MARKET SUMMARY 10-12-2022

The USDA Crop Production report can bring surprises, and the October report delivered one for the soybean production. The USDA lowered soybean yield to 49.8 bushels/acre, well below the expectations of a slight bump in yield to 50.6. This took nearly 80 million bushels off the expected production for the U.S. crop this fall. This easily absorbed the additional 30 million bushels the USDA found on the most recent Grain Stocks report. After a couple of demand adjustments for crush and exports, the USDA left soybean carryout at 200 million bushels for the marketing year, unchanged from the September outlook. The analysts were expecting supplies to increase to nearly 250 million bushels. This was friendly for the soybean market, lifting prices higher on the day, but more importantly, keeping the supply picture extremely tight going forward.

Like what you’re reading?

Sign up for our free daily TFM Market Updates and stay in the know!

CORN HIGHLIGHTS: Corn futures ended as quietly as possible with no change in December, which closed the session at 6.93. A daily high of 7.00 was as notched and a low of 6.87-1/4 shortly after the WASDE report. December of 2023 gained 0-3/4 cents to close at 6.32-1/2. While the market did have a wide trading wage (20 cents), neither bull or bears could sustain momentum. The sideways pattern continues. December corn traded at 6.93 30 days ago.

The yield number on today’s report was neutral and expected at 171.9 bpa, down from last month’s 172.5. Other adjustments were lower exports by 125 mb, (reflecting a slow start) and raising feed usage 50 mb, but also lowering ethanol by the same amount. Carryout for the 2022/2023 season dropped 47 mb to 1.172 mb, above the pre-report estimate of 1.127 mb and below last month’s 1.219 mb. Harvest is progressing quickly as dry down has accelerated this last week. According to the weekly Crop Progress report, 31% is harvested verses a 5-year average of 30%. While rain did push through parts of the Midwest over the last 24 to 48 hours, most total accumulation has been minimal and not a big factor to slow harvest. The most recent 6-to-10-day outlook suggests below normal precipitation for key corn growing areas. The bottom line is that despite some reductions in demand (big in exports, down 5.5% on today’s report) supplies continue to tighten. Expect farmer selling to be slow in the months ahead, especially if prices decline. Stronger cash will likely be a scenario. The biggest problem near-term is central Midwestern farmers who are seeing basis declining due to lack of water on the Mississippi. No one knows when this problem will be alleviated. The high dollar and slow export pace to date suggests and exports could be lowered again.

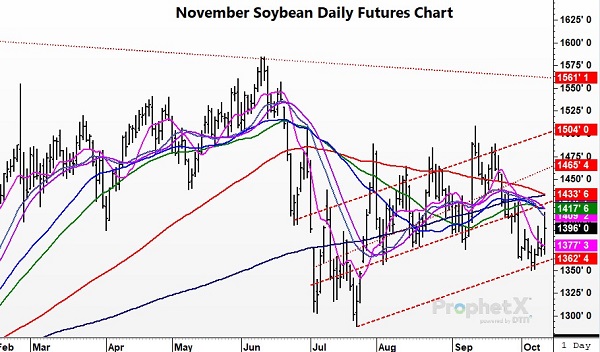

SOYBEAN HIGHLIGHTS: Soybean futures closed higher after today’s WASDE report provided bullish surprises, which supported all three soy products. Crude oil moved lower today, which limited the gains of soybean oil. Nov soybeans gained 19-3/4 cents to end the session at 13.96, and Jan gained 17 to 14.05.

A bullish WASDE report today gave soybeans the juice to run higher today and brought soybean meal and oil up as well. The USDA came out with a slightly lower crop estimate of 4.313 billion bushels compared to the average trade guess of 4.381 bb and last month’s estimate of 4.378 bb. Yield was also dropped relatively significantly to 49.8 bpa compared to the average trade guess of 50.6 bpa and 50.5 bpa last month. Trade was guessing that there would be an increase in ending stocks to near 0.248 bb, but that number remained the same from last month at 0.200 bb. World ending stock estimates were increased from 98.92 mmt to 100.52 mmt as Brazil’s production estimate was bumped up by 3.0 mmt. On the demand side, the USDA increased the estimate of crush demand by 10 mb but also reduced the export estimate by 40 mb to 2.045 bb. Export estimates were likely affected by the current barge traffic caused by low water levels on the Mississippi River. Yesterday the USDA reported that 44% of the soybean crop has been harvested, which is above the 5-year average of 38% for this time of year with faster progress being made West of the Mississippi River and Eastern states lagging. The forecast for Chinese demand was increased by the USDA and it is likely they will increase purchases soon especially with Nov soybeans on the Dalian exchange closing at a contract high at the equivalent of $21.58 a bushel. Nov soybeans were rejected at the 50-day moving average despite the higher close and have moved out of oversold territory.

WHEAT HIGHLIGHTS: Wheat futures posted double digit losses today in the face of a report, which was not fundamentally unfriendly. It seems the market may be more concerned with the overall economic outlook. Dec Chi lost 18-3/4 cents, closing at 8.82-1/4 and Mar down 18 at 8.99. Dec KC lost 20-3/4 cents, closing at 9.70 and Mar down 20-1/4 at 9.68.

All eyes were on today’s USDA report, which seemed to be fairly neutral to maybe a little friendly for wheat (despite a lower close). US 22/23 carryout came in at 576 mb, down from the September number of 610 mb. However, the trade was looking for 563 mb so coming in above that may have put a little pressure on the market. Global ending stocks were pegged at 267.5 mmt and pretty much in line with the pre-report estimate of 267.1 mmt, but down slightly from last month’s 268.6 mmt. For 21/22 the world carryout was increased marginally to 276.0 mmt from 275.7 mmt. The USDA also recently stated that winter wheat plantings at 55% complete are behind the average for this time of year at 58%. Emergence is also down for winter wheat, with the USDA putting that number at 26% vs an average of 32%. With the report now old news, the market will likely go back to trading on factors including the war and economy. There was recent talk that Russia may not impose wheat export quotas Feb-Jul. That talk weighed on the market despite the fact that they have a large crop and were not expected to have export quotas. In related news, power to the Zaporizhzhia nuclear plant was cut off again for a period of time. The reactors have been shut down for a while now due to the war, but they still must be supplied with power (for cooling) in order to avoid a meltdown and radiation leakage. Some reports suggest that they are now relying on diesel generators which have enough fuel to last only 10 days.

CATTLE HIGHLIGHTS: Cattle market was quiet and choppy overall as the market anticipated the USDA Crop Production and the development of cash markets in order to find direction as prices finished mixed too mostly higher. October live cattle gained .375 to 146.175, but December was lower losing .125 to 148.450, but remaining deferred contract finished with mild gains. Feeders saw moderate gains as November feeders added .475 to 176.675.

Cattle markets were in wait and see mode through the USDA report, and the development of cash trade. The Feeder market has been closely tied to movement in grain markets, and after recent gains, the feeder market was nervous for a potential strong move in the corn market. The USDA report was slightly negative for corn and corn prices stayed relatively quiet, allowing feeders to hold recent gains. The Feeder Cash Index was .40 to 175.04, in line with the October futures. In live cattle, cash trade has been slow to develop this week as bids have been quiet, as usual, but prospects are for the cash market to stay steady to higher helped support futures. Trade will likely begin developing going into the end of the week. Beef cutouts were higher at midday, with choice trading 1.17 higher to 247.9 and select added 1.46 to 214.31 on light to moderate demand of 81 loads. The choice/select spread is still trading at a wide 33.61 at midday, reflecting the demand for higher quality beef and an indicator of the potential cash strength on the week. Holding recent gains is a win in the cattle market given the recent weakness over the past couple weeks. The live cattle market will now be focused on the cash market for additional strength into the end of the week..

LEAN HOG HIGHLIGHTS: Lean hog futures finished with moderate to firm gains on short covering as prices continued to recover off recent lows, supported by improve retail values. October hogs, with 2 days left to trade, gained .075 to 93.100 and December hogs pushed 1.175 higher to 80.700. October futures and options expire this week, closing trade on 10/14.

December hogs have now added $6.00 of the most recent lows and traded above the $80 market for the first time since Sept 25. With the October contract expiring on the 14th, the December hogs look undervalued. The CME lean high index traded .03 lower on the day to 92.95 but is still at a 12.25 premium to the December futures. When the Dec contract takes control as the lead month next week, the market will be watching to see if the futures move towards the index or the index down to the futures. The cash hog market is still struggling, but morning direct trade was 3.21 higher to 87.37 and a 5-day average of 86.72. This direct cash market has traded higher for the past 2 midday sessions, hopefully signaling a turn in the market. Estimated hog slaughter for today is 491,000 head, 4,000 higher than last week, and 7,000 over last year. Despite the higher numbers, pork carcasses weights are trending nearly 3 pounds under last year as producers move animals off high-priced inputs. It just has been the ample supply of hogs and the softer export demand tone that has kept pork supplies heavy, limiting prices. Pork retail values were higher, gaining .42 at midday to 103.57 on good demand of 160 loads. Retail demand has picked up again as carcass values have been trending higher over the past handful of days. This gives the market some cash market optimism. The hog market is building a recovery off recent lows, with December gaining $6.00 in the past six sessions. This has been a product of money flow and short covering, now the fundamentals will need to kick in to make the rally last as prices try to recover.

DAIRY HIGHLIGHTS: Despite a strong up day for the spot cheese trade and an unchanged session for butter, milk futures were mostly sideways on Wednesday. The class III trade is coming off of the upper end of the range and may be pressured lower by a weaker US spot whey trade. In yesterday’s session, spot whey hit its lowest price since November 2020. Whey was unchanged today at $0.41/lb, which is $0.4575 off of this year’s high. Cheese prices still look strong, though. Bidding was seen today in the block market which added 1.75c while barrels added 1.50c. As long as cheese holds at these levels, class III should be able to maintain the $20 threshold. Grains were watched closely today due to the release of the October WASDE report. Corn closed steady while December bean meal added $8.30/ton.

Total Farm Marketing and TFM refer to Stewart-Peterson Group Inc., Stewart-Peterson Inc., and SP Risk Services LLC. Stewart-Peterson Group Inc. is registered with the Commodity Futures Trading Commission (CFTC) as an introducing broker and is a member of the National Futures Association. Stewart-Peterson Inc. is a publishing company. SP Risk Services LLC is an insurance agency. A customer may have relationships with all three companies. TFM Market Updates is a service of Stewart-Peterson Inc. Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition.