MARKET SUMMARY 10-17-2022

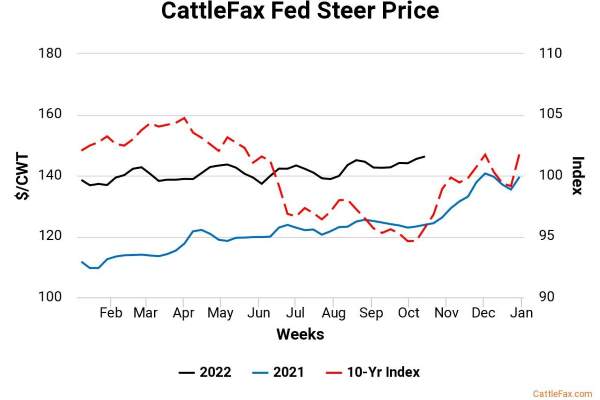

Cash live cattle prices have been on a steady climb recently, and last week posted a new high for the year. Despite concerns in the livestock markets regarding the economy and consumer demand due to possible recession, the cash cattle market has helped stay supportive of cattle prices. Last week, the average cash trade was slightly above the $146 level, pushing to new highs for the year. The cash market has been supported by good demand for export beef, and the demand for higher quality beef. Last week, the choice/select spread traded over the $30.00 mark between the two, signaling a demand for higher-quality beef, which helps support the cash market. This demand looks to stay in the market, and the cattle market looks to be current, keeping the packer active in trying to find higher-quality beef. This should support the cash cattle market into the end of the year.

Like what you’re reading?

Sign up for our free daily TFM Market Updates and stay in the know!

CORN HIGHLIGHTS: Corn futures slid into the close giving up 6-1/4 cents in Dec to close at 6.83-1/2, its lowest close in 8 sessions. Dec 2023 lost 4-1/2 to end the day at 6.24-1/2. Harvest pressure and lack of end user buying were said to be features in today’s lower trade, despite a drop in the U.S. dollar. Lackluster export inspections were not helpful either.

Now that the Quarterly Stocks report, as well as the WASDE report, are out of the way, there isn’t much on the horizon from a report perspective until November 9, the next WASDE report. Focus will be on yield results, farmer selling (or not), exports, and world events including how the dollar and energy markets trade. Good harvest weather is keeping prices in check, as most of the Midwest will remain on the dry side over the next several days. Export inspections at 17.7 mb were termed poor reflecting a slow sales pace. Year-to-date inspections total 129 mb, down over 20% from last year. Despite a lack of friendly news and transportation issues, corn basis, in general, continues to remain historically strong suggesting farmers are filling bins with early harvested bushels, making delivery against forward sales, or both. Today’s slump into the last couple of hours of trade was a disappointment considering the Dow Jones was trading more than 500 points higher and the dollar was down over 1 full point. Yield results remain varied. Moisture content is on the decline as strong winds at the end of last week helped to dry corn down. The big picture looks supportive, yet high prices tend to cure high prices, usually first through demand increase and second through more expected supply. We are already seeing demand cuts from the USDA on the last two reports.

SOYBEAN HIGHLIGHTS: Soybean futures closed nearly unchanged today after trading higher earlier in the day before fading. Export inspections this morning were strong and offered support, but remaining issues concerning shipping beans from the Gulf kept prices down. Nov soybeans gained 1-1/2 cents to end the session at 13.85-1/4, and Jan was unchanged at 13.92-3/4.

The soy complex was mixed today with soybeans higher in Nov but lower in deferred months with meal lower and bean oil higher. Export inspections were surprisingly high for last week coming in at 69.2 mb putting total inspections at 172 mb for the year, only down 23% from the previous year. The low water levels in the Mississippi River have not gotten better and very little rain is forecast which might help the situation, but as it stands barge traffic is severe and shipping soybeans out of the Gulf is a major problem. Soybeans have been shipping out of the Pacific Northwest to meet international demand which has picked up in the last two weeks. China has returned as a major buyer for soybeans and purchased a very large amount last week as prices on the Dalian exchange hit contract highs at the equivalent of $21.59 a bushel. Domestically, demand remains strong with today’s USDA report showing that the act of crushing soybeans produces 19.29 of value in Illinois, 13 cents more than last week, and a generous incentive for processors. The National Oilseeds Processors Association said that members crushed 158.1 mb of soybeans in September, 3% more than a year ago. Soybean oil stocks for the end of September were 1.459 billion pounds which was less than expected and 13% less than a year ago supporting bean oil prices, and the Russian drones that hit and ignited storage tanks of sunflower oil in Ukraine this weekend further supported bean oil. Jan beans are beginning to correct after a slight downtrend and have possibly carved out a bottom with the 14-dollar area acting as resistance for now.

WHEAT HIGHLIGHTS: Wheat futures showed some strength early on, but gave up the majority of that by the close. Wheat remains a volatile market as traders must consider war, weather, economics, and more. Dec Chi gained 1-1/4 cents, closing at 8.61 and Mar up 1-3/4 at 8.78-3/4. Dec KC lost 1/4 cent, closing at 9.52 and Mar unchanged at 9.50-3/4.

A relatively quiet close for the wheat market came after making decent gains earlier in the session. More Russian attacks on Ukraine’s infrastructure do not bode well for the region but did have wheat prices elevated this morning. It was reported that a drone strike hit tanks containing sunflower oil in the port city of Mykolaiv. The port there was planned to be opened to allow for more shipments in the export corridor deal, but now that does not seem likely to happen. Additionally, both Russia and Ukraine are experiencing wet and freezing temperatures which are delaying harvest. On top of all that, the Zaporizhzhia nuclear power plant has again had its power cut after the recent Russian shelling. This power is needed to cool the reactors (and they are now back to using diesel generators). Aside from the situation in the Black Sea, the higher stock market and lower U.S. dollar today were supportive. What was not helpful was the weekly inspections number for wheat which came in at 8.5 mb – total 22/23 inspections are now at 344 mb. All in all, wheat supplies remain tight which may support the market longer term, but for now, things may remain volatile.

CATTLE HIGHLIGHTS: The cattle market saw good money flow, supported by the third week of possible higher cash cattle bids triggered a short covering rally in the cattle markets to start the week. Oct live cattle gained 0.925 to 147.875 and Dec led the market higher adding 1.425 to 149.200. Feeders saw strong buying as well, as Nov feeders traded 1.625 higher to 176.400.

The buyers were in the livestock markets to start the week with strong triple-digit gains in hogs and feeder cattle, and that strength spilled over into the live cattle market. Outside markets were an influence on cattle contracts as energy equity markets traded higher, and the U.S. Dollar Index traded sharply lower on the day. Adding in fundamental support, the cash cattle market is trending higher, and the market is anticipating a third higher week of cash trade as packers are searching for quality beef in a tightening cattle supply market. Cash trade was undeveloped on Monday, typical for the day, as bids and asking prices were undefined. Beef cutouts were higher at midday, with choice trading 1.71 higher to 248.69 and select jumped adding 5.01 to 221.95 on light demand of 45 loads. Feeders saw a big jump in buying support, fueled by the weak price action in the corn and wheat markets and the strength in the live cattle. The Feeder Cattle Cash index was 1.03 higher on Monday, which was a limiting factor. Feeder prices rallied to chart resistance, and additional buying strength could trigger a stronger short-covering rally in feeders. A very positive start to the week in the cattle markets, but the key may be the rest of the week. Cash can stay supportive, and the market will be looking to the next Cattle on Feed report this Friday afternoon.

LEAN HOG HIGHLIGHTS: Lean hog futures jumped sharply higher on short covering and technical buying, as prices pushed to their highest level since early September. Dec hogs are the new lead month, gaining 2.700 to 84.950 and February added 2.550 to 85.975.

Dec took over as the new lead month, and buyers jumped into the contract given its discount to the cash market. Price jumped technically, crossing through moving averages, and closing back above the key 100-day moving average for the first time since September 22. Price paused in the gap on the chart from the September day, which could set up as a technical barrier on Tuesday. The Lean Hog Cash Index traded 0.42 higher on Friday to 93.09 and is still at an $8.14 premium to the futures. The cash hog market was disappointing on Monday as morning direct trade was 2.66 lower higher to 84.63 and a 5-day average of 86.45. Pork retail values were firmer at midday gaining 2.69 to 104.55 on demand of 162 loads. Retail demand has picked up recently, but the focus of the market will be the export totals and support by a strong Chinese pork price. Chinese pork prices are running a strong premium to U.S. prices, and the market will be looking for possible Chinese export business to continue to help manage pork prices, which are trending 30% higher than prices were last year in China. A stronger demand tone will give the market some price optimism. Strong short covering and technical buying rally helped fuel the hog market higher on Monday. Prices have had a strong recovery and the chart looks supported on the prospects of demand and an improved technical picture.

DAIRY HIGHLIGHTS: On Monday, milk futures rebounded after Friday’s limit down session with steady double-digit gains in the nearby contracts. November Class III added 15c to $20.56, while November Class IV added 14c to $23.55. The market responded well to a 5.50c higher bid in the barrel market as 4 loads traded. Blocks held steady at $2.05/lb, while barrels hold a strong premium up at $2.18/lb. The butter and powder markets were softer though, which held back Class IV futures a bit. This week’s events include a Global Dairy Trade auction on Tuesday, followed by a milk production report on Thursday. Both of these events will be watched closely to see if the global dairy market will continue to slide lower and to see if milk production in the US continues to rise.

Total Farm Marketing and TFM refer to Stewart-Peterson Group Inc., Stewart-Peterson Inc., and SP Risk Services LLC. Stewart-Peterson Group Inc. is registered with the Commodity Futures Trading Commission (CFTC) as an introducing broker and is a member of the National Futures Association. Stewart-Peterson Inc. is a publishing company. SP Risk Services LLC is an insurance agency. A customer may have relationships with all three companies. TFM Market Updates is a service of Stewart-Peterson Inc. Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition.