MARKET SUMMARY 10-19-2021

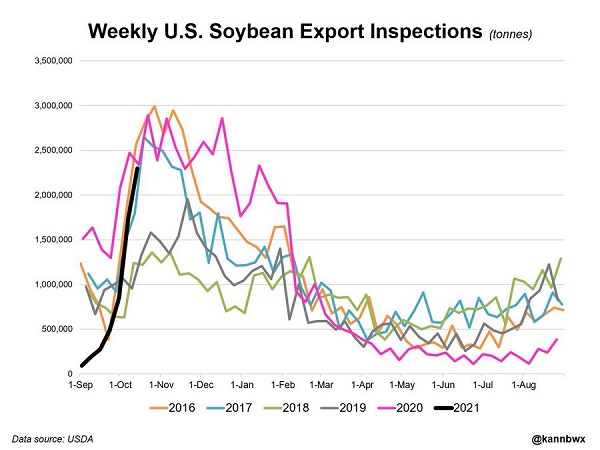

Soybean export inspections are working hard to try and catch up. The USDA released weekly grain inspections on Monday morning, and soybean inspections are working hard to try and fill the void left from a horrible start to the marketing year. The window from September 1 into February is the main time frame that the U.S. exports soybeans globally, until the harvest of the Brazil crop. On Monday, export inspections reached 84.4 million bushels (). The impact of Hurricane Ida on the Gulf of Mexico shipping routes can be seen, due to the lack of activity in the month of September. Even with the strong shipments last week, The U.S. is currently down 51% from last year’s pace with total shipments reaching 216 million bushels. In order for the U.S to catch up to the USDA target of total shipments at 2.090 billion bushel, the shipping window will need to be more active well past the seasonal peak for U.S. bean shipments.

Like what you’re reading?

Sign up for our free daily TFM Market Updates and stay in the know!

CORN HIGHLIGHTS: Corn futures traded both sides of steady, eventually closing with small losses as overhead resistance at the previous nearby high held. December reached 5.37 as its daily high, just under 5.38-3/4 from October 8. Increased farmer selling and harvest pressure as well as a lack of new news kept prices on the defensive.

As harvest progresses it is likely that prices will come under additional pressure. Technical traders will make the point that the 50-day moving average has held as resistance again, a key moving average that the market has been unable to rally above since mid-August. A potential right shoulder on a head and shoulders formation is forming which points to downside objective in December of near 465. The fertilizer situation continues to be a major concern but we’re not sure just yet how important it will be in the long run. It could be wildly critical or eventually things smooth out. Input structure for South American corn is likely more affected. On the one hand South American farmers have had more time to secure input needs yet sharply rising prices may have kept farmers waiting for a better opportunity a which has not occurred and consequently they may have to cut back or not use fertilizer at all. Harvest pressure will make some impact this week as farmers will likely run full steam unless they are rained out. 52% of the crop is harvested as of Sunday, well ahead of the five-year average of 41%.

SOYBEAN HIGHLIGHTS: Soybean futures finished higher for the fourth session in a row on continued export talk and strength in both soybean oil and meal. March futures led today’s rally closing at 12.45-3/4, up 8-1/2 cents. Meal gained 3.00 to just under 5.00 per ton and oil up 15 to 37 cents. Meal is looking more like it is a long-term buy.

After a negative report last week, the futures price recovery has been encouraging and impressive as November has experience over a 50-cent range, this while harvest is quickly moving along. Yesterday the USDA crop progress report indicated harvest was 60% complete, less than most were anticipating but above the 5-year average of near 50%. Good weather the first several days of this week should allow harvest to rapidly move along with expectations that by the end of this week harvest could be near 85% complete. The soybean meal market has found a footing on what we would term an oversold market. Soybean oil continues to find support on tight world vegetable supplies and expectations that a movement more toward bio energy has long term friendly implications for additional crush needs. There are several plants that are either under construction or hope to be under construction within the year.

WHEAT HIGHLIGHTS: Wheat futures were mixed to lower today on profit taking and a lack of fresh news. Dec Chicago wheat lost 1/4 cent, closing at 7.36 and July up 1/2 cent at 7.40-1/2. Dec KC wheat lost 3/4 cent, closing at 7.48-1/4 and July down 3/4 at 7.49-1/4.

December Chi wheat has closed higher for the past three trading sessions but could not make it a fourth today. Though wheat did have solid gains earlier in the day, by the close that action subsided. As we mentioned yesterday, fresh news will be needed to drive the market higher, and today’s lack of such news has kept prices relatively flat. Also playing a hand was yesterday’s poor export inspections number which came in at only 5.1 mb. Profit taking today and spill over from a lower corn trade were also factors. While not able to breach the highs on made on Friday, Minneapolis wheat did perform better than its counterparts today, with gains of 6-1/2 cents in December. According to the USDA, 70% of winter wheat is planted vs 71% average, and next week we will get the first 2022 crop ratings. Total inspections are around 343 mb, which is down about 13% from a year earlier. Offering some support to the wheat market is the fact that Russian prices are increasing because of their high export tax. Paris milling wheat futures started the day higher as well but gave up those gains into the close.

Total Farm Marketing and TFM refer to Stewart-Peterson Group Inc., Stewart-Peterson Inc., and SP Risk Services LLC. Stewart-Peterson Group Inc. is registered with the Commodity Futures Trading Commission (CFTC) as an introducing broker and is a member of National Futures Association. Stewart-Peterson Inc. is a publishing company. SP Risk Services LLC is an insurance agency. A customer may have relationships with all three companies. TFM Market Updates is a service of Stewart-Peterson Inc. Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition.