS: Corn futures with losses of 6 to 10-14 cents on a less than favorable USDA WASDE and spillover from sharp losses in the soybean market where front month November dropped 30 cents.

December lost 10-1/4 cents, closing at 5.22-1/2 and December of 2022 gave up 6-1/4 to end the session at 5.21. Today’s USDA report indicated yield at 176.5 bushels per acre,.6 bushels more than the pre report estimate. Total production is now 15.019 billion. Carry out increased 79 billion bushels above the pre report estimate of 1.421 billion which compares to 1.408 in September. Feed usage dropped 50 million while ethanol remained unchanged at 5.2 billion. Exports rose 25 million two 2.5 billion. On the surface today’s numbers we’re not dramatic in change but when you add 100 million to carry out month to month, futures losing near 10 cents is expected. Funds were estimated to be long near 240,000 contracts prior to today’s report.

SOYBEAN HIGHLIGHTS: Soybean futures plunged 30 cents on a negative USDA Supply and Demand report and long liquidation reaching their lowest level since March 30. Carryout, at 320 mb, was 31 mb higher than the pre-report average estimate and 73% more than the September estimate of 185 mb.

November futures closed at 11.98-1/4, down 30 cents. To say the trend of carry out has changed is an understatement. In midsummer projected carryout was 115 million bushels and suddenly has gained 200 million. How did it get there? Increasing yield expectations this year, higher projected yield last year, and a lackluster demand market the past several months have prices on the defensive. Projected yield at 51.5 bushels per acre was .4 bushels larger than the average pre report estimate. World projected carry out for the 2020- 21 season increased 2.4 million metric tons above the pre report estimate of 287.4 million and for the year ahead increased 3.6 mmt above the estimate 104.6 mmt.

WHEAT HIGHLIGHTS: Wheat futures closed marginally higher on bullish report numbers. Dec Chicago wheat gained 2-1/4 cents, closing at 7.34 and March was up 1-3/4 cents to end the session at 7.47-1/4. Dec KC wheat gained 5-1/4 cents, closing at 7.39-3/4 and March was up 5 cents at 7.47-3/4.

What could have been a notable day for wheat turned out to be somewhat disappointing. Though ending the session with a gain, wheat closed about 6-10 cents off today’s highs. This inability to rally higher may have simply been due to spillover from a poor day in corn and soybeans. The fact that the report was expected to be bullish could also have played a role, as traders may have already positioned themselves before today. US 21/22 carryout for wheat came in at 580 mb – not much different from the pre-report estimate of 581 mb, but down from the September number of 615 mb, and the lowest in 14 years. Harvested acres were also reduced to 37.2 million and yield was lowered to 44.3 bpa. World ending stocks for 20/21 were at 288.4 mmt vs the estimate of 291.5 mmt and 292.6 mmt in September. For 21/22 the USDA reported world ending stocks at 277.2 mmt vs a forecast of 280.9 mmt and 283.2 mmt in September. The USDA left the wheat export estimate unchanged at 875 mb. Exports inspections for last week were pegged at 16 mb about equal to the pace needed to meet the USDA’s goal.

Total Farm Marketing and TFM refer to Stewart-Peterson Group Inc., Stewart-Peterson Inc., and SP Risk Services LLC. Stewart-Peterson Group Inc. is registered with the Commodity Futures Trading Commission (CFTC) as an introducing broker and is a member of National Futures Association. Stewart-Peterson Inc. is a publishing company. SP Risk Services LLC is an insurance agency. A customer may have relationships with all three companies. TFM Market Updates is a service of Stewart-Peterson Inc. Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition.