MARKET SUMMARY 10-18-2022

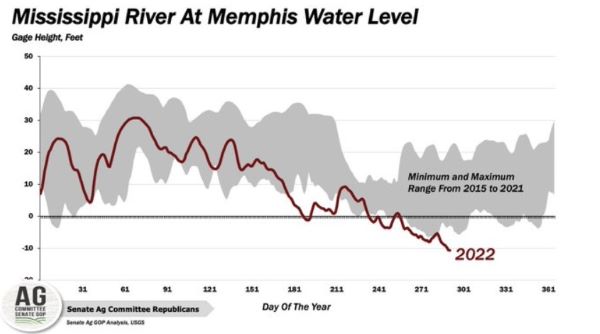

The Mississippi River levels stay a focus in the grain markets, as freshly harvested bushels are having a difficult time getting down the Mississippi River to the Gulf for export. In the Memphis, TN area, the river levels have dropped to their lowest levels since records started in 1954. The current stage of the river sits at -10.79 feet below normal levels, as ongoing dry conditions throughout the country have reduced water available to the river. This has continued to limit barge travel both up and down the river, impacting cash markets, as well as goods coming back upstream, such as fertilizer. The reduced grain flow downriver could, and likely will, have some impact on the ability of the U.S. to reach export targets. The slow transport pace has had an impact on cash markets and basis levels for producers selling grains to river terminals. Weather forecasts remain on the drier bias, which will likely keep this issue in play in the weeks ahead.

Like what you’re reading?

Sign up for our free daily TFM Market Updates and stay in the know!

CORN HIGHLIGHTS: Corn futures sank on the overnight giving up 5 or more cents. This trend continued to about midday with losses of 10 or more, however, prices bounced back to finish with a loss of 2-1/2 cents in Dec and 2-3/4 in Mar. Dec closed at 6.81 and Mar at 6.87. Yield results remain varied, yet this week we would have to tip the scales as more farmers reporting better than expected. Wheat prices remain under pressure, as talk of India exporting wheat and talk of the Nov 19 export corridor deadline being pushed back in order to provide more time for supplies out of Ukraine.

It almost appeared as if traders were moving dollars to equities from commodities, especially with corn harvest keeping a lid on rally potential. A growing concern is the export market and perhaps end users recognizing that low water levels in the Mississippi could limit movement and consequently, buyers could be looking elsewhere. This is occurring at a time when the U.S. dollar is at multi-year high levels. This is concerning enough to suggest if you are behind on cash sales, consider getting current. Or, if basis is too wide, consider corn hedges (selling futures), hedge to arrive contracts, or puts. Harvest at 45% complete is ahead of the 5-ear average of 40%. Good harvest weather is the rational for farmers making rapid field progress.

SOYBEAN HIGHLIGHTS: Soybean futures closed lower today but came about 10 cents off its midday lows. Pressure has come from fund selling sparked by low water levels in the Mississippi River severely hindering barge traffic and causing bottlenecking. Nov soybeans lost 13-1/4 cents to end the session at 13.72, and Jan lost 10-3/4 at 13.82.

While soybeans and bean meal closed lower, bean oil closed higher again today despite another sharp drop in crude after large tanks of Ukrainian sunflower oil were destroyed by Russian drones over the weekend. Monday’s NOPA crush report showed bean oil stocks at 13% lower than a year ago adding support to bean oil. Last week 60 mb of new sales were announced to China and unknown destinations over the span of just three days but no new sales have been announced so far this week putting a damper on higher prices. More importantly and more of a bearish factor, water levels in the Mississippi River are now at the lowest levels in recorded history and severely hindering the movement of grain. Barge traffic is severe, and as a result barge freight costs have risen sharply in most river towns. The bullish aspects of renewed Chinese buying, and tight US supplies are being outweighed by the inability to move grain easily. Chinese purchases from the US are experiencing delays by 15 to 20 days and as a result China may turn to South America to meet their needs, but the PNW has picked up some of the slack as far as exports. Rain chances are limited this week but more promising for next week to help correct the river levels. Additionally, the agreement preventing a rail strike expires in the middle of next month which opens the door again for a strike. Jan beans are in a sideways trend with the 14-dollar level acting as tough support to break.

WHEAT HIGHLIGHTS: Wheat futures sank lower today on a risk off session. Talk that Putin may actually allow the renewal of the Ukraine export deal added pressure. Dec Chi lost 11-1/2 cents, closing at 8.49-1/2 and Mar down 11 at 8.67-3/4. Dec KC lost 7-1/2 cents, closing at 9.44-1/2 and Mar up 8-1/4 at 9.42-1/2.

A risk off session in the grains led to a lower wheat close across the board. MPLS is the only exception which managed to remain about steady, but Paris milling wheat futures lost about 11 Euros (per metric ton) in the front month contracts – a sizeable move. In fact, that Dec contract is now down near the 50-day moving average (and well below the 100-day for the first time in a while). As for what pressured wheat today? Lower corn and soybeans did not provide any support. But the bigger factor is renewed talk that the Ukraine export corridor may indeed be renewed. The catch, however, is that Putin would require many demands to be met before allowing this. Another factor weighing on the market is the fact that US wheat is at a premium to other exporters (especially in the Black Sea). In other news, it was reported that the US is considering sanctions against five of Turkey’s grain companies for importing stolen wheat from Crimea. Here at home, according to the USDA, winter wheat is now 69% planted which is in line with the average and last year. However, only 38% is emerged compared to an average of 44% and 42% last year. The HRW areas are still suffering extreme drought, which may account for this delay. As a final note, the Biden administration announced their intention to release more oil from the strategic reserves. While this will probably not impact wheat directly, it could impact the markets as a whole.

CATTLE HIGHLIGHTS: The cattle market had another good day of money flow into the market supported by the prospects of higher cash and strong midday retail values. Oct live cattle gained 0.600 to 149.475, closing with a new contract high, and Dec added 1.575 to 149.775. Feeders saw more strong buying as well, as Nov feeders traded 1.425 higher to 177.825.

The recent surge in the cattle markets is tied to cash optimism. Last week, cash cattle prices established a new high for the year, and expectations are for trade to continue the trend this week. Bids are still undefined but talk of northern cash bids at $150 being passed on by the lots is supportive of the possible cash tone this week. Trade will likely build later in the week. Packer margins have tightened, and that may be limiting the bids so far this week, so retail values will be an important metric. Beef cutouts were higher at midday after a firm close on Monday afternoon. Choice carcasses traded 3.86 higher to 252.00 and select added 1.38 to 220.99 on light demand of 71 loads. Feeders saw another good day of buying support, fueled by the weak price action in the corn and wheat markets and optimistic the strength in the live cattle. The Feeder Cattle Cash index was 0.81 lower to 172.27, which was a limiting factor in the October contract, as expiration nears on 10/27. Feeder prices rallied through chart resistance, and additional buying strength could trigger a stronger short-covering rally in feeders. Expectations are for cash to stay supportive, and the market will be looking to the next Cattle on Feed report this Friday afternoon, but the technical picture is currently strong, supported by good money flow.

LEAN HOG HIGHLIGHTS: Lean hog futures traded strongly higher for the third consecutive day, as the hog charts are placing a v-bottom recovery on the charts as short covering and technical buying pushed prices higher. Dec hogs gained 1.525 to 86.475 and Feb added 1.825 to 87.800.

Dec hogs have now gained nearly $6.00 over the past three sessions, establishing a V-bottom pattern on the charts. but now may be running into some resistance over the top of the market, established by previous price highs. Dec is not trading above the key 100 and 200-day moving averages for the first time since September 22. The Lean Hog Cash Index traded 0.26 higher on Tuesday to 93.35 and is still at a $6.875 premium to the futures. The cash hog market was supportive on Tuesday, as morning direct trade was 2.44 higher to 87.07 and a 5-day average of 86.98. Pork retail values were softer at midday, slipping 1.52 to 101.98 on demand of 201 loads. A stronger demand tone will give the market some price optimism. The estimated slaughter for Tuesday was 490,000, up 1,000 from last year and 10,000 from last week, as hog supplies are still available. Strong short covering and technical buying rally helped fuel the hog market higher starting last week. Prices have had a strong recovery and the chart looks supported on the prospects of demand and an improved technical picture, but the hog market will still need to have the cash market to complete the rally.

DAIRY HIGHLIGHTS: November Class III and IV futures found gains for the second day in a row after heavy pressure at the end of last week. There appears to be good resistance being placed at $20.25 on Class III November futures as this level has been approached for the fourth time since August and held each time. Class IV November futures have found a resistance point as well as moving below the $23.50 price level has been very short lived the last three times since September. The spot trades were a mixed bag today with cheese and butter finding gains while powder and whey were losers.

Total Farm Marketing and TFM refer to Stewart-Peterson Group Inc., Stewart-Peterson Inc., and SP Risk Services LLC. Stewart-Peterson Group Inc. is registered with the Commodity Futures Trading Commission (CFTC) as an introducing broker and is a member of the National Futures Association. Stewart-Peterson Inc. is a publishing company. SP Risk Services LLC is an insurance agency. A customer may have relationships with all three companies. TFM Market Updates is a service of Stewart-Peterson Inc. Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition.